CFD vs Futures: For beginners and advanced traders seeking clarity in the financial markets, distinguishing between these two can be a game-changer. In this article, you will learn key differences and similarities between CFDs and Futures, and which one you should choose.

What are CFDs?

Contracts for Difference, or CFDs, are a type of derivative trading that allows investors to speculate on the rising or falling prices of the fast-moving global financial markets. Unlike purchasing the underlying asset, CFD traders buy or sell units of a particular instrument, depending on whether they expect future prices to increase or decrease.

Example:

Imagine you believe that the price of Company X’s stock will rise. Instead of purchasing the stock outright, you open a buy (long) CFD position. If the stock price increases, you can sell the CFD at a higher price, profiting from the difference minus any costs.

What are Futures?

Futures are standardised contracts to buy or sell a specific asset at a predetermined price at a specified time in the future. These contracts are traded on futures exchanges, including commodities, currencies, and financial instruments.

Example:

Consider a farmer who wants to lock in a price at which he will sell his wheat crop in 6 months. He can enter into a Futures contract, agreeing to sell his wheat at a particular price, protecting him if wheat prices fall by the time he harvests.

CFDs vs Futures : 9 Differences

Feature | CFDs | Futures |

Expiry Date | No fixed expiry date, allowing for flexible trading durations. | Fixed expiry dates, requiring traders to close or roll over positions by a specific date. |

Contract Size | Flexible contract sizes enable traders to invest with smaller amounts of capital. | The exchange sets standardised contract sizes, often requiring a larger minimum investment. |

Trading Venue | Traded over-the-counter (OTC) directly between two parties without the oversight of an exchange. | Traded on centralised exchanges, providing transparency and reducing counterparty risk. |

Price Determination | Prices are determined by the broker based on the underlying asset’s market price. | Prices are set by market supply and demand on the exchange. |

Costs | Traders must consider overnight financing costs (swap rates) for positions held more than a day. | Traders pay exchange fees and brokerage commissions but do not incur overnight financing costs. |

Market Access | Provides access to a wide range of markets, including stocks, indices, forex, and commodities. | Access is typically limited to commodities, financial futures (like indices and bonds), and currency futures. |

Regulation | Less standardised due to the OTC nature, with regulation varying by country. | Highly regulated with standardised practices across exchanges globally. |

Risk Management | Offers stop loss and take profit orders, but counterparty risk is higher due to the lack of a central clearinghouse. | Futures exchanges provide a central clearinghouse, reducing counterparty risk. Margin requirements and daily settlement help manage risk. |

Investor Suitability | Suitable for short-term traders looking for flexibility and access to leverage. | More suited for institutional investors or those looking to hedge long-term positions due to the higher transparency and fixed terms. |

Example:

CFDs: A retail trader speculates on the price movement of Tesla stock without wanting to invest in the full price of the stock or worry about an expiry date. They can trade a CFD with a broker, taking a position that represents a fraction of Tesla’s stock price.

Futures: An energy company wants to lock in the crude oil price ahead of market fluctuations to hedge against the risk of rising fuel costs. They can enter into a Futures contract, agreeing to buy a specific amount of crude oil at a predetermined price on a future date, ensuring they can manage their fuel expenses regardless of market volatility.

Consider ATFX as your broker

ATFX offers a comprehensive suite of trading options, including CFDs and Futures. ATFX is known for its competitive spreads, user-friendly platform, and FCA regulatory compliance, making it a suitable and reliable choice for traders. Learn more about ATFX.

CFDs vs Futures : 6 Similarities

Derivative Nature

Both CFDs and Futures are derivatives, meaning their value is derived from the price movements of an underlying asset, which can include commodities, stocks, indices, or currencies. This allows traders to speculate on price movements without owning the actual asset.

Leverage and Margin

Leverage and margin trading are common to both CFDs and Futures, enabling traders to control large positions with relatively little capital. This can amplify profits but also increase the possibility of significant losses.

Example:

A trader with $10,000 in their account might use leverage to trade a position worth $100,000 in the oil market, whether through CFDs or Futures. If the market moves in their favour by 1%, they could gain $1,000, effectively doubling their initial investment. However, a move against them could have a similarly magnified effect on losses.

Market Access

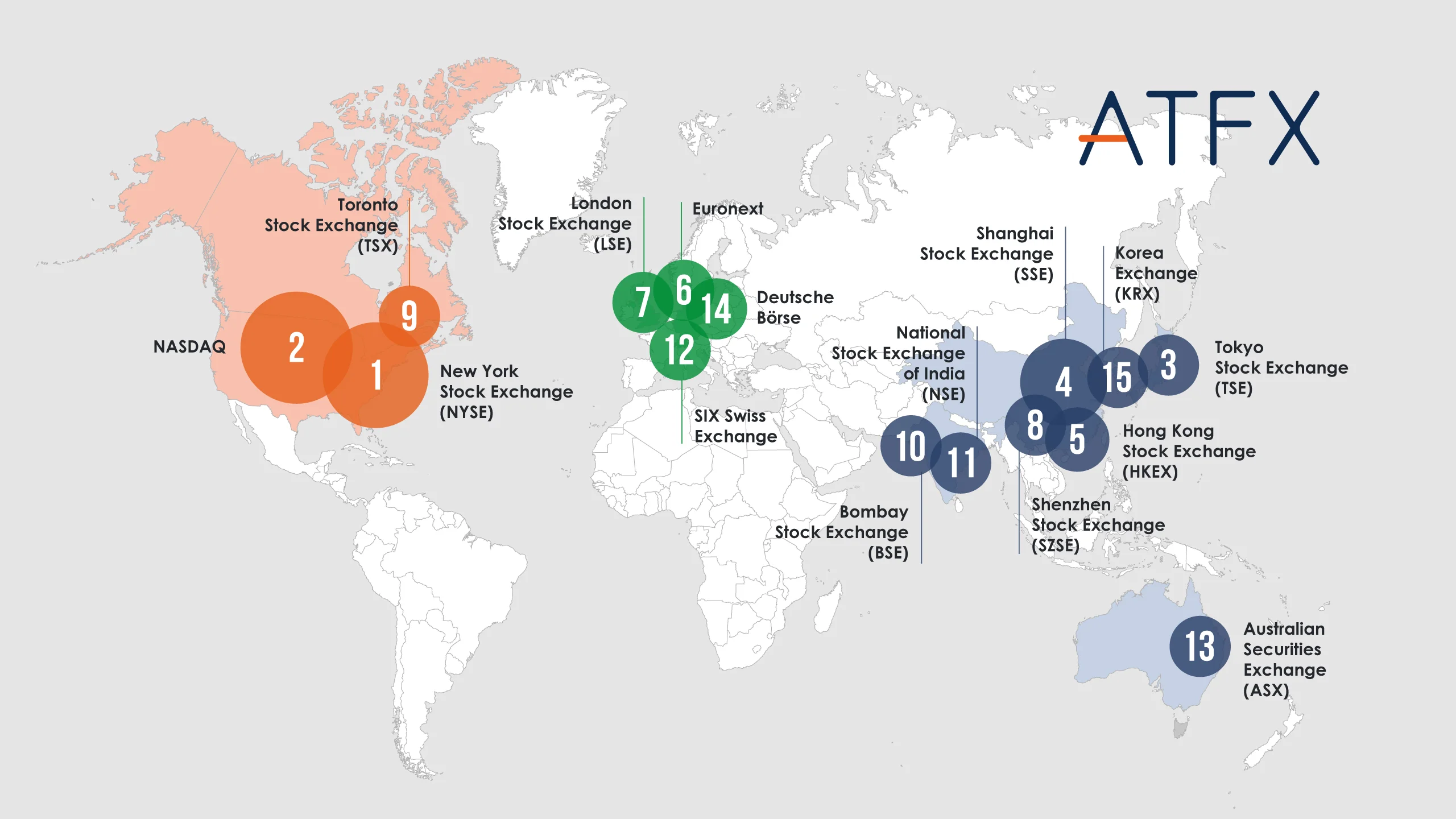

Wide market access is a feature of both CFDs and Futures, offering traders the opportunity to speculate on various markets from around the world. This includes not only commodities but also stocks, indices, currencies, and more.

Speculation and Hedging

Both instruments are used for speculation and hedging. Traders speculate on future price movements to generate profits, while investors and companies hedge against potential losses in their portfolios or business operations.

Example:

An airline might use Futures to hedge against rising fuel prices, while a currency trader uses CFDs to speculate on forex market fluctuations.

Risk

High risk and potential for significant returns or losses are inherent to both CFDs and Futures. Using leverage can lead to large gains or losses relative to the trader’s initial investment.

Regulatory Oversight

Regulatory oversight applies to both CFDs and Futures, though the specifics can vary by country and type of instrument. This oversight is intended to protect market participants and ensure fair trading practices.

CFDs vs Futures: 4 Pros and 3 Cons

Both CFDs (Contracts for Difference) and Futures offer unique benefits and drawbacks to traders and investors. Understanding these can help make informed decisions aligning with one’s trading objectives, risk tolerance, and market strategy.

4 Pros of CFDs

Flexibility in Trade Sizes: CFDs allow trading in smaller increments than Futures, making them accessible to retail investors.

No Expiry Date: Unlike Futures, CFDs do not have an expiry date, allowing long-term positions without needing to roll over contracts.

Access to Global Markets: CFDs provide exposure to a wide range of global markets, including stocks, forex, commodities, and indices, from a single platform.

Ability to Go Long or Short Easily: Traders can easily take long or short positions, enabling them to profit from both rising and falling markets.

3 Cons of CFDs

Overnight Financing Costs: Holding a CFD position open overnight incur financing charges, which can add up, especially for long-term positions.

Counterparty Risk: Since CFDs are traded over the counter, there’s a risk associated with the financial stability of the broker. Always check if the broker is regulated and holds a valid trading license to mitigate this risk. Consider ATFX as your reliable broker, known for its regulatory compliance and robust financial stability.

Lack of Ownership: CFD traders do not own the underlying asset, limiting certain benefits like the lack of voting rights for stock CFDs.

Example:

A retail trader uses CFDs to speculate on the price movement of Apple stock without having to purchase the shares outright. They can take a position representing a fraction of the cost of Apple shares, allowing for high leverage. However, if they hold the position for several months, the overnight financing costs could significantly reduce their profits.

4 Pros of Futures

Standardization: Futures contracts are standardised, simplifying trading and increasing liquidity.

No Overnight Financing Charges: Unlike CFDs, there are no overnight financing charges for holding Futures positions.

Hedging Opportunities: Futures are ideal for hedging against price movements in various markets, providing a way to manage risk effectively.

Regulatory Oversight: Futures are traded on regulated exchanges, offering greater transparency and reduced counterparty risk.

3 Cons of Futures

Potential for Significant Losses: Using leverage can lead to large losses, just as it can amplify profits.

Less Flexibility in Contract Sizes: The standardised nature of Futures contracts means they may not be as accessible to small investors.

Expiry Dates: Futures contracts have expiry dates, requiring traders to roll over their positions to maintain a market presence, which can be cumbersome and costly.

Example:

An agricultural producer uses Futures contracts to lock in a price for their corn harvest, protecting against a potential price drop. While this provides a guaranteed price, the producer must manage the contract until expiry or choose to roll it over, which involves additional decisions and potential costs.

Choosing Between CFDs and Futures

Consideration | CFDs | Futures |

Investment Goals | Suitable for short to medium-term speculative trades or hedging. Ideal for traders seeking flexibility and opportunities in both rising and falling markets. | More suited for longer-term speculation or hedging. Preferred by traders and institutions requiring transparent pricing and the ability to take larger positions. |

Risk Tolerance | High leverage amplifies both profits and losses, appealing to traders with a higher risk tolerance. | Provides leverage with the security of regulated exchanges, suitable for those with moderate risk tolerance. |

Market Knowledge | Requires understanding of OTC market dynamics and specific risks, including counterparty risk. | Demands knowledge of futures markets, contract settlements, rollovers, and the specifics of traded commodities or assets. |

Financial Capacity | Allows trading on margin with lower capital outlay due to flexible contract sizes. Accessible to individual retail traders. | Requires a larger capital commitment due to standardised contract sizes, making it more suitable for institutional investors or well-capitalized individuals. |

Example | Trader A is interested in tech stocks for short-term volatility trading and finds CFDs ideal for their flexibility and lower capital requirements. | Trader B manages a portfolio that includes agricultural commodities and uses Futures to hedge against price fluctuations in these markets, benefiting from transparent pricing and regulatory security. |

Fun Facts | Global daily trading volume for CFDs is in the billions, indicating popularity among retail traders. | Daily trading volumes on major futures exchanges like the CME are in the millions of contracts, highlighting liquidity and scale. |

Practice CFDs and Futures Trading through a Demo Account

If you’re not ready to trade live CFDs or Futures yet, we have a demo account with $50,000 in virtual funds, allowing you to practice your knowledge without financial risk.

For instance, a trader might execute a trade that, in reality, would result in a $500 loss. This setback is virtual in your demo trading account setting, offering a valuable lesson without monetary consequences. The ATFX demo trading platform’s design is identical to a live account, ensuring users become adept with its tools and features before transitioning to live trading.