Introduction to Forex Trading Signals

Quick and informed judgments are critical in the volatile world of forex trading. Many traders, whether novices or seasoned professionals, benefit from forex trading signals, which give valuable insights and real-time suggestions on whether to buy or sell currency pairs. These signals should help traders precisely capture market opportunities and regularly influence trading outcomes. With developments in technology and data analysis, trading signals have become more accessible, affordable, and sophisticated. This article will teach you about forex trading signals, how they are produced, and how to use them effectively in trading strategies.

What Are Forex Trading Signals?

Forex trading signals are real-time indicators that point to a specific action in the forex market, such as buying or selling a particular currency pair. These signals are generated by market analysis, which could be technical (using charts and indicators), fundamental (based on economic events and news), or emotional (based on market psychology). Traders utilise these signals to make rapid judgments and remain current on prospective profit opportunities without manually researching the markets. For example, a signal may tell a trader to purchase the EUR/USD when a positive economic report is issued in the Eurozone, signalling probable currency strength.

How Forex Trading Signals Are Generated

Forex trading signals are generated using various market analysis techniques, including:

Technical Analysis: Technical analysis provides indications using chart patterns, historical price data, and a variety of technical indicators. Moving averages, the Relative Strength Index (RSI), and Bollinger Bands can all predict potential entry or exit points based on price history. For example, when a currency pair’s price crosses a moving average from below, it may signal a buying opportunity. ATFX offers ATFX support and resistance indicators , along with Trading Central and Autochartist , so our traders can enhance their trading analysis and decision-making.

Fundamental Analysis: Economic data releases, interest rate decisions, and geopolitical developments can all give trading signals. For example, news of a country’s solid economic progress may inspire traders to purchase its currency, anticipating a rise in value.

Automated Signal Generators: Advanced trading systems usually feature automated trading signals generated by AI and algorithms. These algorithms can swiftly analyse large datasets, giving traders real-time indications based on technical and fundamental variables. For example, many traders use platforms like MetaTrader 4 or MetaTrader 5 to get automatic signal notifications.

How to Use Forex Trading Signals in Trading Strategies

Forex trading signals may be tailored to suit a range of trading strategies, including scalping, day trading, and swing trading. Here’s how to align signals with these strategies:

Scalping : Scalpers utilise signals to execute high-frequency transactions with narrow profit margins. Scalpers may use short-term technical indicators like minute-level moving averages to capture rapid market fluctuations.

Day Trading: Day traders use signals to enter and exit positions on the same trading day, including technical indicators and economic news releases.

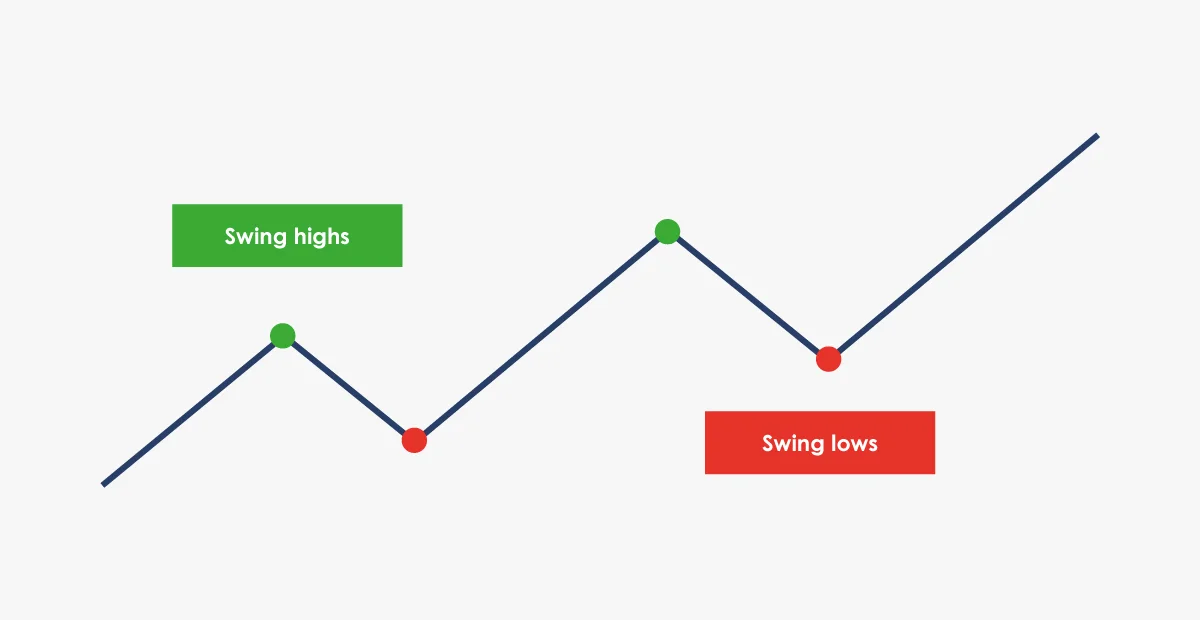

Swing Trading: Swing trading focuses on more significant price changes that last many days or weeks. Depending on long-term trends and indicators, they may use signals that combine technical and fundamental analysis to determine entry and exit locations.

A suggested approach technique is to test the effectiveness of the signals on a demo account to ensure they are in line with the trader’s goals and style.

Advantages and Disadvantages of Using Forex Trading Signals

Advantages:

Time Efficiency: Signals enable traders to make rapid judgments without significant investigation, potentially saving time and effort.

Access to Expert Insights: Many signal providers employ expert teams or powerful algorithms to generate signals based on extensive investigation.

Enhanced Decision-Making: Signals can help traders make more educated decisions, especially when paired with their analysis.

Disadvantages:

Dependence on Signals: Relying entirely on signals without comprehending the underlying market variables can result in losses, particularly during volatile market conditions.

Scam Providers: As signal services become more popular, scammers and untrustworthy suppliers are likely to emerge. Choosing reputable signal provider services with a track record of transparency and verified results is essential.

Types of Forex Trading Signal Services

Forex trading signal services can differ widely, so traders should choose one that best meets their needs and expertise. Common types include:

Paid vs. Free Signals: Paid services frequently give more complex and dependable signals than free ones, with some even delivering personalised insights. However, free signals might be an excellent starting point for newbies.

Manual vs Automated Signals: Expert traders analyse the market and provide insights, whereas algorithms create automated signals. Automated signals are quicker and less prone to human mistakes, but they may lack the depth of human understanding.

Subscription-Based Services: Many signal providers provide monthly or yearly memberships that frequently include instructional materials and assistance. Examples include popular platforms like ATFX and others that provide real-time forex signal subscriptions.

Register your free trading account with ATFX today to enjoy exclusive access to our ATFX Support & Resistance Indicator, Trading Central insights, and Autochartist tools for free!

Tips for Using Forex Trading Signals Effectively

Understand Before Acting: Instead of blindly following signals, traders should evaluate them in the context of their strategy and trading style.

Diversify Signal Sources: Use multiple signal sources for a balanced perspective. For example, combining technical indicators and economic news might provide a more complete picture of market circumstances.

Implement Risk Management: Implement risk management measures, such as stop-loss and take-profit orders. These can help limit potential losses if a signal-based trade does not go as expected.

Regularly Evaluate Signal Performance: Track and review the success rate of the signals over time. Discontinuing services with low accuracy can prevent losses in the long term.

Conclusion

Forex trading signals are helpful for traders to make timely and informed decisions in the volatile currency market. Traders may improve their chances of success by combining trading signals with a good strategy, effective risk management, and a deep understanding of the market. However, like with any trading instrument, it is necessary to use caution, choose credible sources, and avoid depending only on signals.

ATFX provides dependable forex trading signals for traders seeking a high-quality source supported by in-depth market research sent to their trading platform. ATFX’s signals are intended to help traders at all levels get an advantage in today’s competitive forex market.