US stocks have started the year lower as the government heads toward a crucial speaker vote.

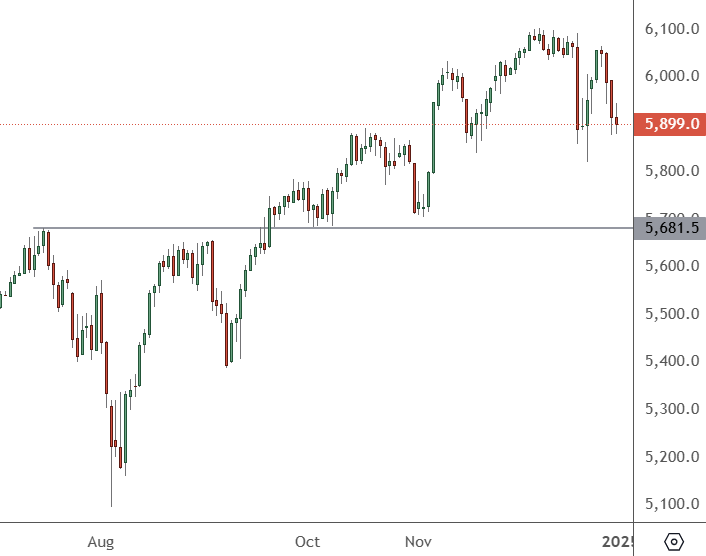

SP 500 – Daily Chart

The SP 500 has dipped over the last few days to 5,899 and there is potential that the price can dip toward the support near the 5,680-800 levels.

Investors are cautious ahead of the Friday vote on Speaker Mike Johnson’s term. The speaker of the house is a role needed to certify Trump’s election on Monday Jan. 6 and any delay would mean more voting and some possible nervousness about Trump’s January 20 inauguration.

After a post-election surge in stocks and crypto, any delay could hurt asset prices early in the year. The President-elect has urged Republicans to support another term for Johnson, who has been in the role since October 2023. Republican Chip Roy has said he believes that Johnson lacks the support to win the vote this week.

“I remain undecided, as do a number of my colleagues, because we saw so many of the failures last year that we are concerned about that might limit or inhibit our ability to advance the president’s agenda,” Roy said on Fox TV.

The dispute around Johnson’s role came as politicians battled over government spending, with Elon Musk vowing to cut $2 trillion from the government’s budget. The recent stop-gap bill includes $100 billion for disasters and support for farmers, while there is also a planned pay hike for the first time since 2009, who already make $174,000 a year.

Investors should be cautious around the vote on Friday as any delay to Trump’s certification on Monday could rattle markets.

US Treasury yields pushed a little higher on Tuesday, which dragged chip stocks lower and hurt the broader market. Energy stocks rallied after crude oil rose to an eight-week high. Low trading volumes still remain in a holiday week and may add to any volatile stock market moves.

The S&P 500 finished 2024 with a gain of 24% and will start 2025 with some nervous political times ahead. The year closed with impeachment proceedings against South Korea’s leader and no-confidence votes looming in Canada, France, and Germany. That may hint at more of the same in the year ahead as spending and budget problems tackle established government leaders.