Chinese electric vehicle maker Xpeng has seen its price rally stumble ahead of earnings.

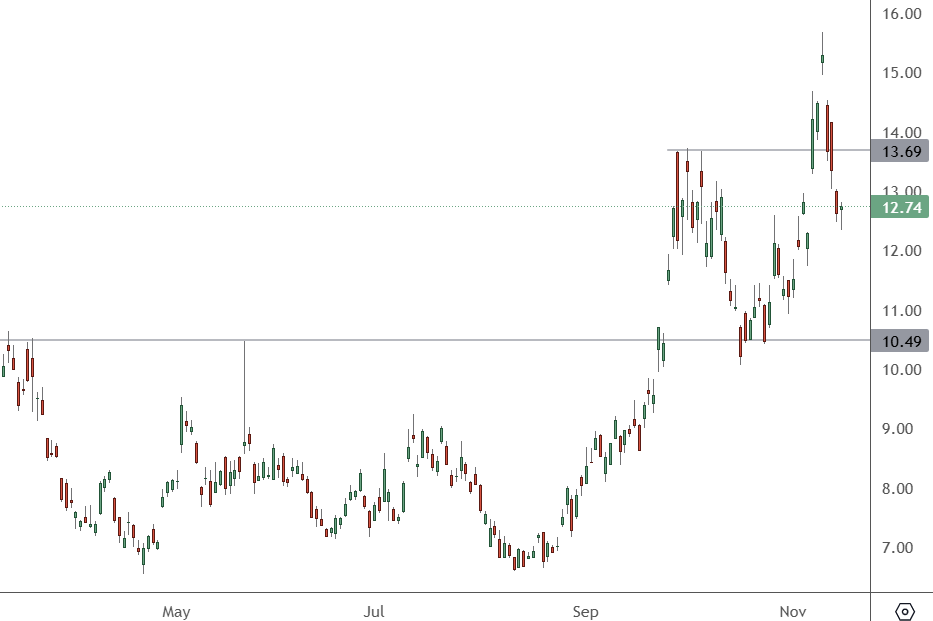

XPEV – Daily Chart

The price of XPEV has hit resistance near the $15.50 level and has dropped below the $13.69 high for a potential double top. A drop to support at $10.50 is possible if earnings disappoint.

Xpev shares had surged 16% after the company hosted its AI Day in China and unveiled what it claims to be the world’s first AI-defined car, the P7+. The new P7+ is equipped with AI Special Edition driver aids, which is powered by a neural network running on high-end chips, similar to Tesla’s technology. XPeng’s CEO, He Xiaopeng, shared a vision of using the advanced technologies as a standard across all models.

The P7+ model also introduces an option for a range extender, allowing the vehicle to travel further than typical EV ranges. Similar to hybrid vehicles, the extended-range electric vehicle includes a generator that uses gasoline to charge the car’s battery while driving. However, unlike standard hybrids, the design does not include gasoline engine transmission, with the electric motor and battery powering the vehicle.

October was a strong month for XPeng, with a record 23,917 deliveries, driven by the budget Mona M03 model, which starts at $17,000. Morgan Stanley increased its price target on XPeng to $17, due to its edge in AI and strategic positioning. The company has a strong balance sheet and its new technology can add to its market share.

The latest earnings will be important for the rally in XPeng shares since August.