Taiwan Semiconductor has jumped again after reporting better-than-expected earnings.

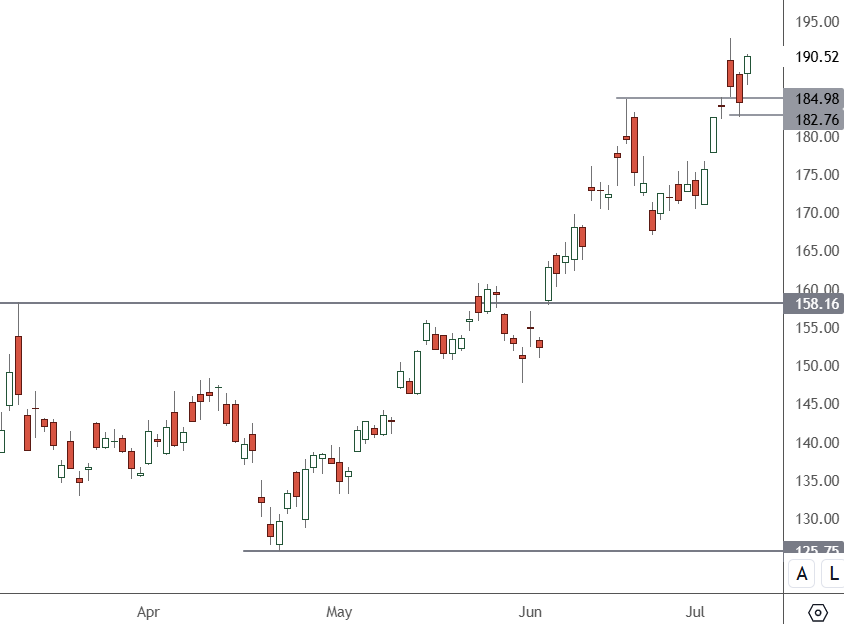

TSM – Daily Chart

The price of TSM on the NYSE has moved above $190, with support below $185.

Taiwan Semiconductor Manufacturing is a significant supplier to Apple and Nvidia and got a boost from AI-driven sales.

The sales suggest that demand for high-end chips remains strong. The news from TSMC also boosted shares of other chip and tech stocks. Nvidia, Apple, AMD, and chip ETFs all saw gains.

According to Mizuho analyst Jordan Klein, the latest move looks like a rotation back into technology hardware stocks after the outperformance of software stocks in June.

“What I am learning about investor sentiment and investing in 2024 with AI is that this is a FOMO (fear of missing out) driven market…So when you see anything beat / sound better due to AI-related capex spend, the stock re-rates in a flash as money rushes to get long,” Klein wrote, noting that it “feels like a bit of a panic rotation”.

Taiwan Semi said June revenue was 207.87 billion New Taiwan dollars ($6.38 billion), up 33% from the same period a year earlier. Second-quarter sales surged 40% to NT$673.51 billion ($20.68 billion).

Second-quarter sales beat the company’s forecast of $19.6 billion to $20.4 billion. The company will formally report its second-quarter earnings on July 18 and has forecast operating margins of 40% to 42%.

The company didn’t add a revenue breakdown. However, Wedbush analyst Matt Bryson said it appeared to be server-driven.

“We are lifting our pricing assumptions for 2026, to account for what appear to be modest price increases. This improvement combined with our expectation HPC (high-performance computing) demand will remain robust, leading to our lifting of our 2025 revenue, margin, and EPS estimates,” Bryson said.

The comments about the FOMO element surrounding chip stocks highlight the risk of buying them. However, an analyst report from Goldman Sachs said, “AI’s fundamental story is unlikely to hold up…the AI bubble could take a long time to burst.”

The analysts discussed the ability of AI builders to create a commercial product that has not yet appeared.