The USDJPY exchange rate has data on Monday with the Japanese GDP growth numbers.

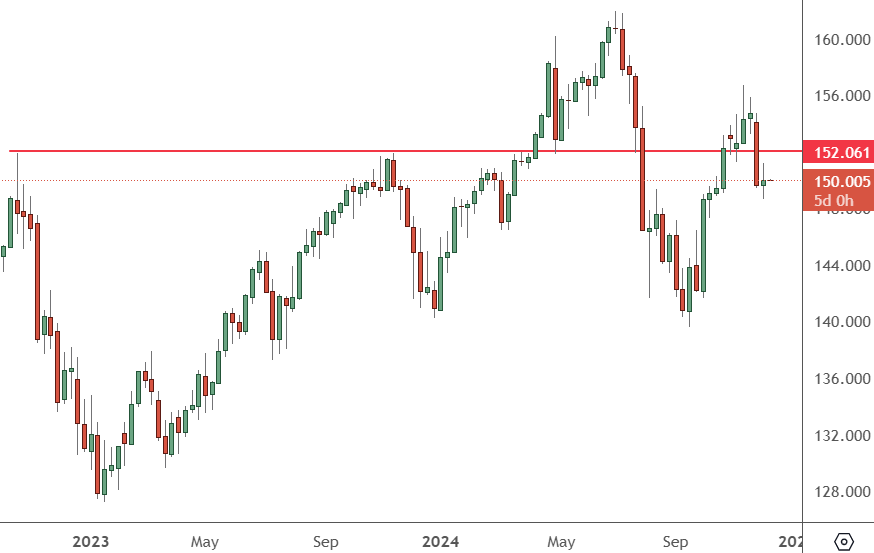

USDJPY – Weekly Chart

The price of USDJPY has rallied to 156 but fell back toward the 150 level. Some negative data for the USD could test the 140 level again.

Japanese GDP growth data comes out at 7:50am HKT on Monday. Analysts are expecting to see a 0.2% print from Japan.

The data follows a big week for US data where manufacturing was stronger and the NFP payrolls job data came in strong. Nonfarm Payrolls (NFP) in the US rose by 227,000 during November, the US Bureau of Labor Statistics (BLS) said on Friday. This reading followed the 36,000 increase reported in October, which was revised up from 12,000 and came in above the market expectation of 200,000.

Other details in the report highlighted that the Unemployment Rate rose to 4.2% in November from 4.1%, as expected. The Labor Force Participation Rate edged lower to 62.5% during the period, while the annual wage inflation, measured by the change in the Average Hourly Earnings, held steady at 4%, coming in above the market.

In Japan, the government held its belief that the economy is recovering moderately on Tuesday, while warning about the potential impact of US President-elect Donald Trump’s policies on the economic outlook.

“Trends in the US economy can have a direct or indirect impact on the Japanese economy, and we also need to be aware of the possibility of an impact through fluctuations in financial and capital markets,” a Cabinet Office official said after the release of the monthly economic report for November.

There is also the potential for investment flows coming in from South Korea, where the President was under threat of treason. Tokyo is about to introduce a four-day workweek for government employees, in an attempt to help working mothers and boost the country’s record-low fertility rates.

“We will review work styles … with flexibility, ensuring no one has to give up their career due to life events such as childbirth or childcare,” said Tokyo Governor Yuriko Koike. It is unsure how the measure will affect consumer spending of GDP in the country.

For the USA, it is a waiting game ahead of the Trump Presidency as the incoming President will have power to affect policy.