Table of contents:

- List of Commodities are Traded

- What is Commodity Trading?

- Top 10 Traded Commodities in the World

- How to Trade Commodities

- What are the Benefits of Commodity Trading?

- How to Become a Commodity Trader?

List of Commodities are Traded

- Energy Commodities:

– Crude oil (USOIL.MMMYY & UKOIL.MMMYY)

– Natural gas (NGAS.MMMYY)

Precious Metals:

– Gold (GOLD_MMMYY & XAUUSD)

– Silver (XAGUSD)

Agricultural Commodities:

– Corn

– Wheat

– Coffee

– Soybeans

– Cotton

Base Metals:

– Copper

What is Commodity Trading?

A commodity is a raw material traded on markets and used to manufacture other products, as seen in the above list of commodities. For example, wheat is one of the world’s top traded commodities, but it needs to be processed before it can be consumed or sold. Sellers of goods such as crude oil, regardless of brand, must follow the same quality criteria to assure fairness.

Essentially, commodities trading involves purchasing and vending these unprocessed materials. It occasionally entails the actual exchange of things. However, futures contracts—in which you commit to buying or selling a commodity at a specific price on a given date—are the most common way that it occurs. These resources create industries, propel economies, and offer merchants countless options.

Now, you might be wondering what factors affect the commodities’ price ? The prices will fluctuate depending on the supply and demand of commodities, weather, geopolitics and economic conditions. For example, severe weather can lower agricultural yields and raise the price of commodities like wheat and corn. In another instance, if unrest breaks out in an area that produces oil, the price of that commodity may rise and affect the global markets. Let’s dive into the world’s most traded commodities.

Top 10 Traded Commodities in the World

Crude Oil (USOIL.MMMYY & UKOIL.MMMYY)

Crude oil is a raw material used for transportation fuels, heating oils, lubricants, and more. It is also known as “black gold,” which places it at the forefront of commodity trading, fueling industries, transportation, and global economies. Over the past three years, crude oil trading volume has consistently soared as one of the most traded commodities in the world. In 2023, the world consumed around 101 million barrels of oil daily, and robust global oil production is expected to continue in 2024. After acquiring Pioneer Natural Resources, ExxonMobil plans to invest heavily in its new Permian Basin oil field assets in 2024. This will significantly boost production and reinforce the company’s commitment to oil trading while strengthening its market position. Simultaneously, Chevron continues investing in the Tengiz field in Kazakhstan to sustain consistent production amid global fluctuations.

Oil trading strategies: The strategies of oil trading look at supply-demand dynamics, geopolitical concerns, and technical indicators to profit from price movements. Traders monitor changes in the world’s oil production and consumption patterns, as well as economic factors that impact the demand for oil and geopolitical upheaval in major oil-producing regions. They also employ technical analysis techniques to determine trends, support and resistance levels, and trade entry and exit points. To navigate the intricacies of the oil market and capitalise on trading opportunities, one must be well-versed in technical and fundamental components and risk management strategies. See WTI Crude Oil Price Live Chart .

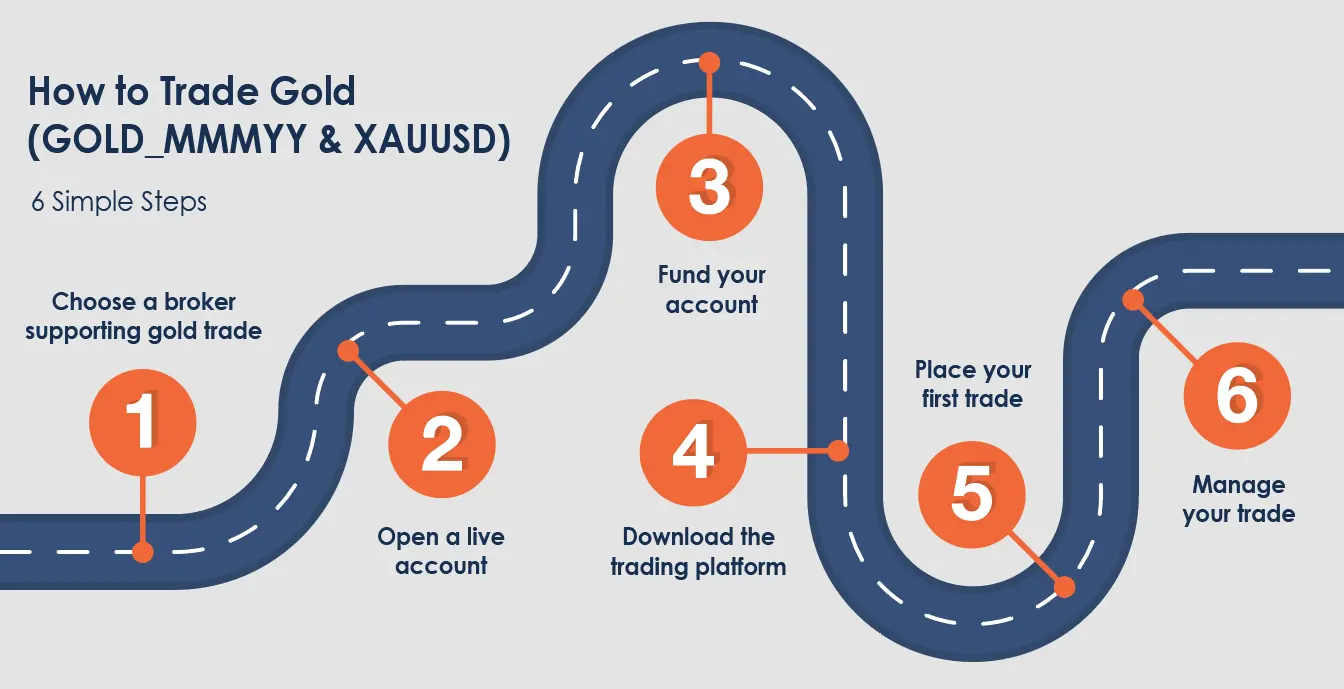

Gold (GOLD_MMMYY & XAUUSD )

As a buffer against inflation and geopolitical unrest, gold is still a sought-after safe haven asset in an uncertain economic environment. In 2023, global gold demand was around 4,448 metric tons, a 5% decrease compared to 2022, while supply reached a record 4,899 metric tons. Investment in gold bars and coins dropped slightly, but the gold price still closed at a record $2,078.4 per ounce. Looking ahead to 2024, central banks continue to buy gold rapidly, and geopolitical issues could push demand even higher. As of April 2024, the gold price had reached an all-time high of $2,431.55 per ounce.

Gold trading strategies: A range of strategies designed to manage the gold price swings caused by variables including inflation, geopolitical unrest, and economic uncertainty. Traders frequently use trend-following strategies, examining past price data to spot patterns and seize momentum. Furthermore, buying gold as a safe haven is expected, with investors looking to hoard the metal during periods of unstable markets. Entry and exit points are determined by using technical indicators like moving averages and MACD, and potential losses are reduced by using risk management strategies like stop-loss orders. Successful gold trading necessitates a thorough grasp of market forces and strict risk management to take advantage of trading opportunities. See today’s Gold Price Chart .

Silver (XAGUSD)

Silver’s trading volume has increased over the last few years due to its many industrial uses and reputation as a store of wealth. Because of its special qualities, it is essential to electronics, solar panels, and medical equipment. Prominent investors and traders, like mining firms Pan American Silver and Fresnillo, have profited from silver’s trading potential.

Silver trading strategies: Diverse trading strategies that draw on a careful examination of several variables to manage price swings. Because shifts in industrial activity directly influence silver prices, traders evaluate the industrial demand for silver across industries, including electronics, solar panels, and medical equipment. Furthermore, macroeconomic factors like interest rates, inflation, and currency fluctuations significantly impact how traders approach silver. Traders also take market psychology and investor emotion into account. They use sentiment indicators and market sentiment research to predict price movements and assess investor attitudes. Through integrating these studies, traders may formulate well-informed trading strategies aimed at optimising trading opportunities and capitalising on the price dynamics of silver.

Natural Gas (NGAS.MMMYY)

Natural gas, a cleaner alternative to traditional fossil fuels, has experienced substantial growth in trading volume amidst increasing global demand. As one of the top traded commodities, its role in electricity generation, heating, and industrial processes underscores its importance. Notable participants in natural gas trading include energy companies like Gazprom and ExxonMobil, which navigate the market with strategic long-term investments and short-term trading positions.

Natural gas trading strategies: To make wise trading decisions, natural gas trading techniques depend on a thorough grasp of supply-demand dynamics, weather predictions, and storage levels. To determine how well supply and demand are balanced, traders carefully monitor variables, including inventories, consumption trends, and output levels. Because harsh weather can affect natural gas use for heating and power production, weather forecasts are essential. Storage levels also shed light on market expectations for supply and inventory levels. By examining these variables, traders may create profitable trading plans to profit from changes in natural gas prices and market openings.

Copper

Copper is a crucial industrial metal used in manufacturing, electronics, and building. With millions of metric tons traded yearly, its trading volume demonstrates its significance in infrastructure development and international trade. Significant users of copper include the automotive, electronics, and construction sectors, while major producers include China, Chile, and Peru. In early May 2024, copper was trading at around $9,818.50 per ton on the London Metal Exchange (LME), marking a 15% increase since the start of the year.

Copper trading strategies: Supply interruptions, global demand patterns, and macroeconomic indicators are the few techniques to be examined. Traders carefully monitor labour conflicts and shifts in production levels in copper-producing countries that might impact supply. They also examine infrastructure investment and worldwide economic patterns to predict copper pricing changes. Potential entry and exit points are also found using technical analysis tools like moving averages and chart patterns. Effective risk management techniques and a thorough grasp of market fundamentals are essential for successful copper trading.

Other Popular Commodities

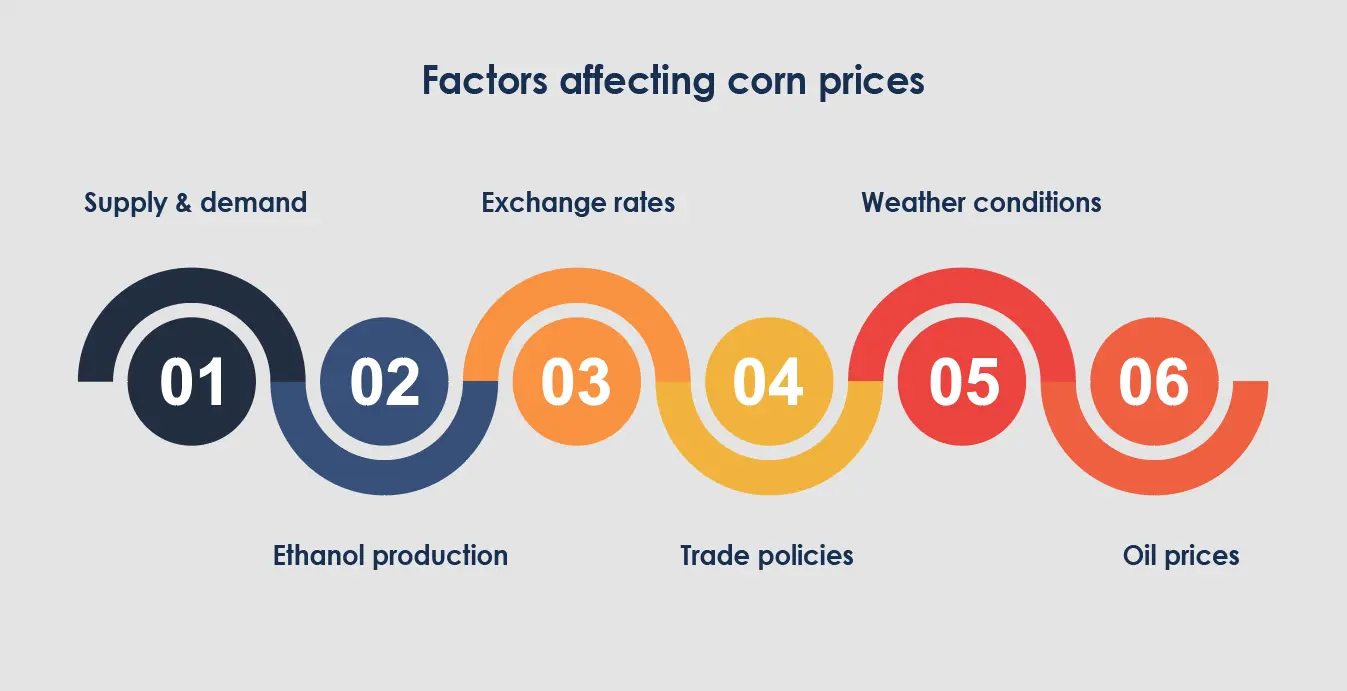

Corn

Corn is a staple grain used extensively in industry and commodity trading. 2024 will be challenging for the global maize market due to falling prices, disruptions caused by weather in Brazil, and logistical issues in Ukraine. The US expects to produce more than 15 billion bushels, while Brazil’s crop drops to 129 million tons. The market dynamics are influenced by the demand from China and Argentina’s growing exports.

Corn trading strategies: The core of corn trading techniques is factor analysis, which focuses on taking advantage of market opportunities and price changes. Since unfavourable weather events like droughts or floods may greatly influence crop yields and maize prices, traders carefully monitor weather trends. Furthermore, traders use crop statistics from industry associations and government agencies to evaluate the condition of corn crops and predict supply changes. Comprehending supply and demand dynamics is also essential; traders use indicators like ethanol production, the need for cattle feed, and export patterns to estimate the total need for corn. By integrating these studies, traders may design efficacious trading strategies to adeptly negotiate the maize market’s intricacies and profit from price variations.

Wheat

Another important staple grain, wheat, is crucial to international trade and food security. Over the years, demand from the food and industrial sectors has kept its trade volume strong. Companies that deal with wheat on a regular basis, including Cargill and Archer Daniels Midland (ADM), use futures contracts to control price risk.

Wheat trading strategies: To maximise market possibilities and make well-informed trading decisions, wheat trading methods entail thoroughly examining several variables. Traders keep a careful eye on patterns in worldwide output to gauge supply and predict shifts in the availability of wheat. Weather patterns also matter greatly since unfavourable weather may affect crop yields and wheat prices. Examples of these include droughts and heavy rains. Additionally, traders monitor geopolitical developments that can interfere with wheat production or trading routes, changing supply and demand dynamics. By combining these insights into their trading techniques, traders may navigate the wheat market and profit from price swings.

These assets shape economies and provide profitable opportunities for traders. By grasping their importance and using innovative trading tactics, traders can confidently navigate the markets and seize various opportunities for success.

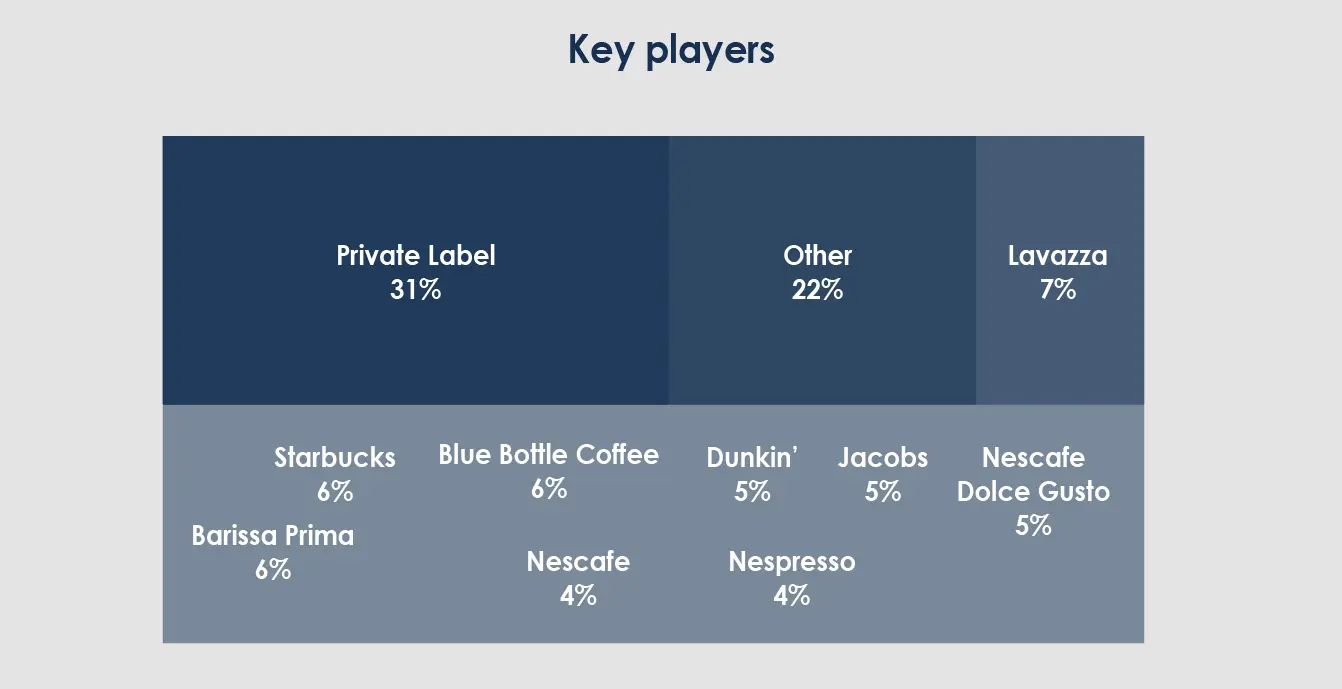

Coffee

Coffee is a popular beverage worldwide and a vital commodity in international trade. Millions of bags are traded yearly, a testament to its popularity and broad usage. Notable commodities market examples of coffee merchants include international corporations like Nestlé and Starbucks and significant coffee growers like Brazil, Vietnam, and Colombia.

Coffee Trading Strategies: To profit from price fluctuations, coffee traders employ tactics that entail analysing several elements, including global demand trends, weather patterns, and crop reports. Traders keep a tight eye on weather changes that might impact crop output in coffee-producing countries. They also examine consumption patterns and demand-supply dynamics to predict coffee pricing changes. Technical analysis tools like momentum indicators and chart patterns are also employed to find possible entry and exit positions. A thorough grasp of technical and fundamental aspects and efficient risk management techniques is necessary for successful coffee trading.

Soybeans

Soybeans are versatile commodities used to produce food, animal feed, and biofuels. The global trade in soybeans has grown significantly, ranking them among the top traded commodities due to the increasing need for meals high in protein and renewable energy sources worldwide. ADM and Cargill are two major competitors in the soybean industry, which agricultural firms dominate.

Soybean trading strategies: Making intelligent trading decisions in the soybean market requires examining crop statistics, weather forecasts, and supply-demand dynamics. To evaluate soybean supply levels, traders carefully monitor variables, including planting progress, weather, and crop yields. Additionally, they examine trade rules and patterns in worldwide demand to predict changes in soybean prices. It is also possible to determine possible entry and exit positions using technical analysis tools like trendlines and moving averages. An in-depth knowledge of market fundamentals and efficient risk management techniques are essential for profitable soybean trading.

Cotton

Cotton is an extensively traded commodity used to make textiles, apparel, and home furnishings. With millions of bales exchanged yearly, its trading volume shows its significance in the world’s textile manufacturing industry. Influential cotton buyers include textile manufacturers and clothing industries, whereas major producers are nations like the United States, India, and China.

Cotton Trading Strategies: Techniques examine variables such as global production patterns, meteorological conditions, and customer demand. Traders carefully monitor weather trends in cotton-growing countries for any changes that might impact crop production. They also examine trade policy and supply-demand dynamics to predict changes in cotton prices. Potential entry and exit possibilities are also found using technical analysis tools like momentum indicators and chart patterns. Effective risk management techniques and a solid grasp of market fundamentals are essential for successful cotton trading.

How to Trade Commodities

Many different approaches are available in commodity trading, each with pros and cons.

Commodities trading platforms: Traders may easily trade futures contracts, ETFs, and options by accessing the commodities markets using platform providers such as ATFX or Introducing Brokers .

Futures contracts: Farmers can use futures contracts to fix the price of their crops before harvest, guaranteeing a steady income despite changes in the market.

Exchange-traded funds (ETFs) : The SPDR Gold Shares ETF ($GLD) tracks the price of gold bullion. Investors interested in gold can use this fund to track gold prices even if they do not own any gold.

Commodity options: Gas producers should purchase call options to hedge against potential increases in gas prices. If gas prices increase, they can utilise their option to lock in gains by buying gas at a lower cost.

Physical ownership: Buy and own the physical gold bars and keep them in a safe place.

Commodity mutual funds: Through mutual funds like the PIMCO Commodity Real Return Strategy Fund ($PCRAX), retail investors can buy a broad portfolio of commodities, such as gold, oil, and agricultural items.

What are the Benefits of Commodity Trading?

Diversification: Spread risk across different asset classes.

Liquidity: Commodities markets are highly liquid, allowing easy buying and selling.

Profit from global trends: Capitalize on global economic trends and geopolitical events.

Enhance portfolio returns: Engaging in commodity trading can increase portfolio returns.

How to Become a Commodity Trader?

To become a commodity trader , learn to differentiate the differences between each commodity and how they are traded. Then, open a live trading account with a reputable broker and practice trading with small amounts to gain experience. If you are not confident, open a demo account to familiarise yourself with the tools. Feel free also to explore other types of market trading . Finally, always stay informed about market trends and continuously refine your trading strategies to maximise success.