Table of contents:

- Top 10 Warren Buffett Stocks Portfolio List 2024

- What is Berkshire Hathaway?

- Who is Warren Buffett?

- History of Berkshire Hathaway

- Class A (BRK.A) & B Share (BRK.B)

- Berkshire Hathaway Portfolio Companies List 2024

- Is Berkshire Hathaway a Good Stock to Buy in 2024?

- Steps to Trade Warren Buffet’s Top Shares

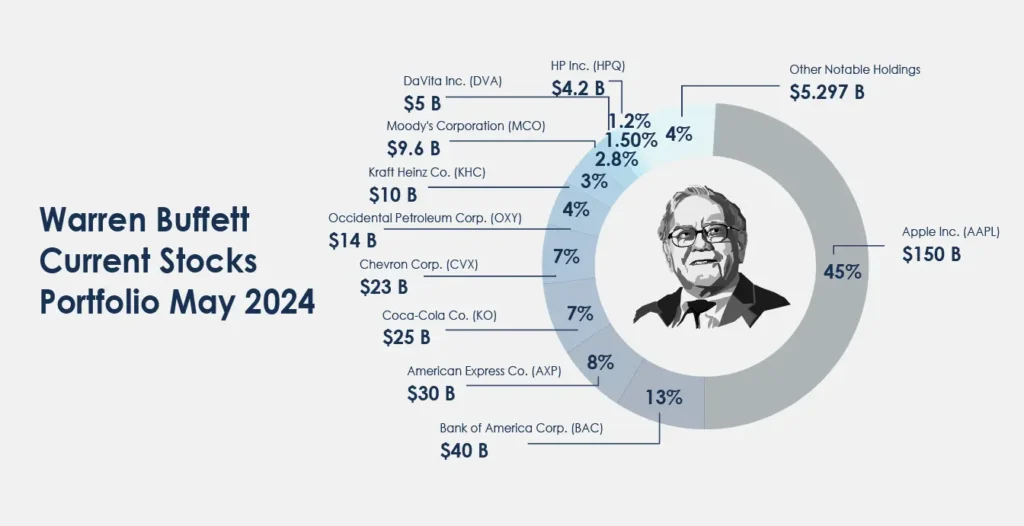

Top 10 Warren Buffett Stocks Portfolio List 2024

- Apple Inc. (AAPL)

- Bank of America Corp. (BAC)

- American Express Co. (AXP)

- Coca-Cola Co. (KO)

- Chevron Corp. (CVX)

- Occidental Petroleum Corp. (OXY)

- Kraft Heinz Co. (KHC)

- Moody’s Corporation (MCO)

- DaVita Inc. (DVA)

- HP Inc. (HPQ)

What is Berkshire Hathaway?

Berkshire Hathaway is a multinational conglomerate led by Warren Buffett. It invests in various industries, including insurance, utilities, railroads, and manufacturing. Berkshire Hathaway’s market value is estimated to be $750 billion in 2024, making it one of the world’s most valuable firms.

In April 2024, Warren Buffett made a significant statement on Berkshire Hathaway’s future strategic path. Buffett announced intentions to enhance his company’s renewable energy and technologies investments. He underlined the significance of sustainability and innovation in achieving long-term growth and shareholder value. This decision is viewed as a strategic shift in line with global trends toward green energy and digital transformation, reaffirming Berkshire Hathaway’s commitment to adapting to changing market realities.

Who is Warren Buffett?

Warren Buffett, known as the “Oracle of Omaha,” is one of the most successful investors in history. He became CEO of Berkshire Hathaway in 1965, and the company has since developed into a global powerhouse. Buffett is well-known for his value investing strategies and long-term market view.

When people talk about Warren Buffett’s shares portfolio, they usually mean the publicly traded stocks in Berkshire Hathaway’s investment portfolio, which is chosen and managed by Buffett and his team. However, this may not include Berkshire Hathaway’s other investments, including privately held companies and significant minority stakes in publicly traded companies.

History of Berkshire Hathaway:

Berkshire Hathaway began as a textile company in the 19th century. Warren Buffett acquired it in the 1960s and transformed it into a holding company with stakes in diverse industries, including Geico, BNSF Railway, and Dairy Queen.

As of 2024, Warren Buffett and large institutional investors like Vanguard, BlackRock, and State Street Corporation hold most of Berkshire’s shares. The Bill & Melinda Gates Foundation also holds notable shares due to Buffett’s contributions. The ownership is rounded out by individual investors, from small shareholders to high-net-worth individuals.

Charlie Munger, Buffett’s longtime partner, passed away in 2023. His estate or trust may still hold his shares, managed according to his estate plan, which could involve distribution to heirs, transfer to trusts, or charitable donations.

Class A (BRK.A) & B Share (BRK.B)

Berkshire Hathaway has two categories of shares, Class A (BRK.A) and Class B (BRK.B), to accommodate different types of investors and allow greater flexibility in stock ownership. They not only serve huge institutional investors and smaller retail investors but also balance accessibility and the aim to retain a stable, long-term investment base.

Class A Shares (BRK.A): These initial shares constitute a greater investment in the corporation. They are pricey and mostly intended for institutional investors and high-net-worth people. In early 2024, each Class A share was valued at more than $500,000.

Class B Shares (BRK.B): These were introduced in 1996 to make Berkshire Hathaway more accessible to small investors. Each Class B share is 1/1,500th of a Class A share and substantially cheaper. Class B shares were worth around $350 in early 2024.

Key Differences Between A and B Shares:

- Price: Class A shares are far more costly than Class B shares.

- Voting Rights: Class A shares have stronger voting power (1 vote per share vs 1/10,000th of a vote per B share).

Berkshire Hathaway Portfolio Companies List 2024:

Warren Buffett has carefully curated a diversified portfolio of publicly traded stocks and wholly-owned businesses. Refer to Warren Buffett’s current portfolio as below.

1. Apple Inc. (AAPL):

- Stake Value: ~$150 billion

- Percentage of Portfolio: ~45%

- Shares Owned: ~915 million

- Industry: Technology

Apple is Berkshire Hathaway’s largest holding. Buffett considers Apple more of a consumer products company due to its brand loyalty and customer ecosystem. The investment in Apple has consistently generated significant returns for Berkshire, with dividends contributing billions of dollars annually. He often praises Apple CEO Tim Cook for his exceptional leadership.

2. Bank of America Corp. (BAC):

- Stake Value: ~$40 billion

- Percentage of Portfolio: ~13%

- Shares Owned: ~1 billion

- Industry: Financials

Bank of America is Buffett’s second-largest holding. Berkshire Hathaway acquired the initial stake during the 2011 financial turmoil through a private deal. Since then, the position has grown substantially, and Berkshire now owns over 12% of the bank, making it the largest shareholder. The investment generates significant dividends and is part of Berkshire’s broader focus on banking and financials.

3. American Express Co. (AXP):

- Stake Value: ~$30 billion

- Percentage of Portfolio: ~8%

- Shares Owned: ~151 million

- Industry: Financials

American Express is a long-term holding in Berkshire Hathaway’s portfolio. Buffett bought American Express shares in the 1960s, during the “Salad Oil Scandal,” when the stock was heavily undervalued. His unwavering belief in the company’s strong brand and customer loyalty has made it one of the most iconic investments in the portfolio. American Express continues to generate consistent dividends and remains a staple in Berkshire’s financial sector investments.

4. Coca-Cola Co. (KO):

- Stake Value: ~$25 billion

- Percentage of Portfolio: ~7%

- Shares Owned: ~400 million

- Industry: Consumer Staples

Coca-Cola is another long-term portfolio investment dating back to the late 1980s. Buffett appreciates Coca-Cola’s global brand recognition and pricing power, translating into consistent dividends. Despite changes in consumer preferences and challenges in the beverage industry, Buffett remains a staunch supporter of Coca-Cola’s leadership and strategic direction.

5. Chevron Corp. (CVX):

- Stake Value: ~$23 billion

- Percentage of Portfolio: ~7%

- Shares Owned: ~130 million

- Industry: Energy

Chevron developed as a substantial asset in Berkshire Hathaway’s portfolio in recent years, with Buffett increasing his share when oil prices rose. Chevron is part of Buffett’s increasing energy portfolio, and the investment delivers significant dividends for Berkshire Hathaway. Despite the volatility in oil prices, Buffett remains optimistic about Chevron’s long-term prospects.

6. Occidental Petroleum Corp. (OXY):

- Stake Value: ~$14 billion

- Percentage of Portfolio: ~4%

- Shares Owned: ~220 million

- Industry: Energy

Berkshire Hathaway became Occidental Petroleum’s largest stakeholder after it acquired Anadarko Petroleum. Berkshire owns more than 20% of the firm, a position it established in 2019. Buffett has voiced trust in Occidental’s management and business strategy, notably its emphasis on low-cost production and fiscal discipline.

7. Kraft Heinz Co. (KHC):

- Stake Value: ~$10 billion

- Percentage of Portfolio: ~3%

- Shares Owned: ~325 million

- Industry: Consumer Staples

Despite recent struggles in the consumer staples sector, Kraft Heinz remains a substantial portfolio company for Berkshire Hathaway. Berkshire Hathaway and 3G Capital purchased Heinz in 2013 and merged it with Kraft Foods. Although the venture has encountered challenges owing to shifting customer tastes, Buffett remains enthusiastic about the company’s future possibilities.

8. Moody’s Corporation (MCO):

- Stake Value: ~$9.6 billion

- Percentage of Portfolio: ~2.8%

- Shares Owned: ~24.7 million

- Industry: Financial Services

Moody’s Corporation, a leading bond-rating agency alongside Standard & Poor’s, plays an important role in Berkshire Hathaway’s portfolio due to its constant profitability and robust market position. Warren Buffett loves Moody’s because of its consistent income streams and critical position in providing financial market credit ratings and research services. Berkshire has made a significant profit from the investment, with the initial cost base now representing a small fraction of its current worth.

9. DaVita Inc. (DVA):

- Stake Value: ~$5 billion

- Percentage of Portfolio: ~1.50%

- Shares Owned: ~36.1 million

- Industry: Healthcare

DaVita Inc. provides Berkshire Hathaway with significant exposure to the healthcare sector, specifically in kidney care and dialysis services, reflecting Buffett’s interest in essential services with consistent demand. Operating a vast network of outpatient centres, DaVita ensures a steady revenue stream and benefits from economies of scale and international expansion. Investments in R&D improve patient outcomes, while regulatory compliance and strategic partnerships broaden its offerings. Emphasizing community involvement, DaVita supports patients and families, making it a resilient addition to the portfolio.

10. HP Inc. (HPQ):

- Stake Value: ~$4.2 billion

- Percentage of Portfolio: ~1.2%

- Shares Owned: ~120.9 million

- Industry: Technology

HP Inc., a major player in the technology industry, is another significant holding in Berkshire Hathaway’s portfolio. Known for its leading position in the personal computing and printing markets, HP provides steady cash flows and a robust dividend yield. Warren Buffett values HP for its strong brand, innovative product lineup, and strategic acquisitions that bolster its market presence. The investment in HP demonstrates Berkshire’s confidence in the company’s ability to generate consistent returns and adapt to evolving technological trends.

11. Other Notable Holdings:

- Stake Value: ~ $5.297 billion (total amount)

- Percentage of Portfolio: ~4%

- Snowflake Inc. (SNOW): A relatively new addition, representing Buffett’s interest in cloud computing.

- VeriSign Inc. (VRSN): Berkshire owns a notable stake in this internet infrastructure company.

- Visa Inc. (V): Berkshire has a meaningful position in the global payments giant.

Is Berkshire Hathaway a Good Stock to Buy in 2024?

Due to Warren Buffett’s proven track record, Berkshire Hathaway is often regarded as a reliable long-term investment. However, consider the following before investing in top Berkshire Hathaway portfolio companies:

Reasons to Buy:

- Diversified Portfolio: Gain exposure to various sectors through one stock.

- Strong Management: Buffett’s value investing approach has historically generated impressive returns.

- Financial Stability: The company holds significant cash reserves for acquisitions.

Reasons to Reconsider:

- Lower Growth Potential: As a mature company, Berkshire may offer slower growth than smaller companies.

- Dependence on Warren Buffett: At 93, Buffett remains a central figure in the company, raising concerns about future leadership.

Steps to Trade Warren Buffet’s Top Shares

- Research and Analyze: Familiarize yourself with the businesses, financial health, market position, and future prospects of Buffett’s top holdings. This comprehensive understanding aids in making informed investment decisions.

- Select a Brokerage Account: Choose a reputable brokerage platform that offers access to U.S. stock markets and provides robust research tools. A good brokerage should have a user-friendly interface, low fees, and reliable customer support. See also shares CFDs on ATFX, including Hong Kong stock trading and global stock trading.

- Portfolio Diversification: Ensure your portfolio is diversified across different sectors and asset classes, even while focusing on Buffett’s top picks. Diversification helps manage risk and reduces the impact of poor performance in any investment.

- Investment Strategy: Follow Buffett’s strategy of holding stocks long-term to benefit from potential growth and compounding returns. This approach reduces the impact of short-term market volatility.

- Regular Monitoring and Adjustment: Regularly review the performance of your investments and make necessary adjustments. Stay informed about any company or market changes to ensure your portfolio remains aligned with your investment goals.