| Summary The Bank of Japan’s decision to maintain steady interest rates, alongside an optimistic economic outlook, caused the USDJPY to rebound from its recent lows. |

The Bank of Japan held rates steady last week, leading to a bounce in the USDJPY.

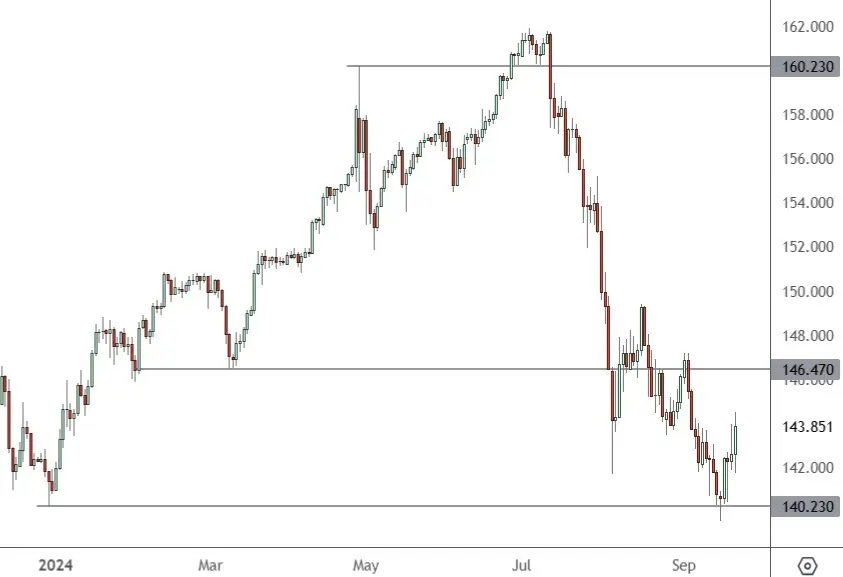

USDJPY – Daily Chart

The USDJPY exchange rate has bounced from previous support at 140.23, which marks the lowest level coming into 2024. The price of USDJPY now has an obstacle at 146.47.

The US dollar has been sliding recently due to the unwinding of interest rates from the Federal Reserve.

The Bank of Japan held its interest rates steady and revised its consumption assessment, suggesting further confidence in a solid economic recovery. That could allow the bank to raise interest rates again in the coming months.

The BOJ held short-term interest rates steady at 0.25% as expected while noting improved domestic conditions, which continue to hint at an unwinding of years of loose monetary policy.

“Private consumption has been on a moderate increasing trend despite the impact of price rises and other factors,” the BOJ statement said. The assessment was more optimistic than previous statements and noted that consumption was resilient.

“Our decision on monetary policy will depend on economic, price and financial developments at the time,” Bank of Japan Governor Kazuo Ueda said.

“Japan’s real interest rates remain extremely low. If our economic and price forecasts are achieved, we will raise interest rates and adjust the degree of monetary support accordingly,” he added.

The dollar bounced despite the Fed’s rate cut and will look to find a bottom at the current lows. The US central bank has hinted at 50 bps of further cuts this year and more in 2025. However, the lack of action by the BOJ to move higher in its rate cycle has allowed some strength to return to the US dollar. Markets will now shift their focus to economic data to see if it backs up the BOJ and Fed assessments.