The AUDUSD exchange rate is lower over the last two days ahead of retail sales data from Australia.

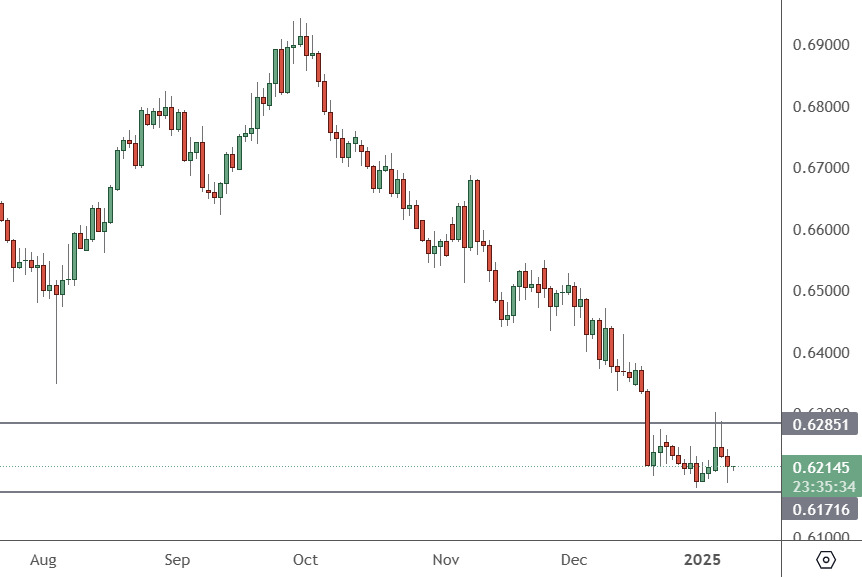

AUDUSD – Daily Chart

AUDUSD had resistance at the 0.6285 level and failed with a move to 0.62145. That brings 2022 support into play at 0.6176 over the next few days.

Australian retail sales are coming in at 8:30 am on Thursday with a move up from 0.6% to 1% expected on a monthly basis. The trade balance figures are also released and analysts expect a drop from 5.935 billion to 5.75 billion.

With the Australian economy staring at interest rate cuts to help the struggling consumer, the US economy remains rigid and that has helped support the US dollar. The latest FOMC minutes from the US central bank has supported a period of caution on rates, which surprised the market again.

The minutes noted inflation risks remain in the United States:

“Many participants suggested that a variety of factors underlined the need for a careful approach to monetary policy decisions over coming quarters”.

Policymakers added “placeholder assumptions” about policy changes under Donald Trump, resulting in an economic growth forecast that was slower, with inflation also remaining firm.

“Almost all participants” judged that upside risks to the inflation outlook had increased, according to the latest analysis. The Australian retail sales figure will play a part in the current trend as a weak print could test the 2022 lows. The trend is currently in motion with dollar strength but traders should be wary around lows that are trailing back two years.