S&P 500

Uncover the key aspects of investing and trading the S&P 500 index. We’ll introduce the S&P 500, analyze its historical performance, discuss differences between the S&P 500 index and futures and live updates of the S&P 500 index will also reflect current market conditions.

Why trade & invest in the S&P 500 with ATFX?

Customer Support

All customers benefit from 24/5 localized one-on-one customer support, alongside access to efficient tools and educational materials.

Tight Spreads

Experience highly competitive spreads on the S&P 500 with ATFX.

Effective Risk Management

Apply risk management tools, including stop loss and limit orders, to secure your investments when trading the S&P 500.

Zero Commission

Enjoy cost savings with tight and competitive spreads for S&P 500 position openings.

S&P 500 Index Live

S&P 500 Futures

At first sight, both charts may initially seem identical, but differences become apparent when switching to a bar or candlestick chart. The S&P 500 index tracks price movements during active trading hours from 9:30 am to 4 pm Eastern US time, excluding holidays and weekends. Price movements outside these hours do not reflect on live charts, but align with S&P 500 futures when trading resumes, often showing price gaps.

On the other hand, the S&P 500 futures chart shows how the index’s CFD asset prices move. It operates 23 hours a day, updating continuously on the charts even when the live market is not open.

Traders should understand this difference because any price gap between the S&P 500 index chart and the S&P 500 futures chart usually adjusts in the direction of the futures asset when the live market opens for trading.

How to trade & invest in S&P 500 in 3 Easy Steps

Discover three simple steps to invest in the S&P 500. First, trade the US500 CFD futures asset on the ATFX platform. Alternatively, consider investing in an S&P 500 index fund, which offers lower risk but may yield modest returns, making it suitable for smaller investments.

Follow the steps below to open a S&P 500 CFD trading account on ATFX.

- Create an account by filling out the online account opening form and submitting your identification and residency documents for verification.

- Fund the account using one of the available payment options

- Trade

1. Account Opening

1.1. No matter your approach to investing in the S&P 500, the first crucial step is to establish a brokerage account. This involves conducting thorough research to identify a broker that provides trading conditions aligned with your investment objectives.

2. Account Funding

2.1. Due to its volatility, the S&P 500 index demands higher margin requirements compared to FX trading. It’s essential to adequately fund your account to manage this volatility. Brokers like ATFX allow you to mitigate price swings by trading fractional S&P 500 contracts.

3. Trading

3.1. Trading the S&P 500 can be implemented via purchasing an index fund that tracks it or using long and short orders with leveraged CFDs to profit from market movements. Success requires a solid profitable strategy and disciplined risk management.

Why Invest in the S&P 500 CFD Asset? 3 Advantages You Should Know About!

ATFX provides the S&P 500 index as a leveraged CFD product, enabling retail traders to access it with reduced capital requirements. This approach allows traders to manage risk by trading the index’s collective price movements rather than individual stocks listed in the index.

The types of S&P 500 index funds are as follows; traditional index funds and exchange-traded funds (ETFs), which operate similarly to stocks. Investors buy shares in these funds, obtaining a portion of the index fund’s overall portfolio.

Trading the S&P 500 index CFD fund comes with three main advantages. These are:

- It is a passive investment

- Such funds are suitable for long-term investment

- The funds tend to be profitable over time

1. All-Weather Investment Channel

1.1. Trading the S&P 500 index CFD ensures you have access to an evergreen investment vehicle. Despite the collapse of many investments during the COVID-19 pandemic, the S&P 500 index CFD remained robust, if not stronger. Its bi-directional nature provides opportunities to profit from both market declines and increases.

2. Great for Long Term Investment

2.1. Building on the earlier section, the consistent long-term returns of the S&P 500 make it a strong investment option. Historically, the index tends to appreciate steadily, with trends that can persist over time. Therefore, investing in the S&P 500 index CFD during market downturns can still generate profits in the long run, provided you implement effective risk management strategies to minimize potential losses.

3. Potential for Larger Profits Over Time

3.1. Since 2000, the S&P 500 index has surged by 307.32%. If you had invested $1,000 in an S&P 500 index fund in 2000, it would have yielded nearly $4,073.2 by 2022. Trading the S&P 500 index via CFDs offers the potential for annual returns ranging from 300% to 500% with a dynamic strategy and sound risk management.

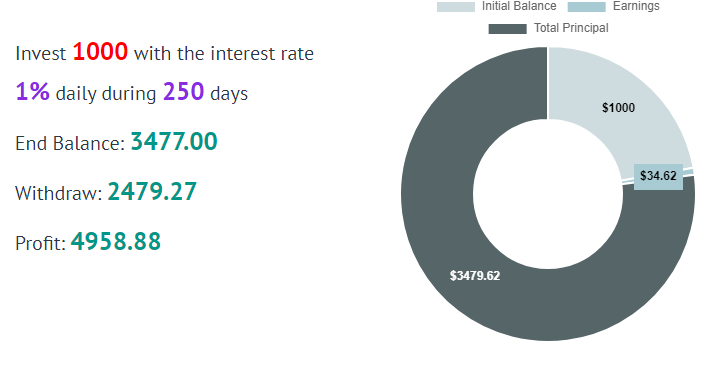

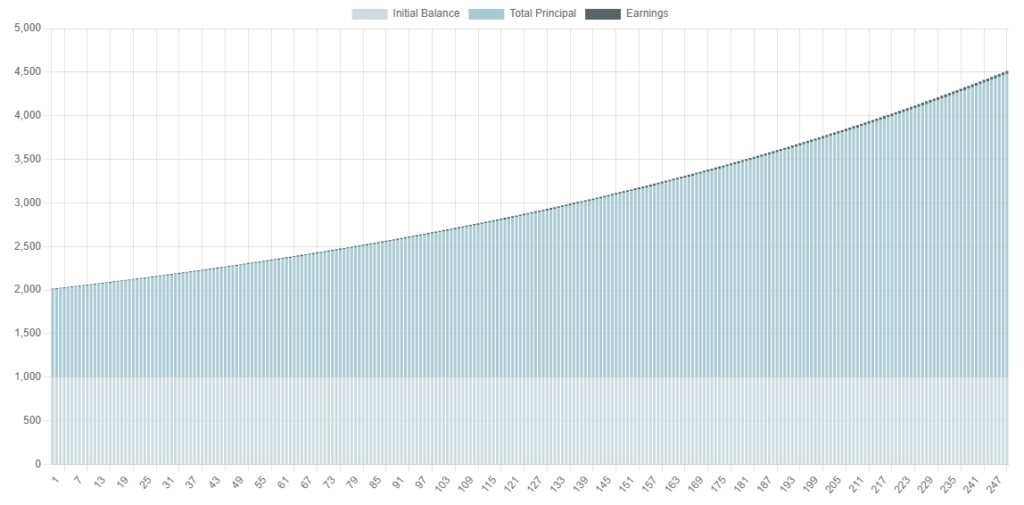

A CFD asset allows the trader to go long or short and take advantage of rising and falling prices. So, how is it possible for S&P 500 CFD trading to deliver potential returns of 300% a year, instead of 300% over 20 years like the main index delivered? Let us use a simple compounding formula, which assumes that the trader will trade the S&P 500 index CFD for 250 days out of 300 trading days in a year, with a starting capital of $1,000. The trades will seek to make 1% gains daily, reinvesting and compounding 50% of all daily gains made and receiving the rest of the percentage gain as a monetary payout.

The snapshot shows the trader would have grown their capital from $1,000 to $3,479, with a total cash withdrawal of $2,479.27 and a net profit of $4,958.88. These figures indicate that it is possible to make 300% to 500% returns on the S&P 500 CFD index product, using an incredibly conservative risk amount and a strategy that delivers a 1% return daily. This calculation factors in that the trader will miss some trading days (50 days out of a 300-day trading year) and will have days where multiple winners and losers will deliver a 1% return together.

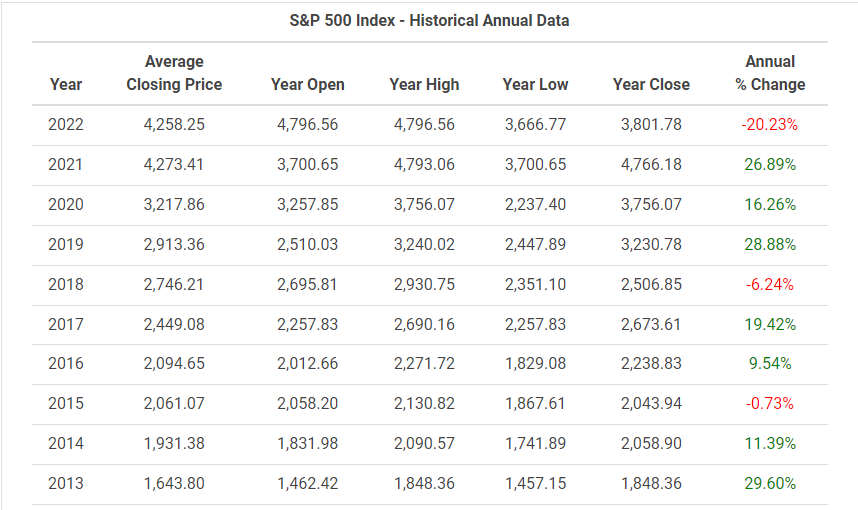

The S&P 500 Average Annual Return

What is the historical average annual return of the S&P 500 index? As we have mentioned earlier, the average annual return is 6.44%. Suppose the trader uses leveraged CFD products to trade the underlying S&P 500 index. Trading leveraged S&P 500 index CFDs also allows you to profit from dips in return and can become significantly larger.

S&P 500 Historical Returns by Year

Why do investors use the S&P 500 as a benchmark?

The S&P 500 index is used as a benchmark for the market’s performance because the market capitalization of the listed companies is more than 4/5ths of the entire US stock market. Therefore, it gives an accurate picture of how the overall market is performing. The S&P 500 index also makes it easy to purchase assets that emulate it, giving one exposure to a diversified pool of stocks.

Research has shown that buying into the S&P 500 will eventually outperform an active portfolio manager who picks large-cap stocks.

What is the S&P 500, and What Does it Measure?

The S&P 500 index is a US stock market index that tracks the performance of the 500 largest U.S. public companies by market capitalisation. In other words, the ranking of the top 500 companies considers the total value of their outstanding shares. The market capitalization of the companies listed in the S&P 500 index is about $39 trillion, representing approximately 80% of the total US stock market capitalization.

What are the Top 10 companies on the S&P 500 in 2022?

Top 10 companies in the S&P 500 index as of 2022:

- Apple Inc

- Microsoft Corp

- Amazon.com Inc

- Tesla Inc

- Alphabet Inc Class A (GOOGL)

- Alphabet Inc. Class C (GOOG)

- Nvidia Corp

- Berkshire Hathaway Inc.

- Meta Platforms Inc (formerly Facebook)

- UnitedHealth Group Inc

Start investing in the S&P 500 in 3 simple steps

Register for an account

Register Live Account

Complete the Live Trading Account application form & send all your e-KYC requirements.

Get Verified

We will verify and establish your identity through a series of security questions. Once we have verified identity, we will set up your account.

Start Trading

Start Trading & Fund Your Account. Go to your dashboard and fund your account to start trading online on our platforms.

FAQ

The best time to invest in the S&P 500 is when it has undergone a correction from its recent highs. This gives you a better entry price since you will buy it much cheaper than at its highs.

The S&P 500 index asset, traded as an index fund or ETF, delivers profitable returns over time with less risk than trading individual stocks. Furthermore, the index fund exposes you to a basket of assets, which reduces the risk of trading an individual stock and gives a single point of failure if the stock price plunges.

The value of the S&P 500 index will also drop significantly if the top 10 stocks are affected.

The Dow Jones Industrial Average is a price-weighted index, while the S&P 500 is a market-capitalisation-weighted one. The Dow Jones tracks 30 stocks, while the S&P 500 tracks 500 stocks.

The S&P 500 index was created in 1957.

The S&P 500 has several symbols, including US500, SPX500 or SP500.

If you are a long-term investor, one can dollar cost average, that is, buy a fixed amount of stock monthly. When the index falls, one can increase the amount bought. As long as the US economy continues to grow in the long run, the S&P 500 is expected to do well.

You can use any of the many momentum indicators, such as the Relative Strength Index (RSI), to determine when the S&P 500 index is overbought (i.e. between 70-100 for the RSI).