Some big-name US hedge fund investors have upped their stakes in Chinese stocks despite recent headwinds.

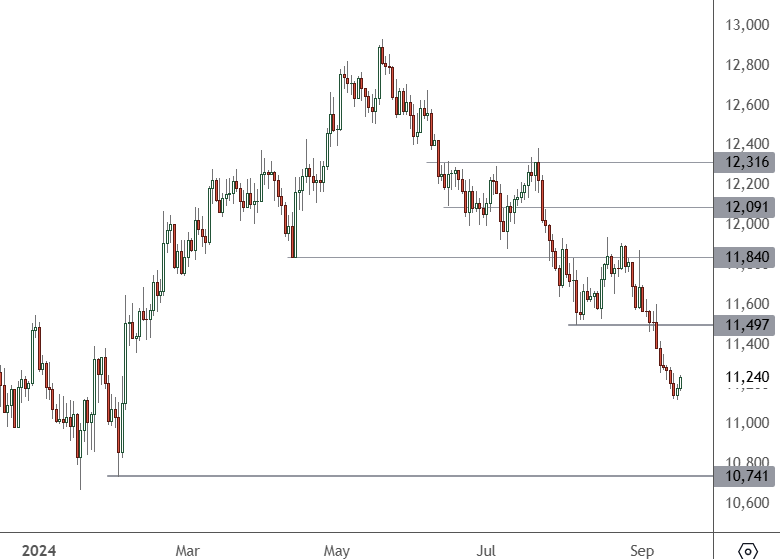

CH50 – Daily Chart

The price of the CH 50 index was higher for two days but the bounce from recent weakness was light on volume. A larger rebound is needed back to the 11,500 level or further lows to 10,741 are possible.

Billionaire investors, including David Tepper and “Big Short” investor Michael Burry, recently added to their China bets. Regulatory filings showed Chinese e-commerce giant Alibaba is still Tepper’s top holding, although he trimmed his stake by 7% in the company during the second quarter. Alibaba now accounts for 12% of his Appaloosa Management’s $6.2 billion equity holding.

Tepper also added stakes to other Chinese companies, including JD.com, KE Holdings and two ETFs (iShares China Large-Cap ETF and KraneShares CSI China Internet ETF).

Burry has made similar moves with an $11.2 million bet on Alibaba. That makes Alibaba Burry’s largest holding, while it also holds Baidu and JD.com.

Veteran investor George Boubouras is also buying into China. The K2 Asset Management research director sees opportunity in emerging markets, telling CNBC he has a “tactical and dynamic tilt” on Beijing, and is playing it through “exporters to China, where their earnings are in the developed world.”

China’s economy softened again in August, extending a slowdown in industrial activity and property prices as the government faces pressure to ramp up stimulus in the country. Data published by the National Bureau of Statistics on Saturday showed weakening activity across industrial production, retail sales, and the property sector compared to July.

“We should be aware that the adverse impacts arising from the changes in the external environment are increasing,” said Liu Aihua, the bureau’s chief economist.

Mr Liu added that domestic demand was insufficient and a sustained economic recovery still confronts multiple difficulties and challenges.