The GBPNZD exchange rate has some important speeches this week from the European Central Bank and Bank of England.

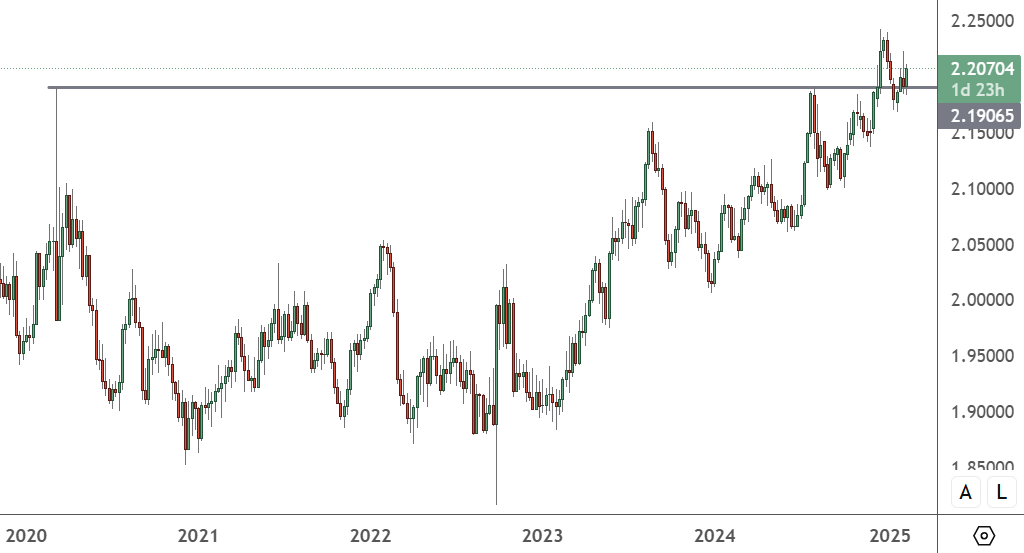

GBPNZD – Weekly Chart

The GBP v NZD price is trading above the 2.20 level but a failure there would possibly see a correction start. The 2020 spike high at 2.19 is going to be pivotal in the weeks ahead.

The key data for the British pound vs New Zealand dollar was due on Thursday with inflation expectations for the Kiwi economy at 10am HKT which will test the recent fall to 2.12%. Any uptick in inflation could arrest the recent slump versus the British currency.

UK GDP growth data at 3pm HKT was expected to show the country’s economy ticking up from a 0.9% annual growth rate to 1.1%. That will be the most important data set as Britain’s economy must support the country’s turnaround plans with a government who cannot afford to require more borrowing.

Any slowdown in the UK economy at this key resistance level in the pair could be the catalyst for a correction. The British economy is on course to grow by 1.5% this year after the budget gave a boost to public spending but could be blown off course if Donald Trump approves tariffs, a leading economic thinktank has said.

In a boost to the UK Chancellor after recent negative data, the National Institute of Economic and Social Research (NIESR) increased its annual growth prediction from 1.2% to 1.5%.

However, it warned that an expansion of tariffs after the US president’s 10% levy on imports from China and 25% on Canada and Mexico, could reduce the pace of growth to 1.3%, and by more if they hit UK businesses directly.

New Zealand’s dollar could be a quiet currency gainer in a changing world where economies will have to wake up to 25% reductions in revenue for key exports.