EURUSD will be in focus of Friday’s Non-Farm payroll jobs numbers from the United States. But there is also the potential for safe haven buying ahead of the weekend in the US dollar as Israel plots its retaliation against Iran.

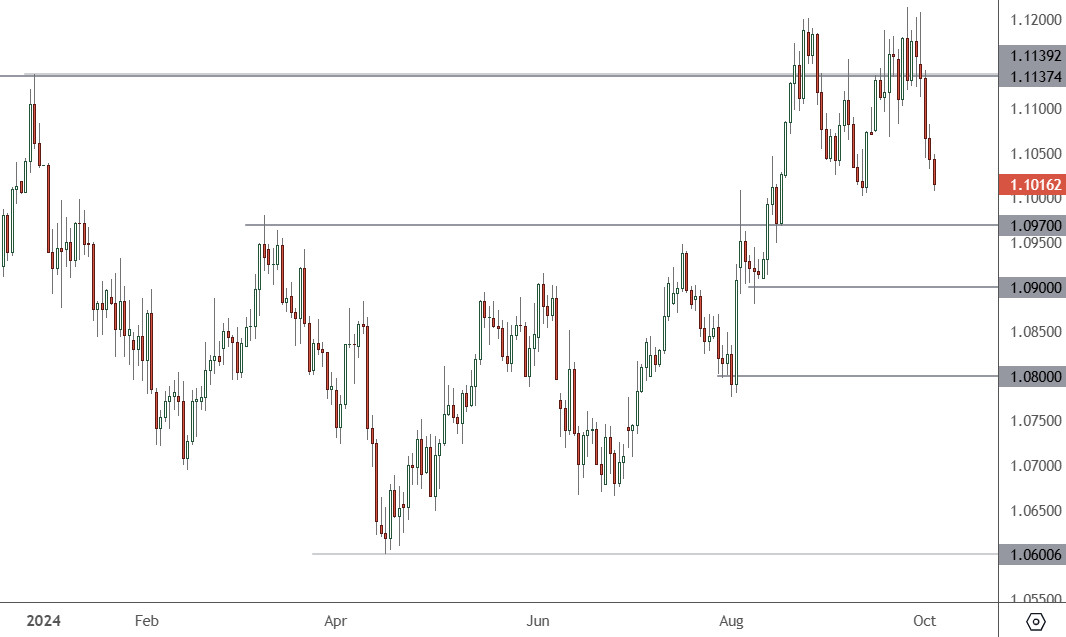

EURUSD – Daily Chart

The price of the EURUSD has failed at the resistance ahead of 1.12 and has now slumped to 1.1015. The round number supports are now in play with the 1.0970 and 1.09 levels up before 1.08.

When markets get comfortable with a narrative, such as the recent focus on Federal Reserve easing, a surprise event can often shock traders into a change of strategy.

That is the case in the EURUSD where traders are now unwinding bets on the Euro and diving into the US dollar. The first issue is the weakness of the European economy. The US interest rate will come down slower than in Europe and its economy is more resilient. The next issue is the moves by NATO and its allies to add risk over the Ukraine situation with its desire to provide long-range missiles.

However, this week we also had the Iranian attack on Israel and the US dollar is now receiving a safe haven bid from anxious investors. As Israel plots its retaliation, investors will not want to be short on the greenback into the weekend. That trend could overpower Friday’s jobs data.

That has also boosted the dollar as job openings in the country have risen to a three-month high of 8 million, which removes any urgency from the Federal Reserve to cut rates sharply. The Labor Department releases its jobs report for September on Friday and it is expected to show that employers added 143,000 jobs last month, while the unemployment rate remains at a low of 4.2%.

“Job openings had a big gain, and while these numbers are volatile, it’s likely employers see falling interest rates spurring the economy and may want to staff up,” said Robert Frick, economist with the Navy Federal Credit Union.

With a stronger job market expected, traders will be focused on the Middle East, where Iran’s missile attack on Israel is likely to cause escalation.