Selling market leader Nvidia has hurt chip stocks across the board.

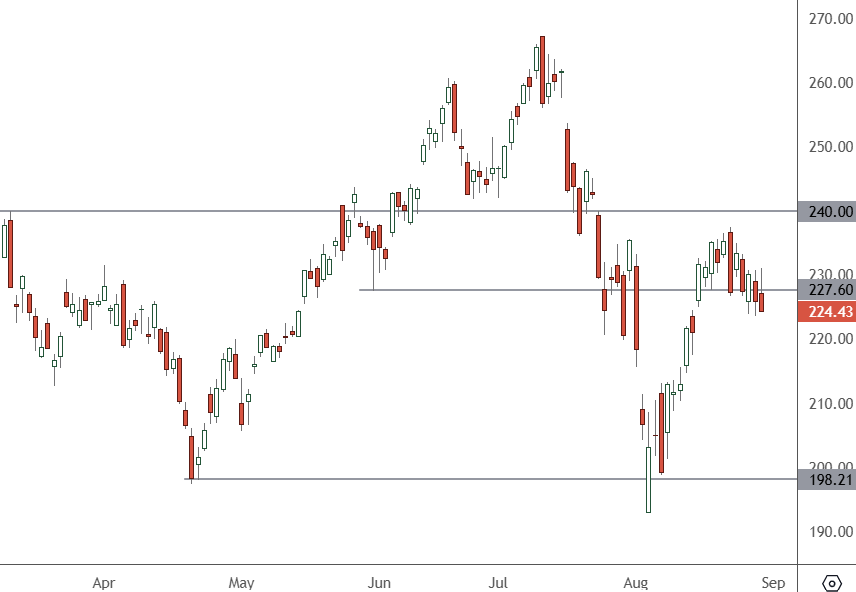

SOXX – Daily Chart

The SOXX semiconductor ETF has recovered from an early-August bounce but is still lower than the July highs. As resistance gives way there is a risk of a deeper correction to $200.

Nvidia shares dropped -6% on Thursday after the company’s earnings outlook fell short of lofty expectations. The selling in the leading AI chipmaker has hurt semiconductor stocks across the board.

The company yesterday forecast third-quarter gross margins that may come in lower than market estimates and revenue that was largely in line. However, there are concerns that production of its next-generation Blackwell chips will not materialise in a big way this year.

“Investors want more, more and more when it comes to Nvidia,” said Dan Coatsworth at AJ Bell.

“It looks like investors might not have taken the average of analyst forecasts to be the benchmark for Nvidia’s performance, instead they’ve taken the highest end of the estimate range to be the hurdle to clear.”

Nvidia forecast revenue of $32.5 billion, plus or minus 2%, for the third quarter, compared to analysts’ estimates of $31.8 billion. That forecast still implies 80% growth from the year-ago quarter, but was below the high-end of market predictions of $37.90 billion.

A delay in the production of the next-generation Blackwell chips until the fourth quarter was not a big concern for analysts, due to higher demand for its current Hopper chips. Some analysts were also concerned about rising regulatory concerns after Nvidia disclosed requests for information from US and South Korean regulators. That comes on top of recent inquiries from the EU, UK and China previously.

Nvidia stock was valued at 36 times earnings ahead of its quarterly report, while the S&P 500 is trading at 21 times expected earnings. That is higher than a five-year average of 18. Nvidia’s sell-off comes due to the stock being heavily priced for growth and the latest results were near expectations.

Chipmakers were seeing red across the board with AMD down -0.88% and TSM down -0.40% on Thursday.