Nvidia delivered its latest box office earnings on Wednesday after the market closed, and that will guide stocks over the weekend. Fellow chipmaker Super Micro Computer lost 20% after delaying its results on the back of a pessimistic analysis.

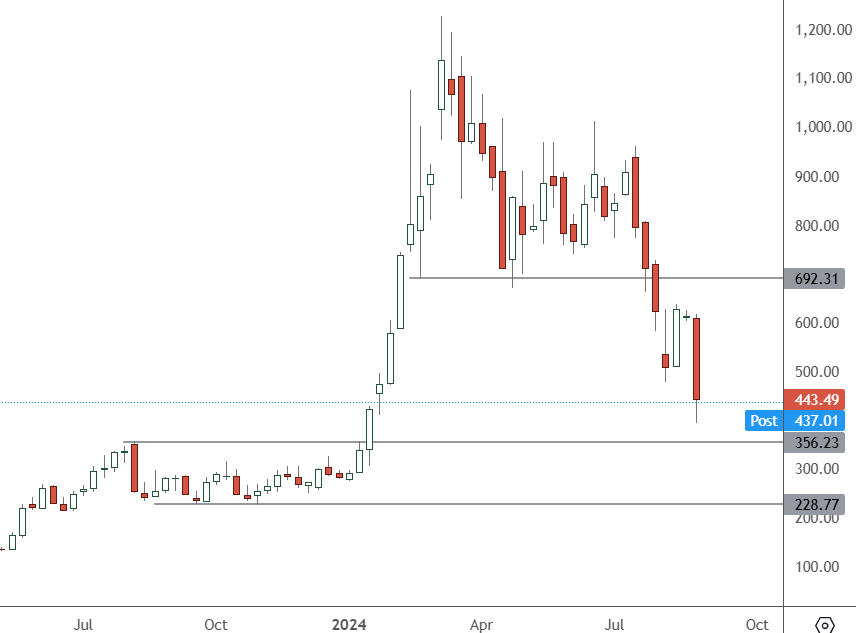

SMCI – Daily Chart

The price of SMCI continues to slump, and critical support will come in at $356, which is almost 30% lower than the all-time high set this year. The recent 2023 support at $228 could be in play if the coming earnings are negative.

Super Micro Computer closed down more than -19% after it said it would delay filing its Annual Report on Form 10-K for the fiscal year ended June 30, 2024.

The news came after the company received a negative analysis from short-selling activist Hindenburg Research. The research firm cited several concerns regarding the company’s accounting practices and corporate governance, which could be concerning for investors and shareholders.

Despite a $17.5 million settlement with regulators in August 2020 for accounting violations, Hindenburg said the company continued to embark on questionable practices shortly after that and re-hired staff involved in the accounting issues.

“Less than 3 months after paying a $17.5 million SEC settlement, Super Micro began re-hiring top executives that were directly involved in the accounting scandal, per litigation records and interviews with former employees,” the report said.

Super Micro’s dealings with sanctioned countries were also questioned. Despite a guilty plea for exporting banned chips to Iran in 2006 and assurances of compliance with US export bans to Russia, the report said exports to Russia have increased, potentially violating the US sanctions.

However, some analysts are still bullish on the company. Rosenblat analysts said that while the 10-K delay “is not a good look”, the near 20% plunge in SMCI stock “seems over the top when considering the Hindenburg dynamic as old news or inaccurate”.

The accusations against the chipmaker will play out over the medium term. However, the company could face further volatility after the Nvidia earnings on Wednesday.

Chipmakers have driven the AI stock market rally, but the Santa Clara firm has been the market leader. The company released earnings that aligned with expectations and guided higher for Q3. However, the stock was down more than 4% in post-market trade.

Nvidia forecasted revenue of $32.5 billion, plus or minus 2%, for Q3, compared with analysts’ estimates of $31.8 billion, according to LSEG data.

The company also expects several billion dollars in revenue from its new Blackwell chips in the fourth quarter, despite recent fears of production delays hurting growth.