Table of contents:

- What are ETFs?

- Four Major Types of ETFs to Buy & Examples

- How to Start Investing and do ETF trading?

- How To Make Money With ETFs

- Pros & Cons of Buying ETFs With CFDs

- Start Trading ETF CFDs with ATFX Live Account

What are ETFs?

Exchange-traded funds (ETFs) offer the diversification benefits of mutual funds and the trading flexibility of individual stocks, enabling their prices to vary in real-time. The high liquidity and responsiveness to market movements allow ETFs to be traded throughout the day. This makes them an attractive option for investors looking to implement dynamic strategies, especially during market volatility, unlike mutual funds, which are priced at the end of the trading day.

Traders have the option to trade ETFs through Contracts For Difference (CFDs). Unlike traditional ETF investments, trading ETF CFDs does not require owning the actual ETF. When traders take a position, they gain exposure to the price movements of the underlying ETF. A significant advantage of CFD trading is the leverage it offers, enabling traders to control larger positions with a smaller amount of capital. This has the ability to increase earnings while also amplifying losses. ATFX provides the option to trade ETFs using CFDs.

Four Major Types of ETFs to Buy & Examples

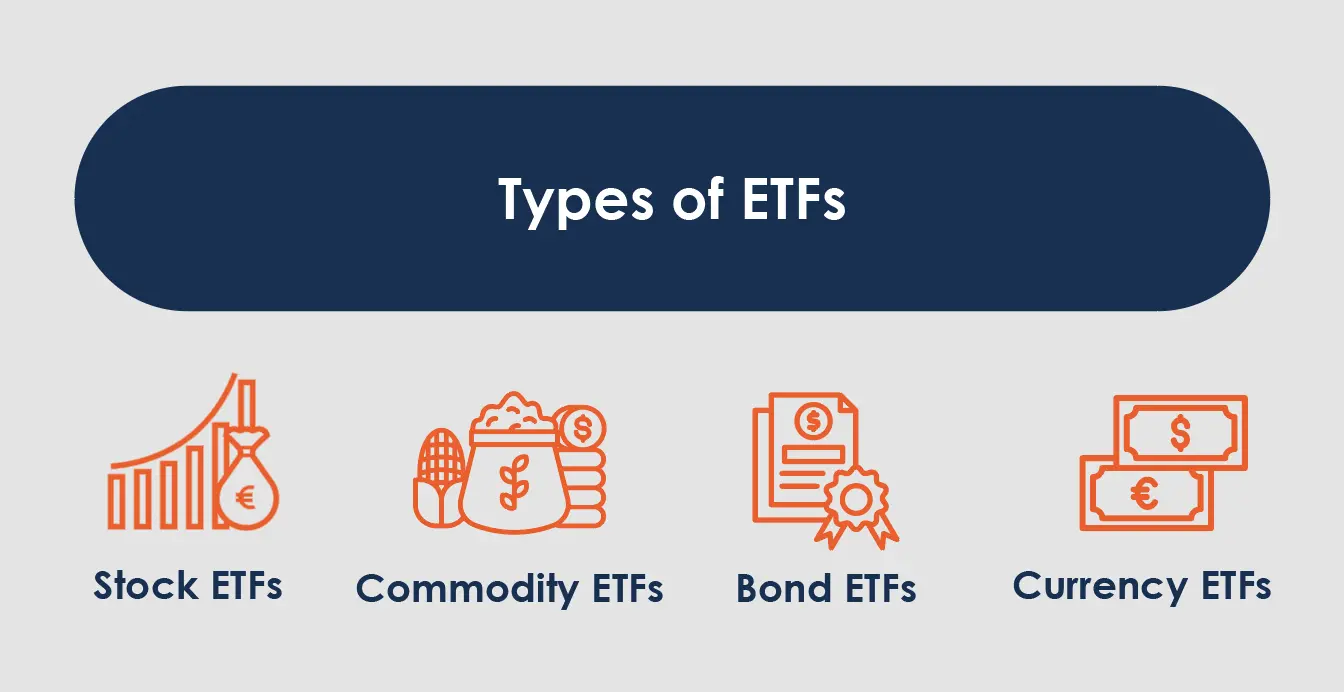

Before learning how to purchase ETFs, traders should acquaint themselves with the different types of ETFs available. These funds offer a range of options tailored to various investment strategies. It’s crucial to understand how each ETF works before starting to buy ETFs.

Stock ETFs to Buy

Stock ETFs are among the most frequently traded ETFs. They track the performance of major stock indices, like the S&P 500, and specialised indices representing specific sectors or themes. Some stock ETFs focus solely on the technology sector, while others may focus solely on environmental, social, and governance( ESG) criteria. Traders can quickly gain exposure to broad or specialised market segments with one transaction. Beginners looking to invest ETFs should start with those that track major indices, which are generally safer and easier to manage.

The table below shows the popular stock ETFs in the market:

Instruments | Name |

#ETF-SPY | SPRD S&P 500 Index ETF |

#ETF-IWM | iShares Russell 2000 ETF |

#ETF-IYY | iShare Dow Jones U.S. ETF |

#ETF-DIA | SDRP Dow Jones Industrial Average ETF |

Advantages & Disadvantages of Stock ETFs:

Advantages | Disadvantages |

|

|

Commodity ETFs to Buy

Commodity ETFs provide convenient access to the global commodities market, aiding in portfolio diversification and serving as a hedge against inflation. Unlike direct investment in physical commodities, which involves storage challenges and risks of spoilage, commodity ETFs simplify the investment process. When exploring commodity ETFs, assessing their performance and stability is important, especially if you’re planning to invest ETFs in volatile markets like oil or precious metals.

The table below shows examples of commodity ETFs:

Instruments | Name |

#ETF-USO | United States Oil Fund ETF |

#ETF-GDX | VanEck Vectors Gold Miners ETF |

#ETF-GLD | SPDR Gold Trust ETF |

Advantages & Disadvantages of Commodity ETFs:

Advantages | Disadvantages |

|

|

Bond ETFs to Buy

For investors seeking stability and steady returns, explore bond ETFs as they allow you to invest ETFs in a diversified pool of government and corporate bonds. Bond ETFs offer traders a way to invest in fixed-income securities without buying individual bonds. These ETFs can cover U.S. Treasuries and corporate and municipal bonds are among the different debt types. Each type of bond ETF has its own risk and return characteristics influenced by variables like credit reliability, duration, and interest rate sensitivity. Therefore, bond ETFs are a versatile tool for traders looking to make money and adjust their exposures based on risk tolerance and industry outlook.

For example, the iShare Core U.S. Aggregate Bond ETF is the latest bond ETF, with over $100 billion in assets, as of 2024.

Advantages & Disadvantages of Bond ETFs:

Advantages | Disadvantages |

|

|

Currency ETFs to Buy

For traders who are interested in forex markets, explore currency ETFs, which enable you to invest ETFs in foreign currencies without the complexity of direct forex trading. Currency ETFs are specialised exchange-traded funds that provide traders with exposure to global currency markets, bypassing the complexities of traditional forex trading. These ETFs track currency pairs, baskets of currencies, and individual currencies. Investors use them for various purposes, such as hedging against currency risks in international investments, speculating on forex movements, and diversifying global portfolios.

For instance, currency ETFs include the Invesco DB US Dollar Index Bullish Fund, Invesco CurrencyShares Euro Trust, and Invesco CurrencyShares Japanese Yen Trust.

Familiarising yourself with the various types of ETFs and specific examples will enhance your understanding of ETFs and the nuances of ETF trading.

Advantages & Disadvantages of Currency ETFs:

Advantages | Disadvantages |

|

|

How to Start Investing and do ETF trading?

Trading Exchange-Traded Funds (ETFs) necessitate precise planning and knowledge of the trading environment. Here is a complete guide on trading ETFs effectively.

Step 1: Understand Your Investment Goals

Before traders start trading Exchange-Traded Funds (ETFs), they need to understand both the mechanics of ETF trading and their own investment goals. These factors will shape their trading strategy and guide their selection of ETFs. It’s important to consider your investment horizon, risk tolerance, and financial objectives. Are you seeking quick returns through short-term trading, or do you prefer a medium-term approach? How comfortable are you with volatility for possibly higher returns, or do you want solid, prudent growth? Identifying your goals early on makes adjusting your trading strategy to your individual requirements easy.

Step 2: Research & Analyze ETFs

To identify the most suitable ETFs for your investment objectives, thorough research and analysis are essential due to the vast array of options available globally. It’s important to understand the various types of ETFs, whether they are sector ETFs targeting specific industries like technology or healthcare or global ETFs providing exposure to international markets. These categories include equity ETFs that invest in stocks, bond ETFs offering fixed income, and commodity ETFs tracking the performance of commodities such as gold. Key factors to consider are the expense ratio, which indicates the annual fee (generally, lower is better), tracking error, which measures how closely the ETF follows its benchmark index, and liquidity, where higher trading volumes typically result in narrower bid-ask spreads.

Step 3: Choose a way to trade ETFs CFD

ETFs can be traded through various methods, such as contracts for difference (CFDs), options, and futures. Each method comes with its own unique features and risks, so traders should choose based on their investment goals, market outlook, and risk tolerance.

Step 4: Understand Key ETF Trading Strategies

Adopting effective trading strategies is vital to understanding how to invest in ETFs. Advanced traders often buy ETFs using sophisticated strategies like swing trading, day trading, and other trading strategies to maximize their returns.

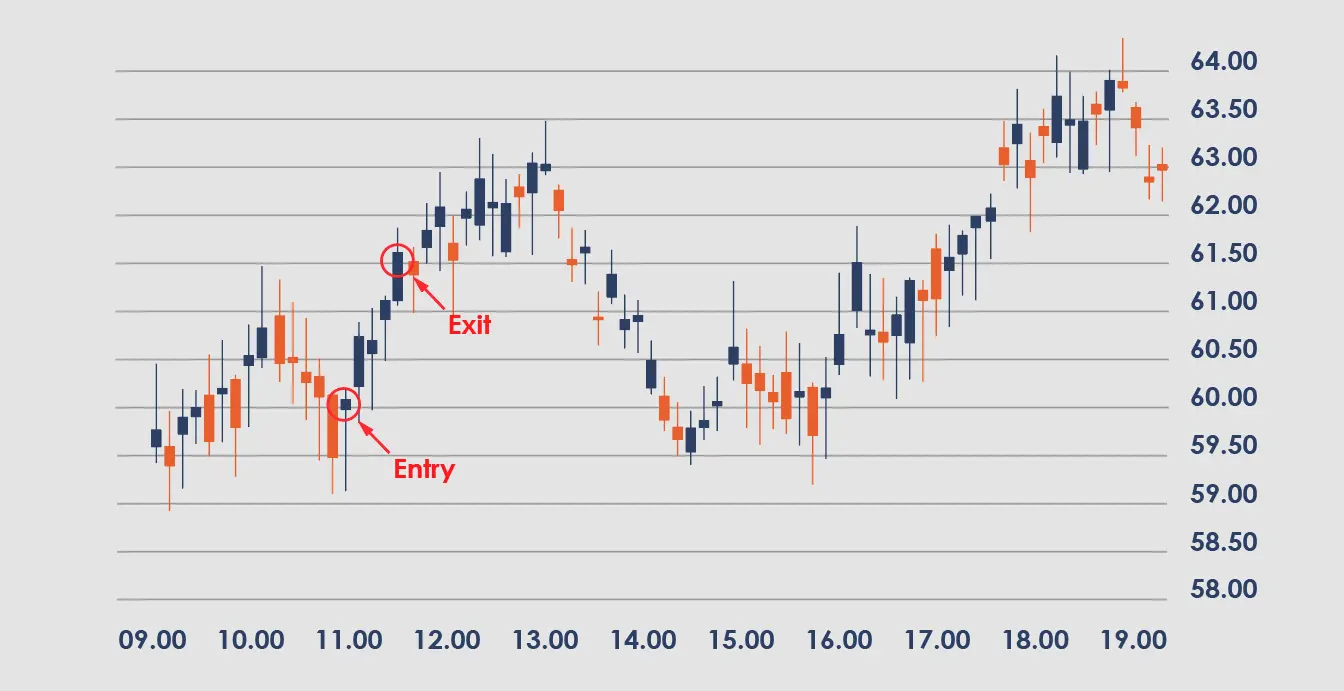

Day Trading

Day trading involves buying and selling ETFs within the same trading day to profit from intraday price movements. This strategy requires a high level of discipline and understanding of market trends.

Find out more about day trading strategies for beginners

Swing Trading

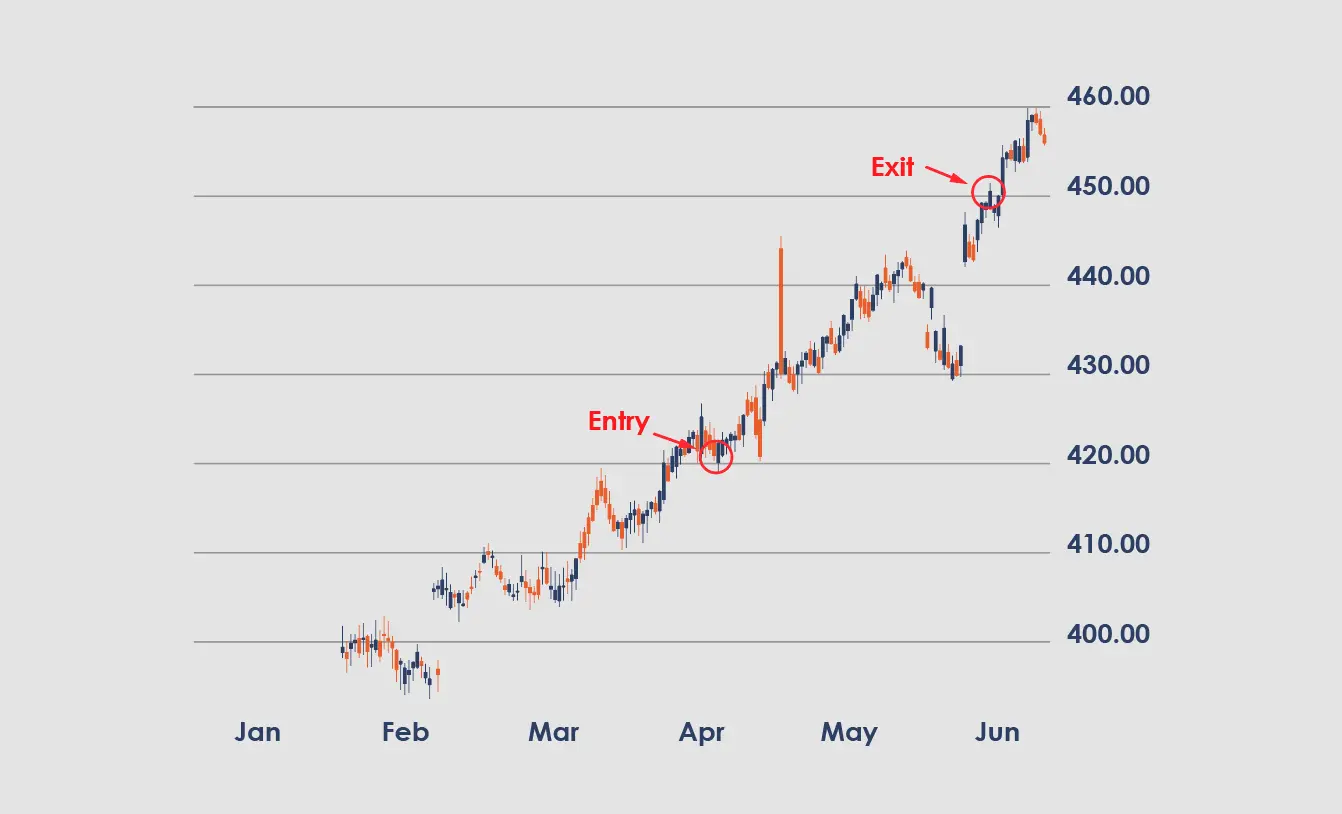

Swing trading involves holding positions for several days to weeks to capture medium-term price movements. Traders often use technical analysis to identify potential entry and exit points.

Trend Trading

Traders use moving averages, trendlines, and technical indicators to identify the trend direction and execute trades. Traders use this strategy to follow and profit from established market trends, whether upward (bullish) or downward (bearish).

Step 5: Choose a Broker

Choosing the right broker is essential for effectively executing your ETF trading strategies. When starting your ETF trading journey, seek out brokers known for their competitive spreads, zero commission fees, and strong reputation, like ATFX. ATFX provides a broad selection of products and offers competitive spreads for CFD trading.

In your journey to learn how to trade ETFs, practice how to buy ETFs in a demo trading account to build confidence and test strategies without financial risk. Create a demo account now with ATFX to learn how to trade ETFs today!

Step 6: Monitor & Adjust

After you buy ETFs, and once your ETF portfolio is established, it’s essential to monitor and adjust it to ensure it continues to meet your objectives. Regularly review your portfolio to evaluate ETF performance against benchmarks and maintain diversification. Adjust your holdings as needed to maintain the desired asset allocation, and stay informed about market developments and news that could impact the value of your investments.

How To Make Money With ETFs

Dividend Earning: Many ETFs pay dividends from the underlying stocks they hold. Therefore, investing in these ETFs allows you to generate passive income and make money. Further, the dividend payout earned from the ETFs can be reinvested to purchase additional shares, compounding growth over time.

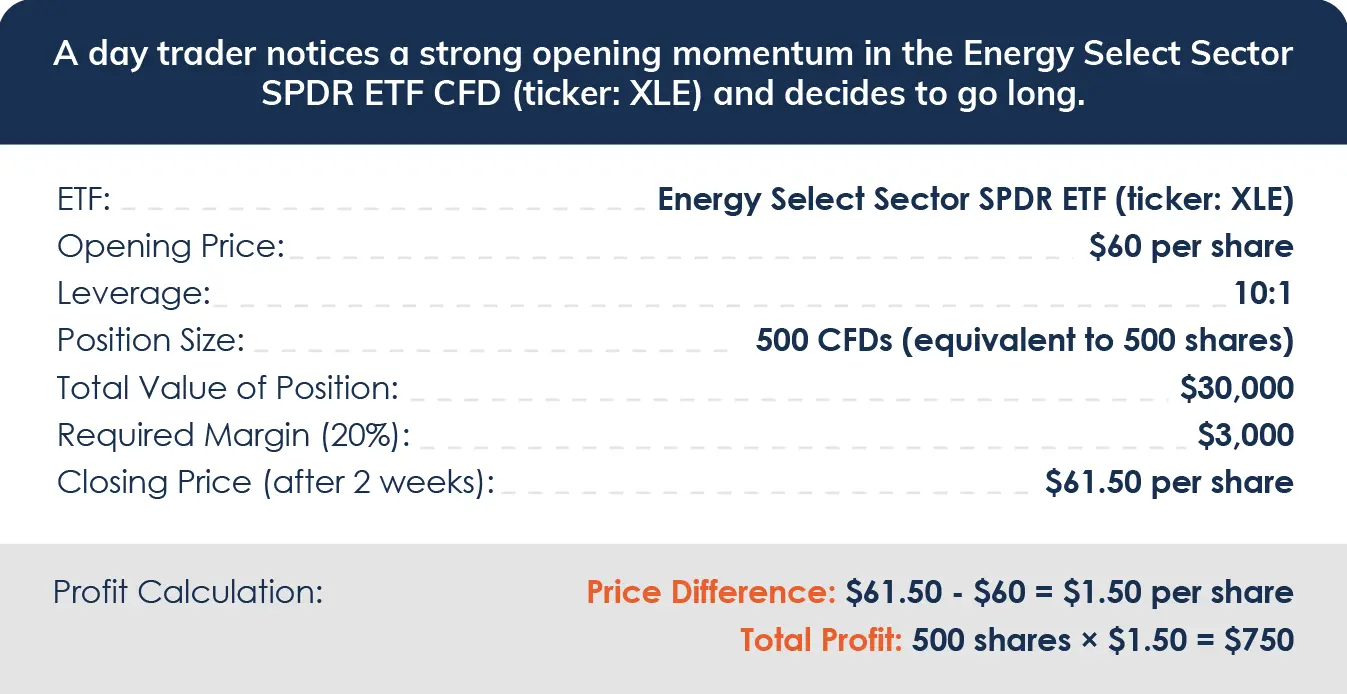

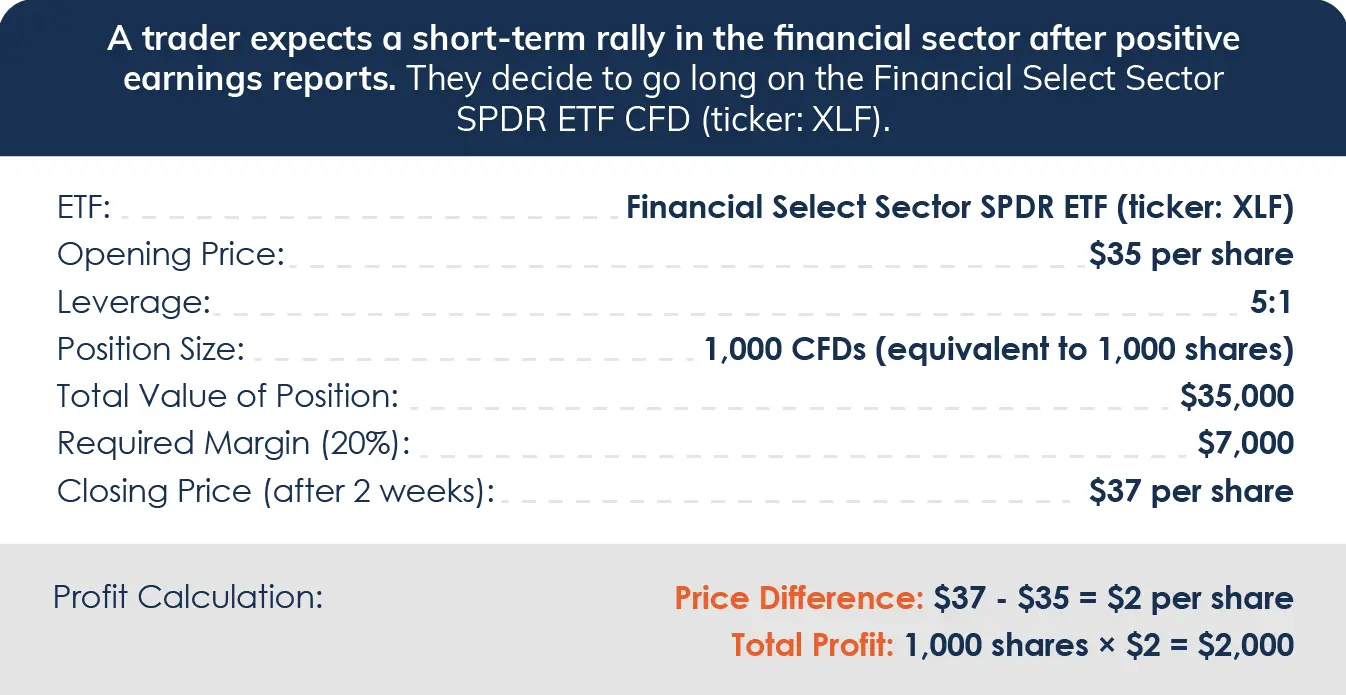

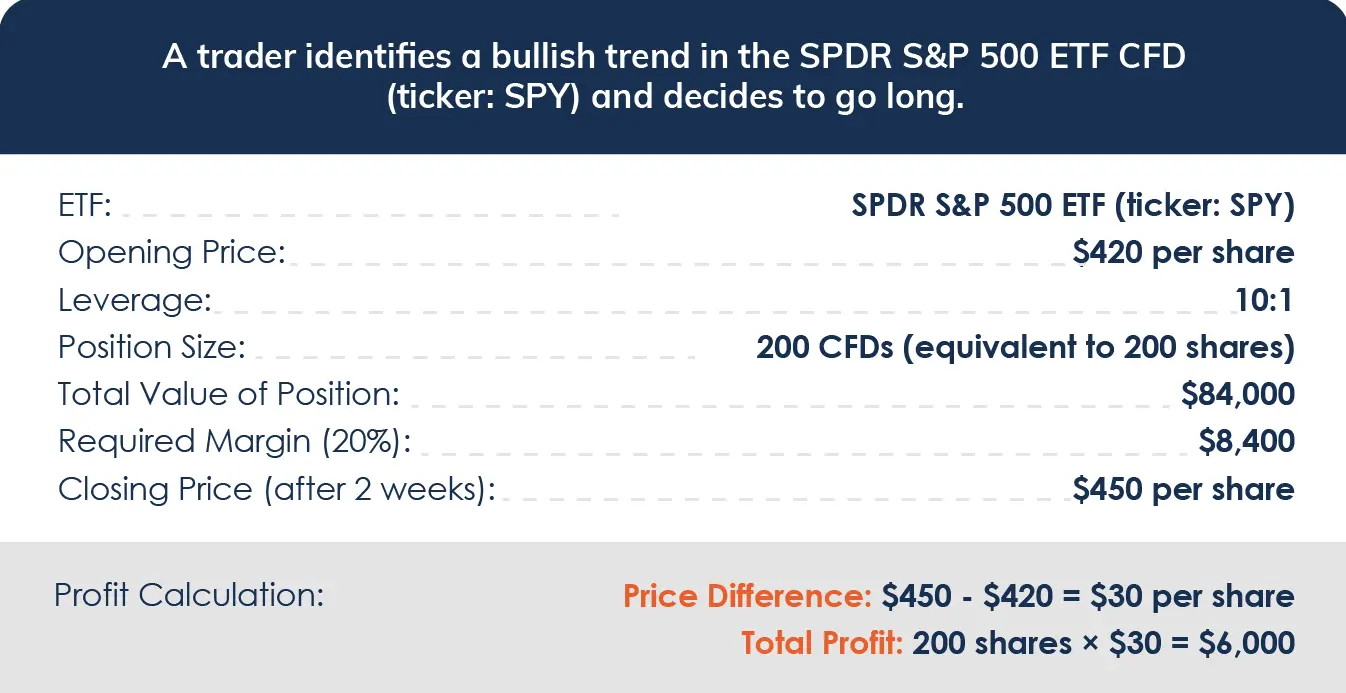

Contract For Difference (CFDs): Another way to generate income with ETFs is CFDs. Trading ETF with CFDs allow traders to profit from price movement without owning the underlying assets. This allows traders to generate income by trading long or short positions. In addition, CFDs allow you to trade ETFs on margin, potentially amplifying returns even with a small starting capital.

Ultimately, a well-researched approach and careful risk management can help you get the most out of ETF investing.

Pros & Cons of Buying ETFs With CFDs

Knowing how to trade ETFs and how to make money with ETFs, traders should also understand the pros and cons of investing in ETFs with CFDs.

Pros: ETF CFDs enable traders to invest in ETFs’ price movements without holding the underlying assets. Leverage, which enables traders to hold more positions with small capital, is one of its most significant benefits. This feature can potentially increase profits, particularly when day trading or swing trading. ETF CFDs also enable traders to gain from both rising and falling markets. CFDs give traders access to world markets and a wide range of sector-specific ETFs, giving them more opportunities to trade in various styles.

Cons: Using leverage to buy ETFs has the potential to be profitable, it also magnifies losses, which can exceed the initial investment if not handled effectively. Due to the leveraged nature of CFD trading, traders are also susceptible to overnight charges, which may build over time, particularly for long-term positions.

Furthermore, trading ETF CFDs requires a solid understanding of risk management, as volatility may cause unexpected and significant price shifts. Before trading ETFs with CFDs, traders must be aware of these risks and employ a disciplined trading approach to properly reduce potential drawbacks.

Start Trading ETF CFDs with ATFX Live Account

Using a demo account is a great way to test your newly acquired knowledge and skills. However, when you’re ready to apply your strategies and trade ETF CFDs in the real market, consider opening a Live Trading Account with ATFX.

In addition to ETFs, ATFX provides various instruments such as forex, index, commodity, cryptocurrency, and shares as a solid trading platform. This enables you to practice diverse strategies while benefiting from the educational guides and free training materials ATFX offers. Sign up for your demo trading account now with zero cost!