Nvidia (NYSE:NVDA) will release its latest earnings on Wednesday as fears over delays to its new Blackwell range linger.

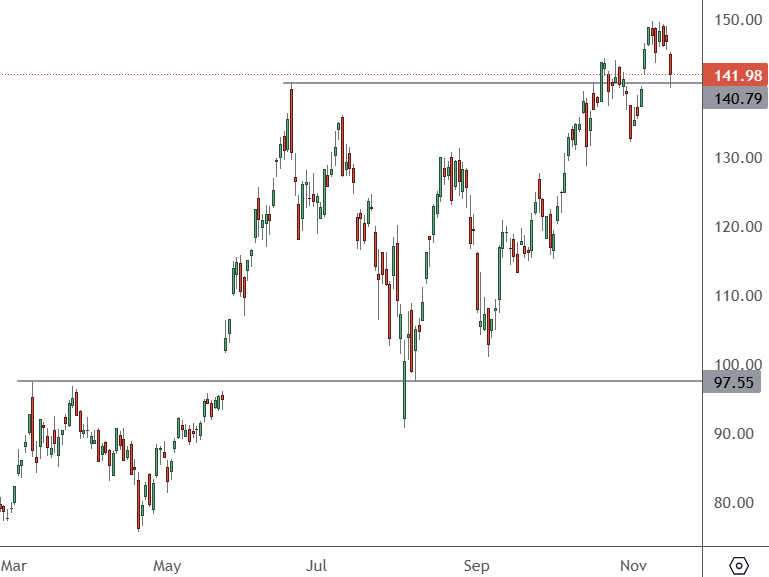

NVDA – Daily Chart

The price of NVDA shares is testing the previous high which now makes for support at the $140.79 level. Any disappointment in earnings or guidance could lead to a correction in the stock.

Nvidia has beaten Wall Street revenue expectations for the last eight quarters, but analysts now expect a slower pace of growth. The focus will now be on how the company overcomes recent delays and supply chain issues.

The chipmaker that has driven a sector rally in generative artificial intelligence is expected to report that its third-quarter sales surged 82.8% to $33.13 billion, analysts said. If analysts are correct, it would mark the slowest growth in six quarters, with its sales at least doubling in the previous five quarters.

Growth for the company’s fourth quarter ending January, which will start to include sales of Nvidia’s new Blackwell chips, is likely to slow further to 67.6%. Design flaws in the new product have led to redesigns as customers report overheating issues. That now puts at risk the company’s previous prediction of “several billion dollars in Blackwell revenue” in the January quarter.

Morgan Stanley analysts expect to see Blackwell revenue coming in between $5 billion and $6 billion for the latest quarter. In comparison, Piper Sandler forecasts a range of $5 billion to $8 billion in revenue from the chips that have 30 times more speed than earlier models.

Nvidia’s ability to deliver the new chips may also be limited by supply chain constraints, with capacity very tight going into 2025. Taiwan Semiconductor, which makes chips for Nvidia, said in July that supply issues were a concern.

“It’s hard to read this with any precision, to be clear,” Morgan Stanley analysts said, adding that even a one-week change in the timeline for delivering Blackwell chips could have a meaningful impact on revenue expectations.