Microsoft (MSFT) shares are in focus as the company is the latest tech giant to release its earnings report.

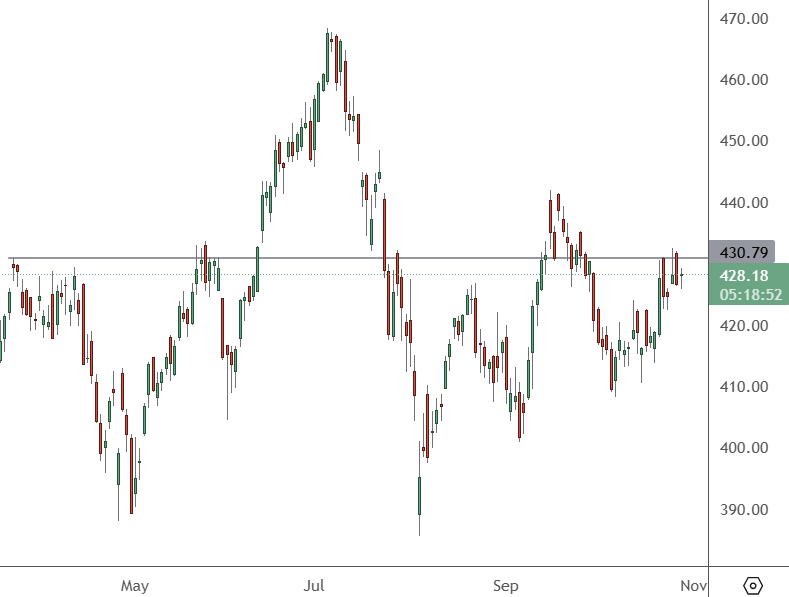

MSFT – Daily Chart

The price of MSFT is testing the $430 level and that has been a pivot area for the stock since March. A strong earnings report could see the price jump above that level and test the $440 area, while there is support down to $410.

Microsoft shares have slipped from a July high near $470 as investors wound back their expectations for artificial intelligence revenue streams. Microsoft’s earnings will be similar to Alphabet’s, where investors want to see further cloud growth and also the level of spending that the company has committed to.

Microsoft is now the third-largest company in the world, with a market valuation of $3.18 trillion, after Nvidia soared to number one. The company’s June earnings were disappointing after cloud growth slowed down.

In the upcoming earnings report which is released after the market close on Wednesday, investors will again look for the cloud growth outlook. The Azure segment has been a key driver of revenue for the company. Another focus will be the company’s spending on its data centre infrastructure. Analysts are worried that rising capital expenditure could hurt profit margins.

Azure and other cloud services now account for nearly 60% of the company’s total revenue, making it critical to future growth. Azure ranks second in global market share, behind Amazon Web Services. Google is in third and will also release its earnings report this week, which could highlight competition.

In the fourth quarter of its fiscal 2024, Microsoft’s Cloud segment reported revenue of $28.51 billion, for an increase of 19% year-on-year. That was driven by a 29% growth in Azure and other cloud products. However, Azure’s growth fell short of analysts’ expectations in the quarter.

Deutsche Bank analysts said they expect Azure to post a low-to-mid 30s percentage increase for the fiscal first quarter, saying the company “needs to deliver Azure outperformance and guidance for little if any deceleration”.

Microsoft management has said that increased investment in data centres are needed to meet a fast-growing demand for AI training. In the forward-looking statements of the June quarter, the tech giant acknowledged “significant investments in products and services that may not achieve expected returns,” after an extra $3 billion was spent compared to the previous quarter.

Microsoft will need to see a rebound in its upcoming earnings release if the share price is to return to its March highs.