A bear market is a period during which stock prices consistently decline, often by 20% or more. It is essential for investors to understand bear market dynamics and adopt suitable strategies to protect their portfolios and capitalize on potential opportunities.

This article provides strategies and tips for investing during a bear market, helping you navigate through these challenging times.

Table of content

- Understanding bear market fundamentals

- Key investment strategies for bear market

- Value investing and identifying opportunities

- Safe haven assets and alternative investments

- Risk management and capital preservation

- Maintaining a long-term perspective

- Conclusion

1. Understanding bear market fundamental

a. Causes of bear markets

The causes behind bear markets are varied. They can be brought on by economic downturns, geopolitical issues, changes in investor outlook, or financial crises. For instance, the bear market of 2008-2009 was mainly due to the global financial crisis, while the bear market caused by COVID-19 in the early part of 2020 was the result of a combination of economic recession and investor apprehension.

b. Common features of bear markets

During downward trending markets, shares generally experience a decline in value, trading activities may lessen, and the market’s instability tends to spike. Between 2000 and 2002, the S&P 500 index plunged by approximately 50%, mainly because of the dot-com bubble burst and the consequent decrease in investors’ confidence.

c. Duration and severity of bear markets

The duration and severity of bear markets can vary greatly depending on the underlying causes and market conditions. The bear market of 1987 experienced a 22.6% decrease in the Dow Jones Industrial Average on the fateful day of Black Monday, spanning across a brief period of three months. In comparison, the bear market spanning across the Great Depression lasted for a duration of approximately 34 months, witnessing a striking fall of almost 90% in the Dow Jones Industrial Average.

d. Psychological effects on investors

Investor sentiment often becomes increasingly pessimistic during bear markets, which can lead to fear-based selling and further declines in stock prices. After the occurrence of Black Monday, a significant sell-off by investors followed, exacerbating the market’s decline. This phenomenon was also observed during the financial crisis of 2008, where general apprehension and uncertainty fueled a selling cycle that depreciated stock prices and intensified the bear market’s gravity.

2. Key investment strategies for bear markets

a. Diversification

Diversification is crucial during a bear market, as it helps to mitigate risks and protect your investment portfolio.

Focus on diversifying across asset classes, geographies, and sectors to reduce the impact of a market downturn.

I. Asset allocation

Ensure that your portfolio includes a mix of stocks, bonds, cash, and alternative investments to spread risk and provide a cushion against market declines.

II. Geographic diversification

Invest in companies a nd assets from different regions to minimize the impact of localized economic downturns and market declines.

III. Sector diversification

Include exposure to various sectors, such as technology, healthcare, utilities, and consumer staples, to benefit from the varying performance of different industries during a bear market.

b. Defensive stocks

Defensive stocks have a tendency to perform better in economic downturns and are less reactive to market fluctuations.

It may be wise to invest in these stocks to minimize risk.

Characteristics of defensive stocks

Defensive stocks typically have stable revenues, strong balance sheets, and a history of paying dividends.

Examples of defensive sectors and industries

Utilities, healthcare, consumer staples, and telecommunications are examples of defensive sectors that tend to perform better during bear markets.

c. Dollar-cost averaging

Investing a fixed amount of money in a particular asset at regular intervals, regardless of the asset’s price is known as Dollar-cost averaging.

This strategy can help investors bypass potential market timing mistakes and reduce the effects of market volatility on their portfolios.

Definition and explanation

Dollar-cost averaging involves buying more shares when prices are low and fewer shares when prices are high, ultimately averaging out the cost of your investment.

Benefits and drawbacks

Dollar-cost averaging can help reduce the risk of investing a large amount of money at an inopportune time, but it may result in lower returns compared to lump-sum investing during a bull market.

d. Dividend investing

Dividends can provide a steady income during bear markets and help protect your portfolio from market declines.

Importance of dividends in bear markets

Dividends can provide an additional source of income, support stock prices, and mitigate losses during market downturns.

Dividend aristocrats and other high-quality dividend stocks

Dividend aristocrats are companies that have consistently increased their dividends for at least 25 consecutive years. These stocks tend to be stable and resilient during bear markets.

3. Value investing and identifying opportunities

a. Principles of value investing

Value investing, made famous by the renowned investor Warren Buffett, involves purchasing underestimated stocks that are trading below their intrinsic value with the idea that their market price will eventually increase. To exemplify, Buffett’s investment in American Express in the 1960s was anchored on his belief that the company was undervalued despite temporary setbacks. It ultimately became one of his most lucrative investments.

b. How to find undervalued stocks

Finding undervalued stocks involves researching and analyzing companies to identify those trading below their intrinsic value, offering the potential for price appreciation as the market eventually recognizes their worth. Apple Inc., for instance, was considered undervalued during the early 2000s, as investors overlooked its potential for growth and innovation. Investors who recognized Apple’s true value and invested at that time have since reaped substantial rewards.

c. Evaluating financial statements and ratios

To recognize stocks that are undervalued, examine the financial statements of businesses and compute crucial financial metrics, such as the P/E ratio, P/B ratio, and dividend yield. In an instance from 2008, JPMorgan Chase took over Bear Stearns at a P/B ratio of less than 1, signifying that the bought firm’s assets held a higher value than its market worth – a quintessential case of an undervalued stock.

d. The role of patience and discipline

Value investing requires patience and discipline, as it may take time for the market to recognize a stock’s true value and for its price to increase. A well-known example is Netflix, which faced skepticism from investors during its early years. Those who remained patient and held onto their shares have experienced remarkable returns as the company’s stock price has risen significantly over time, reflecting its true value.

4. Safe haven assets and alternative investments

a. Bonds and fixed-income investments

Investments in fixed-income securities and bonds can provide investors with a consistent income source and minimize their portfolio’s overall risk during bear markets. For instance, throughout the 2008 financial crisis, U.S. Treasury bonds were a secure haven for investors, with the 10-year Treasury yield dropping from 4.03% in January 2008 to 2.24% by December 2008.

b. Gold and other precious metals

The tendency of precious metals like gold to appreciate in value amidst economic instability and market turbulence typically makes them viewed as safe-haven assets. For example, during the financial crisis of 2008, gold prices went up from approximately $869 per ounce in January 2008 to over $1,100 per ounce in December 2009, leading to shielding against drops in stock markets.

c. Cash and cash equivalents

Maintaining an amount of your investment portfolio in easily convertible assets, such as cash or equivalents, can grant you the opportunities to make use of various market investments when it is at a low point. A prominent example of this tactic is billionaire investor Warren Buffett, who was able to invest in underpriced assets and companies during the 2008 financial crash with the nearly $25 billion he had in cash reserves.

d. Cryptocurrencies and other alternative investments

Cryptocurrencies and other non-traditional investment vehicles have the potential to provide diversification and returns in a bear market, but they come with significant volatility and risks. During the market downturn brought on by the COVID-19 pandemic in 2020, Bitcoin initially experienced a steep decrease, but it eventually bounced back and eventually reached new all-time highs in the months that followed. Even though some people benefited from this unpredictability, others experienced substantial losses because the cryptocurrency markets are inherently difficult to predict.

5. Risk management and capital preservation

a. Importance of risk management during a bear market

Proactively managing risk is critical during a bear market to preserve capital and prevent substantial losses.

b. Stop-loss orders and other risk management tools

Utilize stop-loss orders, trailing stops, and position sizing to protect your investments and limit potential losses.

c. Rebalancing and adjusting your portfolio

Regularly review and rebalance your portfolio to ensure it aligns with your risk tolerance and investment objectives during a bear market.

d. The importance of an emergency fund

Maintaining a contingency fund may aid in sidestepping the necessity to liquidate investments at a deficit to cover unforeseen expenses in a bearish market

6. Maintaining a long-term perspective

a. Historical perspective on bear markets and recoveries

Bear markets are a natural part of market cycles, and history has shown that they are typically followed by bull markets and periods of economic growth.

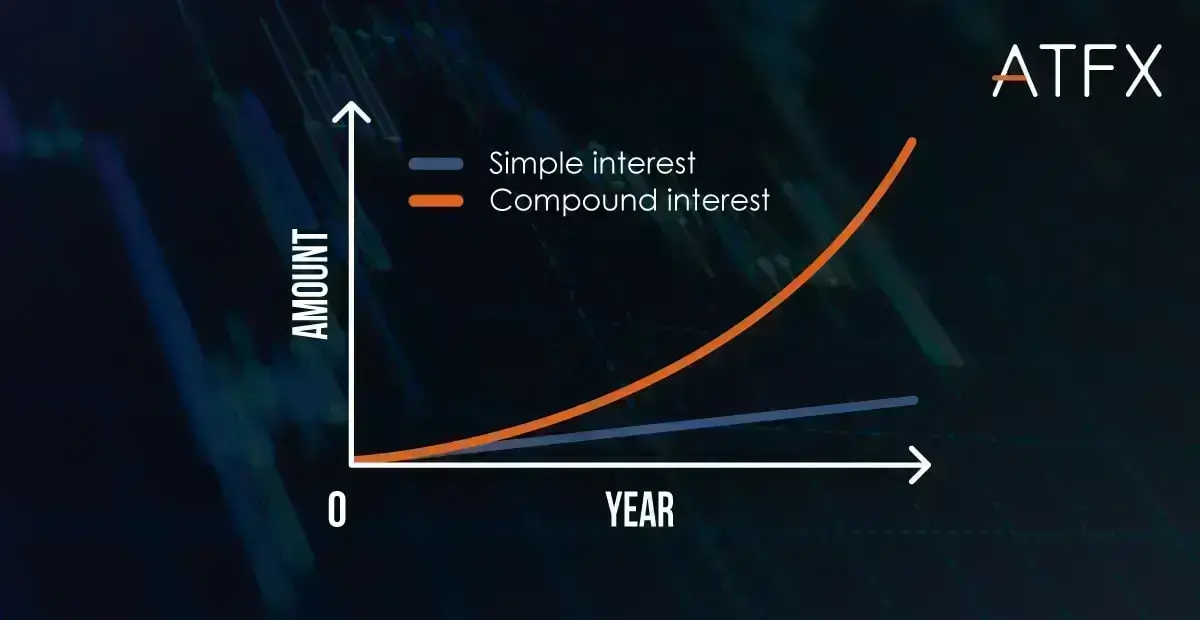

b. The power of compound interest

By maintaining a long-term perspective and continuing to invest during a bear market, you can take advantage of the power of compound interest to grow your wealth over time.

c. Staying informed and adaptable

Stay up to date with market developments and be prepared to adjust your investment strategy as conditions change.

d. The importance of remaining emotionally detached

Resist the urge to make impulsive decisions based on fear or greed during a bear market. Instead, maintain a disciplined approach and focus on your long-term investment goals.

Conclusion

Navigating a declining market can prove to be a difficult task. However, by implementing appropriate measures and maintaining a long-term approach, one can safeguard their investment portfolio and reap benefits from investment prospects. Stay committed, knowledgeable, and stay focused on objectives to be well-prepared to tackle the challenge and emerge even stronger when the market improves.