Baidu (HKEX:9888) is in focus on Thursday as the tech giant releases its latest earnings report.

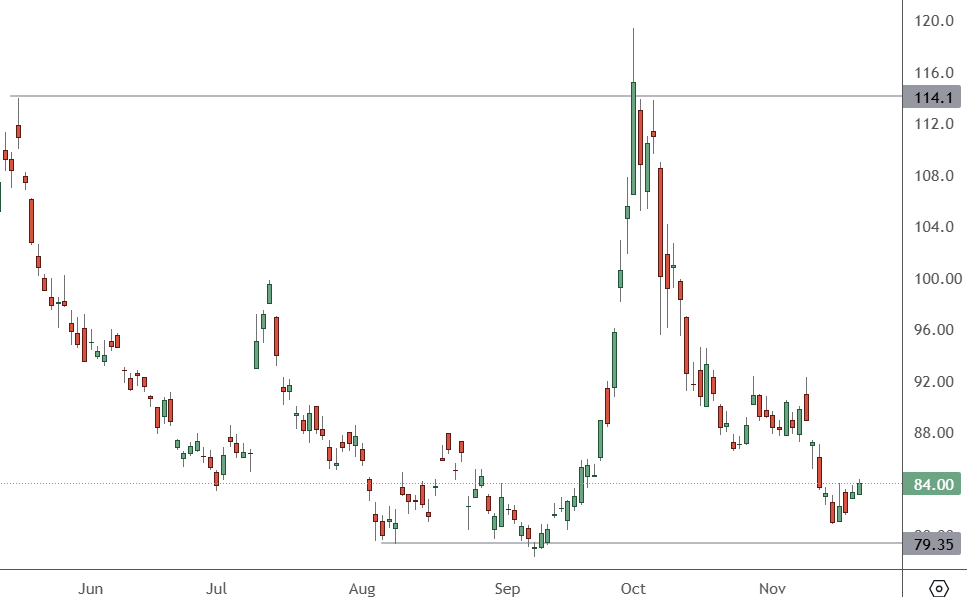

BIDU – Daily Chart

The price of Baidu’s shares have been on a rollercoaster after the government announced its stimulus plans. The price shot up from a low around 80 to hit resistance at 116. The price has now slumped back to almost test the lows once more.

Wall Street is expecting to see Baidu to post earnings per share of $2.47, while revenue is expected to rise nearly 1.5% to $4.65 billion during the quarter.

Back in August, Baidu delivered revenue below expectations, although its profit beat Wall Street estimates. The company has faced strong headwinds from the tough macro environment and competition. However, the company was positive on its AI capabilities, saying that it would boost its ad business.

Baidu’s AI innovations have been offering hope, but its core businesses have been stagnant, and AI revenue impact remains marginal. Over the last two years, Baidu has beaten EPS estimates 100% of the time and has beaten revenue estimates 88% of the time.

Wall Street analysts are bullish on the firm but shares have collapsed with lower expectations for government stimulus. Investors will be focused on AI Cloud revenue growth, any updates on generative AI expansion and the company’s Apollo robotaxi business.

The Apollo Go robotaxi unit is said to be in talks with several firms to expand into overseas markets. Baidu said this week that it has brought down the production cost of its Apollo RT6 self-driving vehicle to 250,000 yuan (US$34,525) per unit.

At a trade event in Wuhan, co-founder, chairman, and chief executive Robin Li Yanhong said the RT6 is now the world’s only mass-produced Level-4 autonomous (L4) driving vehicle. That could give the company an important lead in autonomous driving for Chinese customers.

“Tesla represents another technology road map … [it] wanted to go from L2 to L4, and is still working on it,” Li said.