We noted the recent rally in the China 50 index and broader market but it is interesting to see news outlets in the west doubting the move. It is actually a rally from oversold levels that can continue higher.

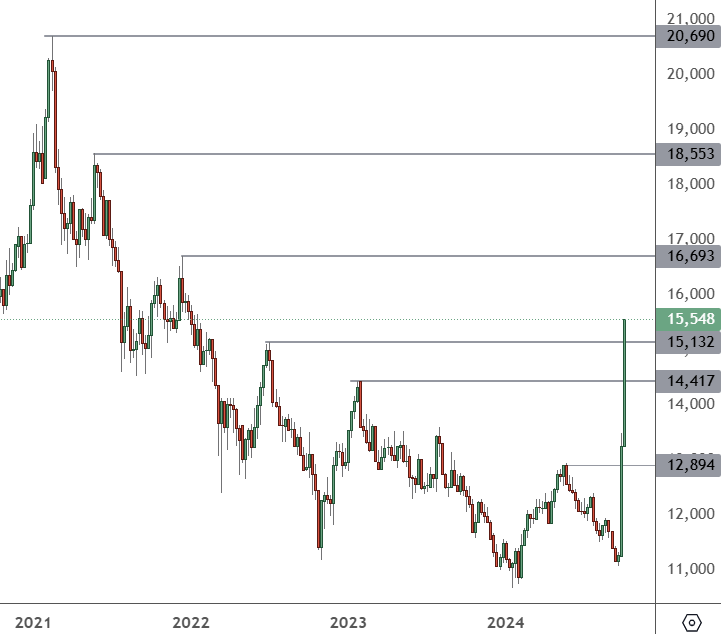

CHINA 50 – Weekly Chart

Even on a visual basis with the weekly chart, we can see that the index of the top 50 Chinese stocks based around the 11,000 level on three occasions since 2022. The market is not close to the 2021 high above 20,000.

An article from US-based outlet CNBC said that the recent rally “has echoes of the 2015 bubble”. Another from Forbes said that “China’s 30% Stock Rally Has An Economic Problem”.

Those types of articles fail to note that the United States stock market has been rallying to all-time highs on the promise of AI gains that have failed to materialise yet.

A quick example is Alibaba stock, which now trades at a price-to-sales ratio of 1.86x. That is still 51% lower than the 5-year average of 3.79x. The company’s US peer Amazon trades at 3.08x sales and both companies have interests in artificial intelligence.

A disappointing recovery in the Chinese economy led to slow foreign investment in domestic firms but Western investors could miss out on future gains.

Bloomberg reported that Invesco said that “Some stocks have become really overvalued”. Other investment banks are urging caution but will happily sell US stocks at the top of their recent valuations.

“Whether the sweeping moves will rescue the nation’s deeply distressed real estate sector and ease consumer malaise is uncertain,” said Gina Adams at Bloomberg Intelligence. “China’s late-week moves have yet to lift the broader earnings outlook for emerging markets for 2024 or 2025 as analysts and investors gauge the impact”.

The recent move in China is based on the government finally drawing a line in the sand and committing to stimulus. As overseas investors focus on the recent economic issues, stocks can return to a healthier valuation and are far from a bubble.