Gold, often regarded as a “Safe Haven” asset, has captured the interest of traders and investors worldwide. It’s an enduring value and historical significance make it an attractive choice for diversifying investment portfolios or seizing trading opportunities. In this article, you will learn how to trade gold.

Table of contents:

- What is gold trading?

- Why should you consider trading gold?

- Understand what moves gold prices

- Choose your preferred ways to trade gold

- Choose the right gold trading platform

- Create your gold demo trading account

- Develop an effective gold trading strategy

- Transition to live trading and place your first trade

- Always monitor your trades & update your trading strategy

- Common gold trading mistakes and how to avoid them

Ready to practice gold trading without putting in real money?

1. What is gold trading?

The act of buying and selling gold for financial purposes is known as gold trading. This can take different forms, including physical gold, gold ETFs, futures contracts, or Contracts for Difference (CFDs).

Traders often engage in such trading to profit from the varying prices of this precious metal.

It involves analysing market trends, using technical and fundamental analysis, and implementing trading strategies to capitalise on potential price changes and maximise returns.

Learn more about the history of gold.

2. Why should you consider trading gold?

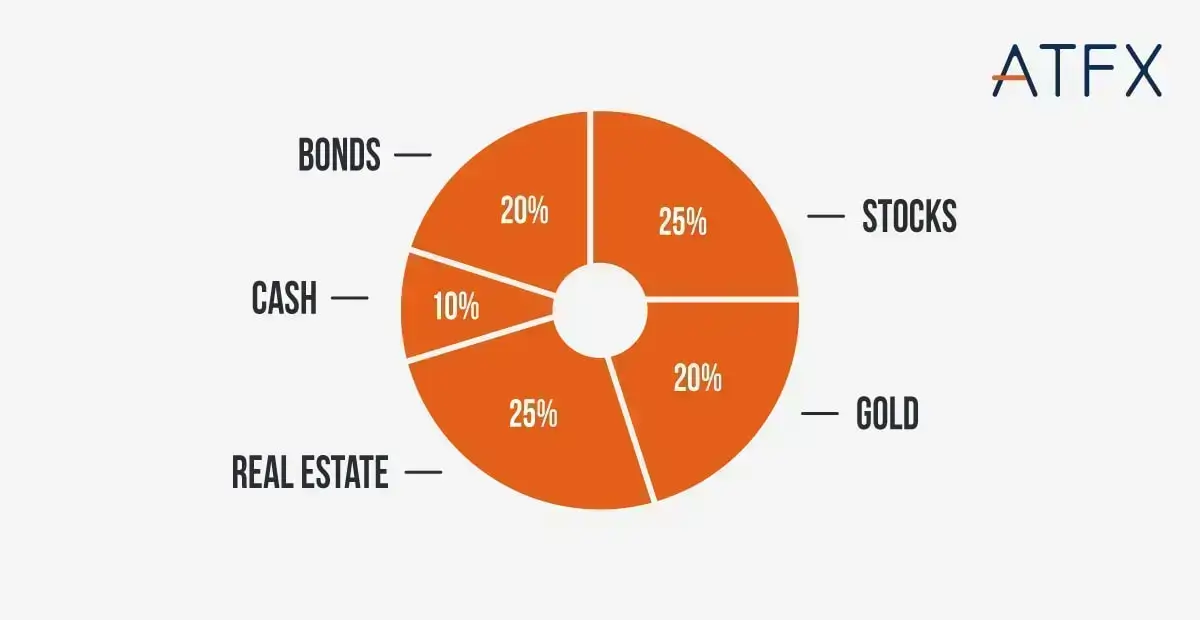

I. Diversification:

Gold diversifies investment portfolios, acting as a hedge against market volatility and providing stability during uncertain periods.

II. Store of Value:

With enduring intrinsic worth and universal acceptance, gold serves as a reliable store of wealth for long-term capital preservation.

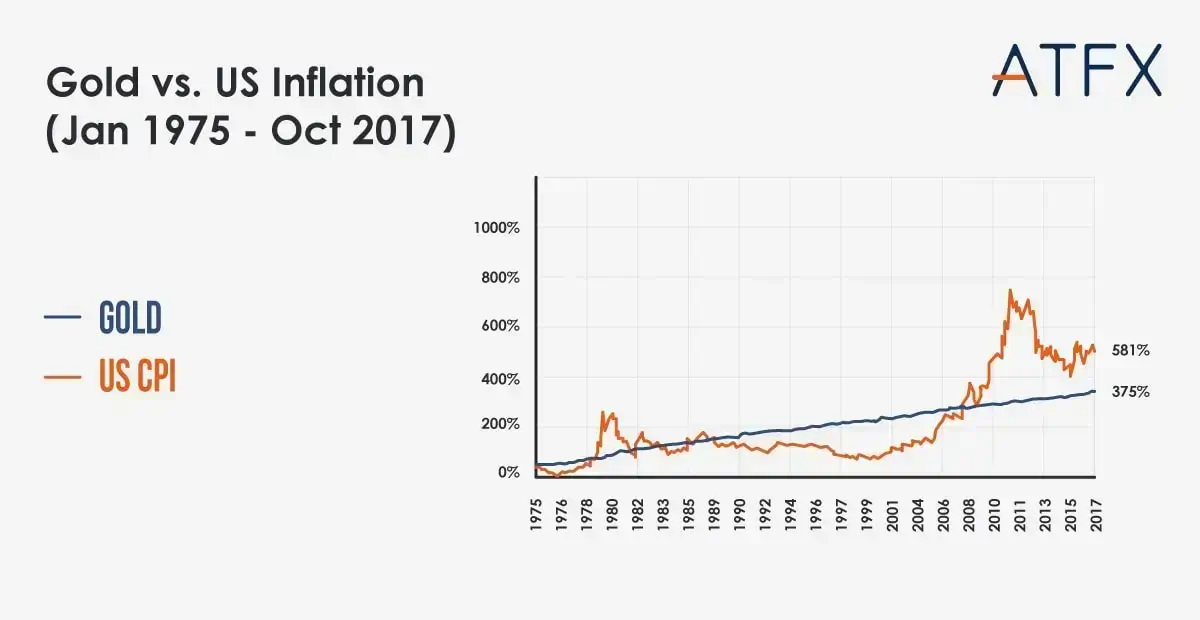

III. Inflation Hedge:

Gold historically acts as a hedge against inflation, preserving purchasing power when paper or fiat currencies decline.

IV. Geopolitical Stability:

During periods of uncertainty, gold thrives as a safe haven asset, allowing traders to benefit from potential price surges.

V. Profit Potential:

Gold’s price fluctuations, driven by supply, demand, economic indicators, and sentiment, offer profit opportunities for skilled traders.

You may also be interested in: is gold a good investment ?

3. Understand what moves gold prices

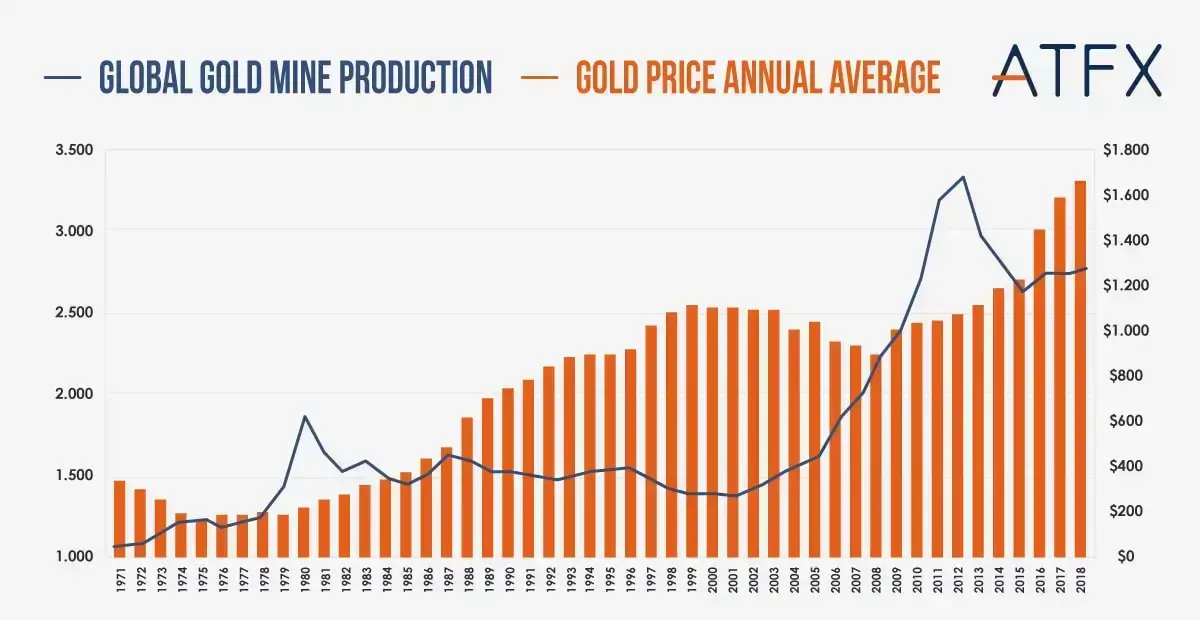

I. Supply and Demand:

The balance between gold supply and demand plays a significant role. Mining production levels, central bank buying and selling, and changes in jewellery or industrial demand all impact the available supply of gold.

Learn more about the supply and demand for gold.

II. Economic Indicators:

When economic indicators such as GDP growth, inflation rates, interest rates, and employment data point towards a weak economy or high inflation, investors often see gold as a safe haven asset, leading to an increase in its price.

III. Geopolitical Events:

Political and geopolitical events, such as elections, geopolitical tensions, wars, or trade disputes, influence gold prices. Uncertainty or instability in global affairs often leads to increased demand for gold as a safe haven asset.

The chart above shows that the gold price surged after the Russia-Ukraine war broke out in March 2021.

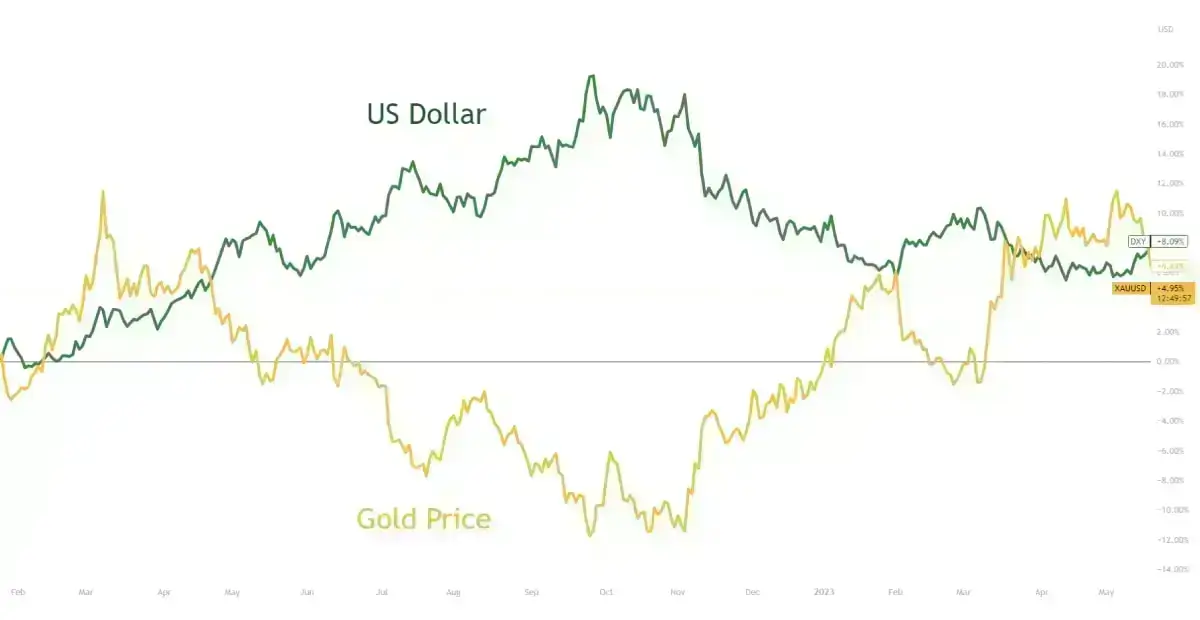

IV. Currency Movements:

Gold is often priced in U.S. dollars, so fluctuations in currency values impact its price. Investors find gold cheaper when the dollar declines and purchase it using other currencies. The gold price increases due to an increase in demand.

The chart portrays the relationship between the US dollar and gold price. An increase in the US dollar causes a decline in the gold price and vice versa.

V. Investor Sentiment:

Market sentiment and investor behaviour can impact gold prices. If there is optimism and confidence in the economy, investors may prefer riskier assets over gold, leading to lower demand and potentially lower prices. Conversely, economic uncertainty can drive up gold prices as investors seek a safe haven.

4. Choose your preferred ways to trade gold

I. Gold Contracts for Difference (CFDs):

How it works:

Trading gold through Contracts for Difference (CFDs) involves speculating on price movements without owning the physical gold. CFDs are derivative products where traders enter into an agreement with a broker to exchange the difference in the gold price from the time of opening a trade position to when they decide to close it.

Pros:

- Ability to profit from both rising and falling gold prices.

- Flexibility in terms of position sizing and leverage.

- Access to various trading platforms and tools.

Cons:

- Higher risk due to leverage; potential for losses exceeding the initial investment.

- CFD pricing may deviate slightly from the actual spot price of gold.

- Counterparty risk associated with the CFD provider.

II. Physical Gold:

How it works:

Trading physical gold involves purchasing and owning tangible gold products such as bars, coins, or jewellery. Investors can buy gold from authorised dealers or bullion banks and store the precious metal in a secure location of their choice.

Pros:

- Direct ownership of physical gold.

- Potential for long-term wealth preservation.

- Tangible asset with intrinsic value.

Cons:

- Requires storage and security considerations.

- Additional costs for transportation, insurance, and potential authentication.

- Lack of liquidity compared to other investments and assets.

III. Gold Exchange-Traded Funds (ETFs):

How it works:

Gold ETFs are investment funds traded on stock exchanges that aim to track the price of gold. Investors can buy and sell shares of an ETF like stocks, and the fund holds gold bullion as its underlying asset.

Pros:

- Convenient and accessible way to gain exposure to gold.

- Lower transaction costs compared to physical gold.

- Liquidity and ease of trading on stock exchanges.

Cons:

- Indirect ownership of gold; investors don’t own the physical metal.

- ETF prices may deviate slightly from the actual spot price of gold.

- Counterparty risk associated with the ETF issuer.

IV. Gold Futures and Options:

How it works:

Gold futures and options involve contracts that specify the future delivery or option to buy a certain amount of gold at a predetermined price and date. Traders aim to profit from price movements by buying or selling these derivative contracts.

Pros:

- Leverage allows control of a larger gold position with a smaller investment.

- Ability to profit from both rising and falling gold prices.

- Access to the futures and options markets for professional traders.

Cons:

- Requires understanding of market dynamics and contract specifications.

- Higher risks and potential for substantial losses.

- Obligation to fulfil the contract or settle the difference in cash.

V. Gold Mining Stocks:

How it works:

Investing in gold mining stocks means buying shares from companies that are engaged in gold mining operations. The value of these stocks relies on factors such as gold prices, production levels, operational efficiency, and developments specific to the company.

Pros:

- Indirect exposure to the gold market and potential leverage on mining company performance.

- Diversification within the mining sector and potential for dividends.

- No storage or security concerns associated with physical gold.

Cons:

- Dependency on company performance and management decisions.

- Exposure to additional risks specific to mining operations.

- Correlation with the broader stock market movements.

Summary table

| Gold CFDs | Physical Gold | Gold ETFs | Gold Futures and Options | Gold Mining Stocks | |

| Accessibility | Highly accessible | Widely accessible | Highly accessible | Limited accessibility | Highly accessible |

| Ownership | No ownership of physical gold | Direct ownership | Indirect ownership | No ownership of physical gold | Indirect ownership |

| Risk Level | High risk | Low risk | Moderate risk | High risk | Moderate to high risk |

| Potential Returns | High potential returns | Moderate potential returns | Moderate potential returns | High potential returns | Variable potential returns |

| Storage and Security | No physical storage required | Requires personal storage and security | No personal storage required | No physical storage required | No personal storage required |

| Liquidity | High liquidity | Low liquidity | High liquidity | High liquidity | High liquidity |

| Cost Effectiveness | High cost effectiveness | Moderate cost effectiveness | Low cost effectiveness | Moderate cost effectiveness | Moderate cost effectiveness |

5. Choose the right gold trading platform

When selecting a gold trading platform, it is essential to choose one that offers a holistic trading experience. Always take the following factors into consideration:

I. The Gold Trading Options Offered:

Check if the platform offers a wide range of gold trading instruments, including physical gold, ETFs, futures contracts, CFDs, or mining stocks. Having multiple options allows you to diversify your trading strategies.

Learn more about gold trading offered by ATFX

II. Security and Regulation:

Ensure that the trading platform you choose is authorised and regulated by a reputable financial authority. This safeguards your investment and guarantees that the platform adheres to stringent regulations.

ATFX is regulated by 4 major authorities. These include the UK Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Financial Services Commission (FSC), and the Financial Services Authority (FSA). This offers multiple layers of regulatory protection for traders. Regardless of your location, you can trade with confidence, knowing your investments are securely guarded.

Read more about ATFX regulatory compliance that keeps your trading safe.

III. Customer Support:

Reliable customer support is essential. Check if the platform offers responsive customer service through various channels like phone, email, or live chat. Prompt and knowledgeable support can address any concerns or technical issues that may arise during your trading journey.

IV. Reputation and Reviews:

Research the platform’s reputation by reading reviews, testimonials, and forums. Consider the experiences of other traders to gauge the platform’s reliability, execution speed, and overall user satisfaction.

Check out ATFX reviews.

6. Create your gold demo trading account

To get started, begin by registering for a demo account on the ATFX website. This invaluable resource allows you to practice gold trading in a risk-free environment, safeguarding your hard-earned funds.

Once registered, complete the verification process by providing the necessary identification documents. Rest assured, there’s no pressure to deposit real money until you feel prepared to transition to a live trading account.

With a demo account, you have the freedom to explore the platform’s features and tools at your own pace. This allows you to become familiar with the platform, ensuring a seamless and confident trading experience when you eventually progress to live trading. Take your time to experiment and gain confidence before advancing to the next stage.

7. Develop an effective gold trading strategy

Creating a successful trading strategy for gold is crucially important in the gold market. Here are some vital steps that can assist you with developing a robust trading strategy:

I. Set Clear Goals:

These goals may include profit targets, risk tolerance, and trading timeframes. Having a solid understanding of your objectives can help you make informed decisions and stay focused on making progress towards achieving them.

II. Conduct Market Analysis:

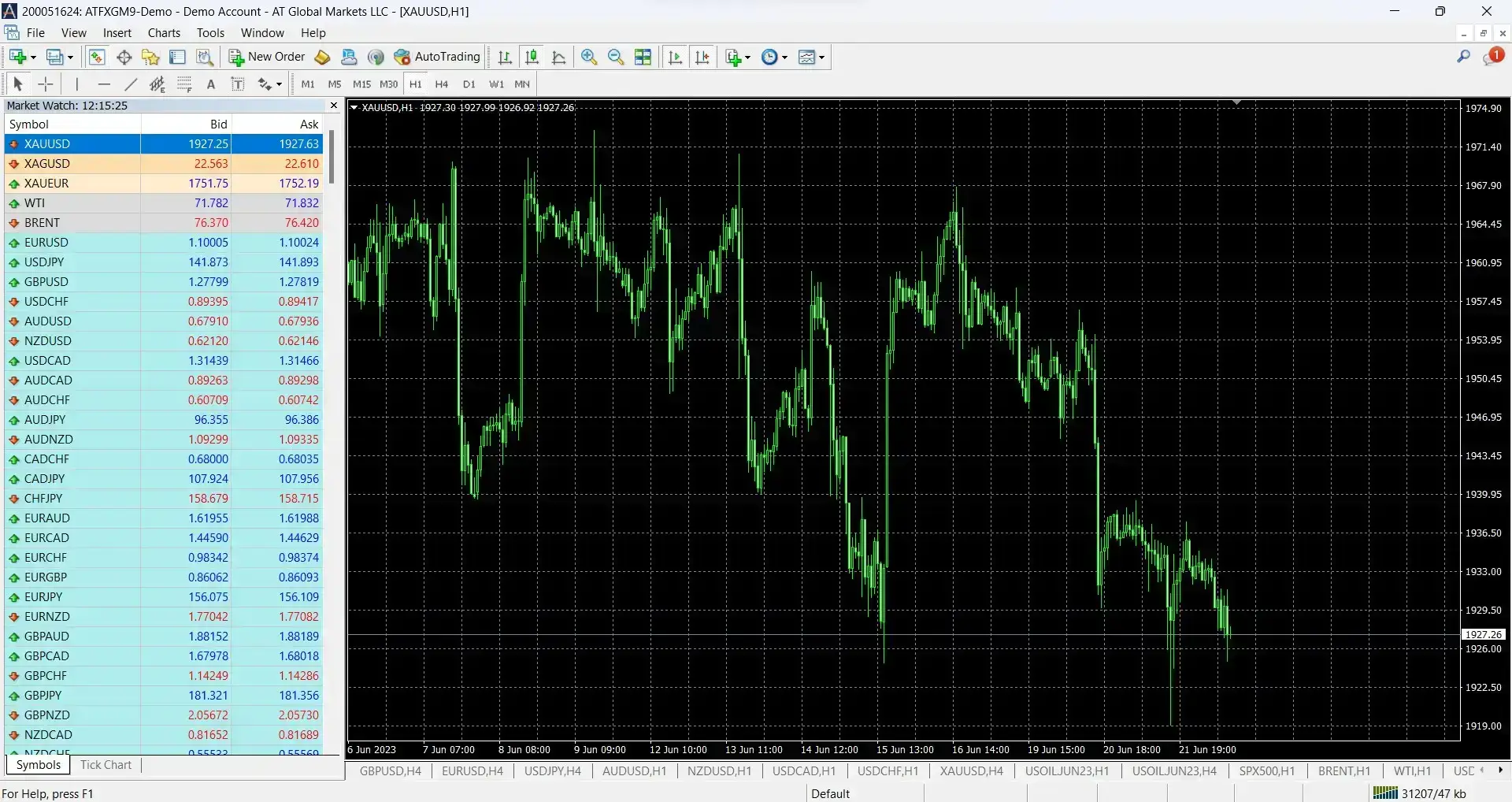

Perform thorough market analysis using Metatrader 4 or a similar platform to understand the factors influencing gold prices. Utilise both technical analyses (e.g., chart patterns, indicators) and fundamental analyses (e.g., economic data, geopolitical events) to identify potential trends and opportunities.

The image above shows the gold weekly chart, with the MACD indicating a bearish crossover from both the signal line and momentum. The MACD is a widely used technical indicator that helps identify potential trends and generate trading signals based on the relationship between the MACD line and the signal line. The indicator helps traders make informed trading decisions. The bearish MACD crossover and momentum indicator that the gold price could start falling.

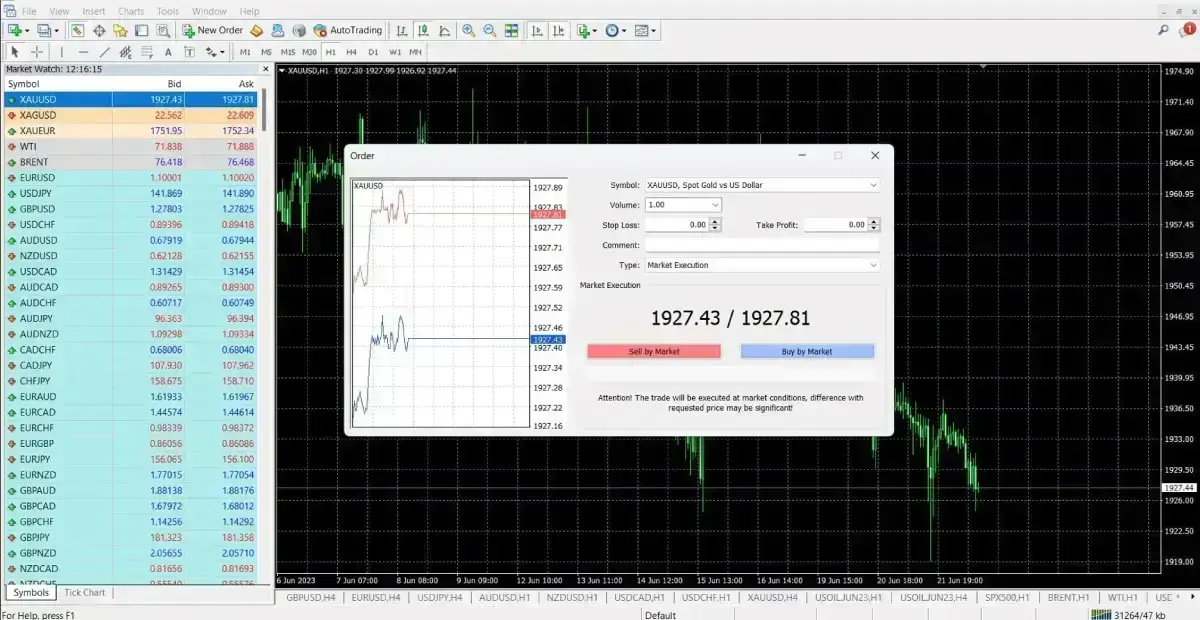

III. Determine Entry and Exit Points:

Next, you must identify strategic entry and exit points for your trades based on your analysis. This includes setting specific price levels or using mt4 indicators as a trigger for your trades. Consider incorporating risk management tools like stop-loss and take-profit orders to protect your capital and secure profits.

The image above shows the gold daily chart, with the price levels for the entry and exit strategy plotted on the chart. The Stop Loss and Take Profit price points will take reference from past resistance and support levels, respectively. On the other hand, the recent breakout from 1937 and the formation of a new candlestick below this level provides us with the confirmation for an entry.

IV. Implement Risk Management:

Develop a risk management plan to protect your capital and limit potential losses. Determine an appropriate position size for each trade based on your risk tolerance and account size. Set clear risk-reward ratios and adhere to disciplined money management principles.

V. Backtest and Demo Trade:

Take advantage of your ATFX demo account to execute trades aligned with your strategy. The risk-free setting allows you to observe and evaluate your trades, pinpointing areas that may require enhancement. Demo trading provides valuable insight into how your strategy will perform in live market conditions. Based on your trading results, you can make necessary adjustments to optimise your approach.

8. Transition to live trading and place your first trade

Once you have gained confidence in your trading strategy, it’s time to take the next step by opening a live trading account with ATFX.

To begin, deposit your initial investment capital into the account. Apply your refined trading strategy and effective risk management techniques to execute live trades. It is advisable to start with a small amount initially to minimise your risk exposure while you continue to gain experience in the dynamic live market environment.

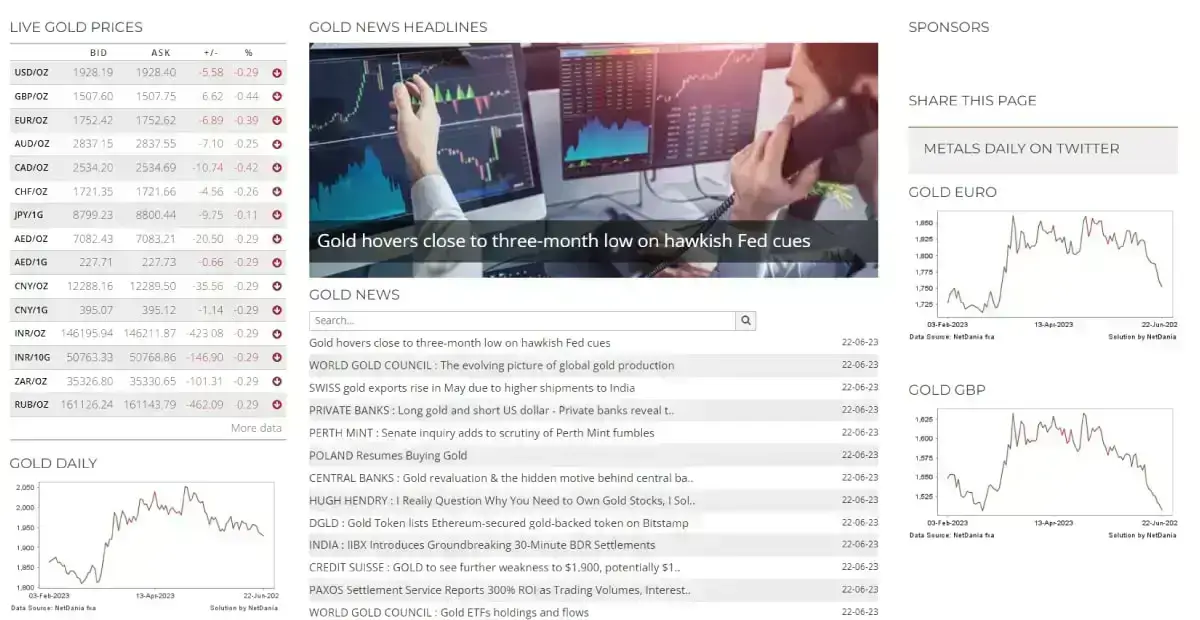

9. Always monitor your trades & update your trading strategy

Stay informed about developments in the gold market by utilising ATFX’s learning resources. Stay up-to-date with the latest market news by regularly checking our blog posts. Additionally, explore our YouTube channel for valuable trading ideas and insights.

It is essential to regularly assess the progress of your trades. Continuously monitor their performance and evaluate how the market is evolving. Based on market conditions and your personal growth as a trader, be open to adjusting your trading plan as needed. Long-term success as a trader requires ongoing learning and adaptability to changing market conditions.

10. Common gold trading mistakes and how to avoid them

I. Lack of Proper Education:

Educate yourself about gold trading to make informed decisions. Learn about the market, strategies, and risk management. Utilise educational resources and stay updated with market news.

II. Emotional Decision-Making:

Don’t let emotions drive your trading. Stick to a trading plan with clear criteria. Implement stop-loss and take-profit orders to manage emotions and maintain discipline.

III. Overtrading:

Avoid excessive trading for quick profits. Focus on quality trades that align with your strategy. Be patient and selective.

IV. Failure to Use Risk Management Tools:

Don’t neglect risk management. Set appropriate stop-loss orders and manage position sizes. Consider risk-reward ratios before entering trades.

V. Neglecting Ongoing Learning:

Continuously learn and adapt to market conditions. Stay updated, follow experts, and seek new strategies. Embrace a mindset of continuous improvement.

You may also be interested in 5 tips for trading gold.

Ready to practice gold trading without putting in real money?

Are you ready to start trading gold? You can sign up for a free demo account with ATFX to practice your skills. Apart from gold trading, ATFX also offers many other financial products on a robust trading platform that allows you to try different strategies and learn from the broker’s guides and training materials. Take advantage of this opportunity and get your free demo trading account now!