The NZDJPY exchange rate dropped sharply ahead of Japanese data on Thursday.

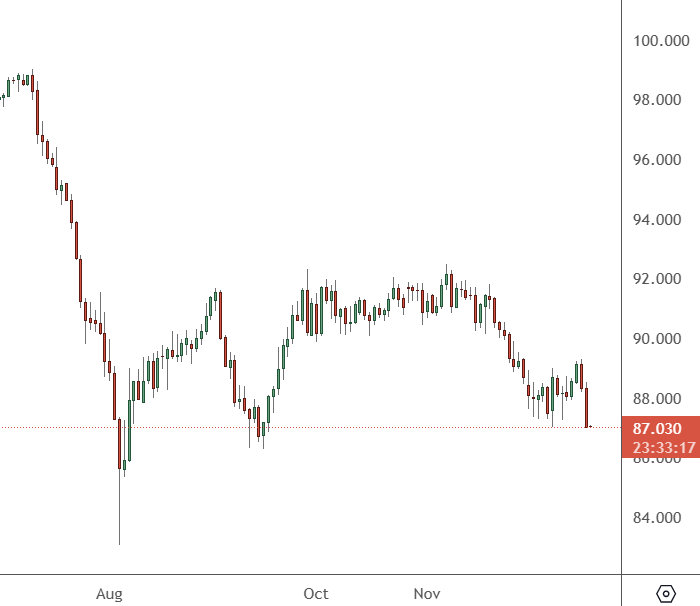

NZDJPY – Daily Chart

The price of NZDJPY has dropped through the 88 level with support below at 86. The 2024 lows could come under threat below that level.

GDP growth data for the New Zealand economy at 5:45 am HKT, showed New Zealand’s economy suffered a deeper-than-expected recession in the second and third quarters due to high interest rates. GDP declined by -1% in the three months through September, Statistics New Zealand said. Economists expected a -0.2% contraction. In the second quarter, GDP shrank a revised -1.1% compared to an initially reported -0.2% drop. The latest data comes ahead of the BOJ interest rate decision and monetary policy statement. Markets are looking for a sign from the BOJ to see when they will move to hike interest rates.

Markets are not ruling out a 0.25% cut from the Bank of Japan and export data on Wednesday was another boost for the economy. Exports rose for a second consecutive month in November, highlighting strong global demand that may later be hurt by protectionist US trade policies.

Total exports rose by 3.8% cent year-on-year in November, more than market forecasts for a 2.8% increase and 3.1% rise in October. Exports to China, the country’s largest trading partner, rose 4.1% in November from a year earlier. Exports to the United States were down -8%. Imports dropped -3.8% in November from a year earlier, compared with market forecasts for a 1% increase.

Nearly three-quarters of Japanese companies fear Donald Trump’s next term as US, citing a negative impact on the business environment, a Reuters survey said. BOJ Governor Kazuo Ueda has said the bank will continue raising rates if the economy and prices move in line with projections. However, Reuters sources said the central bank is leaning toward keeping interest rates steady this week due to overseas risks.