Traders pushed the S&P 500 higher by looking ahead to interest rate cuts.

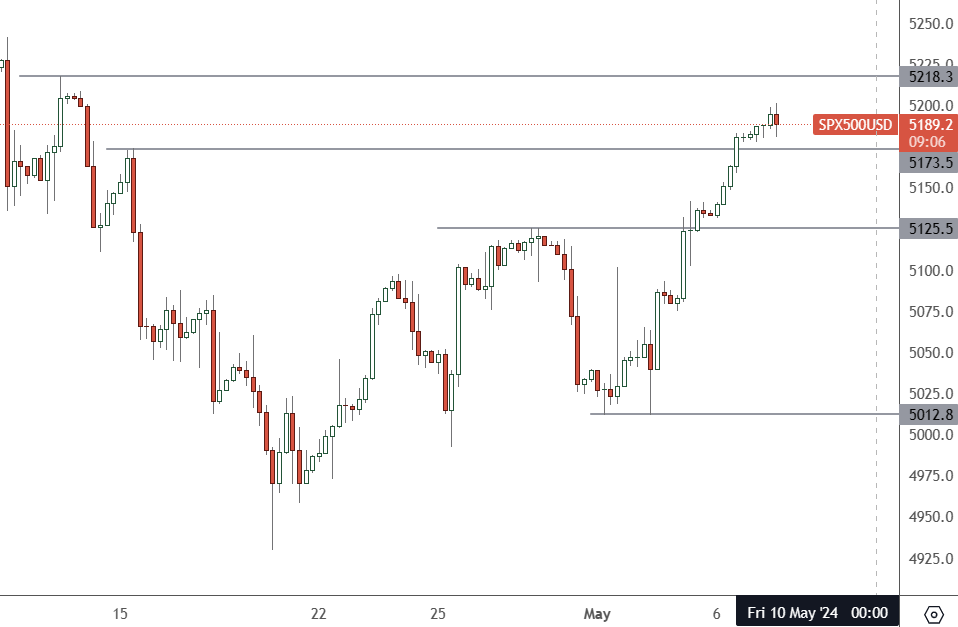

SP500 – Daily Chart

The SP500 has resistance at the 5,218 level with no new catalyst for significant moves.

Global shares were trading at one-month highs on Tuesday, boosted by optimism that the Federal Reserve will cut US interest rates once or twice this year.

The US jobs report last week was weaker than economists had expected. It showed the slowest growth in nearly two years, leading to investors speeding up their timeline for rate cuts.

According to LSEG data, traders now see 45 basis points of Fed rate cuts by the end of 2024, with a first cut expected in September. Traders had been gloomy about cuts after recent inflation data showed higher inflation. The yield on benchmark 10-year Treasury notes dropped to a one-month low of 4.420.

The strength of the US housing market and higher inflation means monetary policy may be less restrictive than officials believe, Minneapolis Fed President Neel Kashkari said. His report cast doubt on inflation getting below the Fed’s 2% target anytime soon.

Treasury yields were also lower, with traders focused on absorbing $125 billion in new supply this week.

There was mixed earnings data, with Disney shares falling 10% on weaker-than-expected results. Peloton jumped after CNBC said that private equity firms were interested in the firm.

US shares have not been affected by the tensions in the Middle East, and Michigan consumer data is the only high-level event for the US market on May 10. US stocks are back on a bullish footing, and there is no catalyst yet for any change in the tone. In March, the S&P 500 made an all-time high around the 5,284 level and could look to head there again.