After a sharp sell-off, Thursday’s economic figures will test the USDJPY exchange rate bounce.

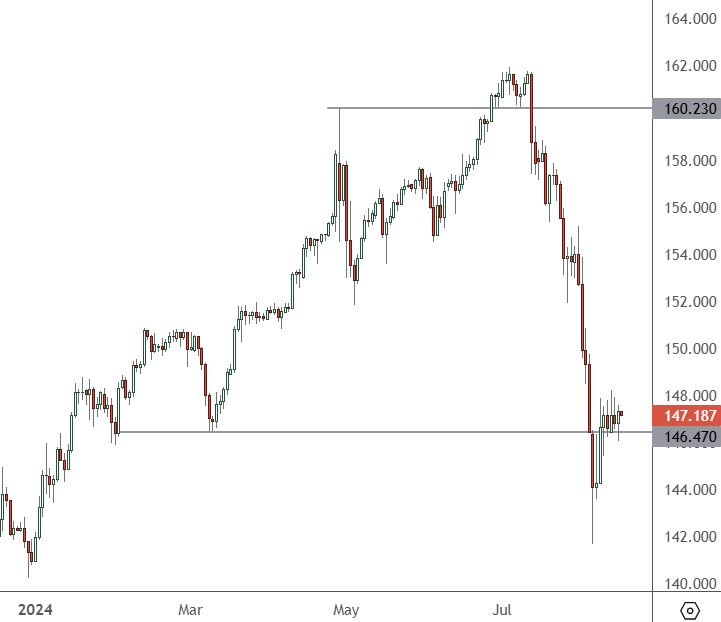

USDJPY – Daily Chart

The USDJPY has bounced from a sharp correction to trade near the 148 level. Recent weakness in the exchange rate rocked the Tokyo stock market, and traders will be on guard for the latest data.

Thursday brings an annualised GDP growth reading for the Japanese economy at 7:50 am HKT, with analysts expecting a significant reversal of 2.1% from the previous month’s -2.0%.

The latest preliminary data could help to back up the BOJ’s recent rate hike if strength emerges as expected.

After FX currency interventions to slow the weakness in the Japanese yen, the BOJ added a surprise rate hike to shut the door on short sellers. That rocked the Japanese stock market and led the central bank to step back from any further monetary policy changes at this time.

The US will release retail sales data later in the evening. The reading is expected to be 0.3%, up from a flat 0% the previous month.

After softer price data increased the chances of a Federal Reserve rate cut in September, the dollar was lower on Wednesday.

US July CPI slowed to 2.9% year-over-year from 3.0%, slightly better than expectations of no change at 3.0% and the smallest annual increase over three years. July CPI ex-food and energy eased to 3.2% from 3.3% annualised in June, which is in line with expectations and the smallest annual increase over three years.

Market veteran Ed Yardeni said the Federal Reserve will only cut rates once this year because the economy is too strong. That is contrary to many other analysts who see a September cut followed by another in December.

Economists fear a recession in the US, and some want interest rates reduced to ease the burden.