The GBPUSD exchange rate has dropped over the last few days as concerns grow over debt levels.

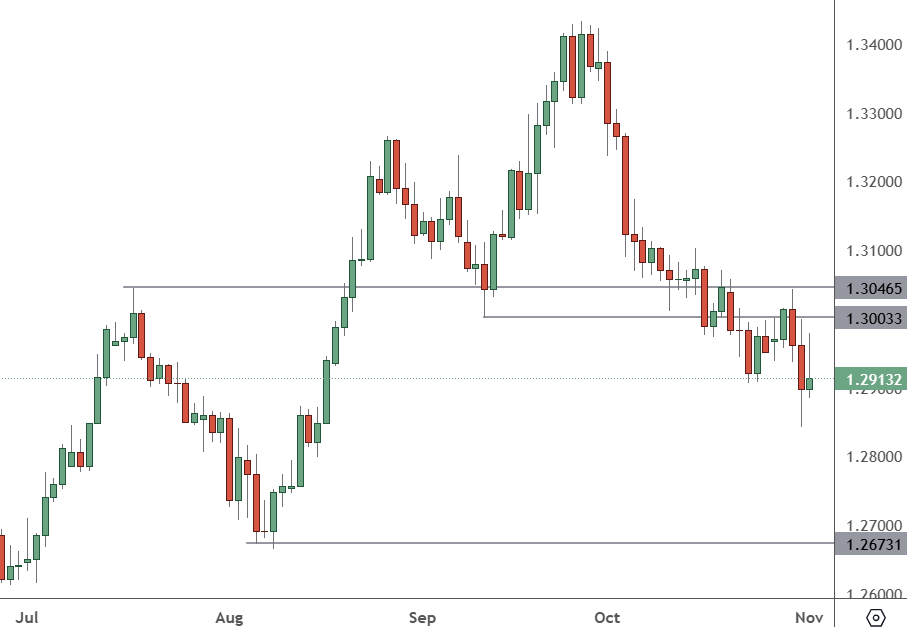

GBPUSD – Daily Chart

The price of GBPUSD has dipped below the 1.30 level and a failure to rebound could see lower levels. The next big support target comes in at 1.27.

The government’s independent forecaster has warned that UK debt is currently on an “unsustainable path” unless spending is cut and taxes are raised. The Office for Budget Responsibility (OBR) said that surging energy prices and pressures from an ageing population are risks for the country that could lead to a recession. Moving from fossil fuel vehicles to electric is also a threat to tax revenues, the OBR said. The group said that debt levels could rise threefold over the next 50 years.

Higher inflation is increasing interest payments for the country, which hit £7.6bn, the highest level for that month on record and a £3.1bn jump from the same period a year ago. In its fiscal risks and sustainability report, the OBR said the government had already spent as much this year to help households cope with the cost-of-living crisis as it did supporting the economy through the 2008 financial crisis.

The OBR said bringing debt back to 75% of GDP “would need taxes to rise, spending to fall, or a combination of both”.

“The pressures of an ageing population on spending and the loss of existing motoring taxes in a lower carbon economy leaves public debt on an unsustainable path in the long term,” the OBR said. The government has committed to banning the sale of new petrol and diesel-powered cars from 2030 and that will remove fuel duty as a source of tax revenue.

UK retail sales will be released on Tuesday at 8am HKT and analysts expect a dip from 1.7% to 1.4%. Former UK Prime Minister Rishi Sunak said the Labour party’s budget was “broken promise after broken promise.”

“They don’t like it, but this is the truth. They have fiddled the figures. They have raised tax to record levels. They have broken their promises, and it is the working people of this country that are going to pay the price now,” he said.