Chinese electric vehicle maker XPeng has earnings released on Tuesday and will look to extend recent gains.

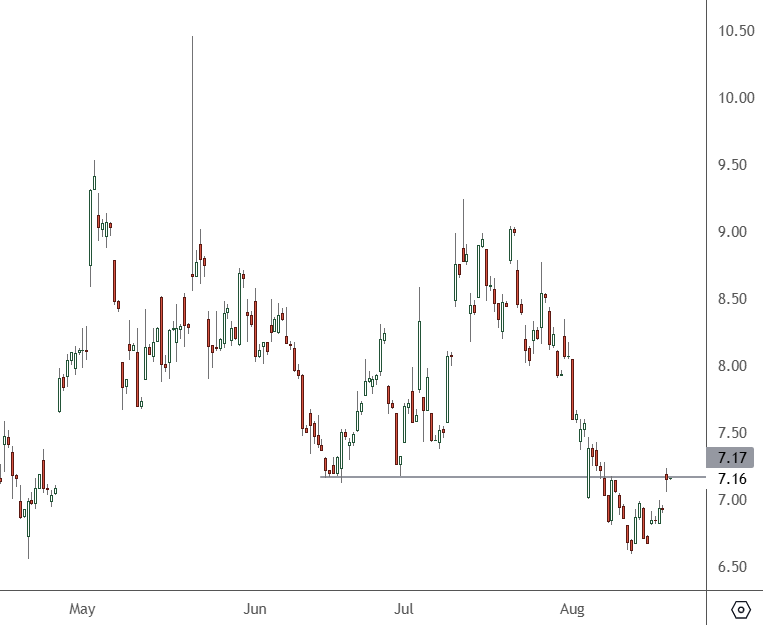

XPEV – Daily Chart

The price of XPEV has bounced from recent lows to test resistance at 7.16. A push ahead of that level with earnings could lead to a more sustainable recovery.

XPeng, one of Tesla’s big rivals in the domestic market, will release earnings on Tuesday, which could reveal further progress in the international market. Chinese EV manufacturers have looked to tackle Tesla in its foreign markets.

However, there is also further competition in the domestic market. Geely-owned EV maker Zeekr has released a lithium iron phosphate battery technology that can charge from 10% to 80% complete in less than 11 minutes.

“The 2025 Zeekr 007 sedan will be the first model to carry the new lithium iron phosphate batteries with deliveries to begin next week,” said Michael Lew in his Advanced Battery newsletter.

Analysts will be keen to see the latest profitability and sales from XPeng. A slowdown in EV adoption may put pressure on the company’s earnings. Wall Street analysts expect the manufacturer to report a loss of 18 cents per share and a positive $1.1 billion in revenue.

Investors will be watching closely for the Mona M03 launch to see if there are any potential shifts in consumer sentiment. Attention will also be paid to the Beijing-based company’s recent corporate reorganisation. XPeng has also been looking to artificial intelligence as a further catalyst.

Three recent analyst ratings for XPeng from BofA Securities, Citigroup, and Macquarie predict an average price target of $9, implying a 26.23% upside from the current price.