Table of contents:

- Introduction

- When is the Next US Election?

- Major Candidates and Their Platforms

- Historical Impact of Elections on the Market

- Key Issues Influencing the Market in 2024

- 5 Trading Tips During The US Presidential Election 2024

- How To Trade During The US Presidential Election 2024

- Summary

- Trade During the US Election 2024 with ATFX

Introduction

The US Presidential election 2024 is shaping up to be one of the most critical events in recent history, not only in politics but also within the monetary markets. Investors, traders, and residents know how election outcomes affect financial policy, markets, and emotional and economic well-being. This article explains what to expect from the imminent election and how it could affect the marketplace.

When is the Next US Election?

The next US presidential election is scheduled for November 5, 2024. This date marks the result of a series of primaries, caucuses, and conventions throughout the year. The procedure begins with primary elections and caucuses in numerous states, where every celebration’s candidates compete to win delegates. These delegates will then vote at their respective national conventions to officially nominate their party’s presidential candidate.

The primaries generally begin in early February with the Iowa caucuses and amplify through June. Each country’s primary or caucus enables the delegates for the national party conventions, generally held in July or August, where the final presidential candidates are officially nominated.

Major Candidates and Their Platforms

As of mid-2024, the major applicants in the US Presidential Election are anticipated to come from the Democratic and Republican parties, with possible significant third-party candidate applicants additionally entering the fray. The Democratic candidate, Kamala Harris, and the Republican candidate, Donald Trump, are anticipated to be the number one contenders.

Democratic Candidate

Kamala Harris, or doubtlessly a leading challenger, will focus on persevering with or revising modern management’s policies. Key areas include healthcare reform, climate change initiatives, tax regulations for wealth redistribution, and social justice issues. For instance, proposals will amplify the Affordable Care Act, implement stricter emissions rules, or increase taxes on the rich to fund social applications.

Republican Candidate

The leading Republican candidate, Donald Trump, will possibly emphasize monetary growth through tax cuts, deregulation, a sturdy stance on immigration, and a focus on countrywide protection and regulation enforcement. They might advocate lowering corporate taxes, rolling back regulatory measures on businesses, strengthening border security, and growing defence spending.

Real-life Example: In the 2020 election, candidates Donald Trump and Joe Biden substantially differed, mainly regarding healthcare, tax policy, and climate change. Similar stark contrasts are predicted in 2024, shaping voter alternatives and market expectations.

Historical Impact of Elections on the Market

Historically, US presidential elections have had notable impacts, frequently leading to periods of increased volatility and significant price movements. The anticipation of new policies, potential shifts in regulatory environments, and changes in economic strategies can all affect trader sentiment and market dynamics. Here, we explore critical historical examples to understand those impacts better.

2008 Election: Obama vs. McCain

The 2008 election, during the peak of the worldwide financial disaster, noticed Democrat Barack Obama running against Republican John McCain. Due to the ongoing economic turmoil, the marketplace became exceedingly volatile. After Obama’s victory, the marketplace experienced a downturn driven by fears of improved laws and higher taxes. However, subsequent measures to stabilize the economy, including the American Recovery and Reinvestment Act, eventually resulted in a recovery and an extended bull market.

Impact: Initial market decline followed by recovery due to economic stabilisation efforts.

Key Policies: Economic stimulus package, financial regulation reform.

2012 Election: Obama vs. Romney

In the 2012 election, incumbent Barack Obama confronted Republican challenger Mitt Romney. Obama’s re-election was primarily visible as a continuation of the existing policies, which furnished some stability to the marketplace. However, there was excellent market volatility in the run-up to the election because of uncertainties about tax rules and financial cliff negotiations.

Impact: Periods of volatility leading up to the election, followed by relative stability post-election.

Key Policies: Continuation of economic recovery policies, Affordable Care Act.

2016 Election: Trump vs. Clinton

Significant marketplace reactions marked the 2016 election between Donald Trump and Hillary Clinton. Leading up to the election, markets had been volatile, with many traders unsure about the economic implications of a Trump presidency. Following Trump’s unexpected victory, the market experienced a sharp rally, often known as the “Trump Bump.” Expectations of corporate tax cuts, deregulation, and increased infrastructure spending drove this rally.

Impact: Significant post-election rally driven by pro-business policy expectations.

Key Policies: Corporate tax cuts, deregulation, infrastructure investment.

2020 Election: Biden vs Trump

The 2020 election, conducted amid the COVID-19 pandemic, saw Democrat Joe Biden challenge incumbent Donald Trump. The market became volatile due to the pandemic’s effect and uncertainties surrounding the election outcome. After Biden’s victory, there was initial market volatility because of issues about potential tax increases and regulatory adjustments. However, the promise of considerable financial stimulus and a coordinated pandemic reaction eventually boosted market confidence.

Impact: Initial volatility followed by market rally due to anticipated economic stimulus.

Key Policies: COVID-19 response, economic stimulus package, potential tax reforms.

Key Issues Influencing the Market in 2024

Several key issues will likely influence the market during the 2024 election:

Economic Policies

Taxation, regulation, and government spending might be necessary. Candidates’ handling of inflation, unemployment, and economic increase may be closely scrutinized. Policies stimulating the economy, infrastructure spending, and business tax incentives could impact the marketplace.

Trade Policies

Stances on worldwide trade agreements, tariffs, and relations with predominant trading companions like China and the EU will be critical. A candidate proposing import tariffs might lead to volatility in companies’ stock prices, relying heavily on foreign trade.

Healthcare

Healthcare reform proposals can notably affect healthcare shares and related sectors. Universal healthcare or significant adjustments to Medicare and Medicaid could affect pharmaceutical and insurance agencies.

Environmental Policies

Climate change tasks, renewable power investments, and regulatory modifications impacting traditional strength sectors may be crucial. Stricter emissions requirements could affect the automobile enterprise, while incentives for renewable strength may want to boost sun and wind energy stocks.

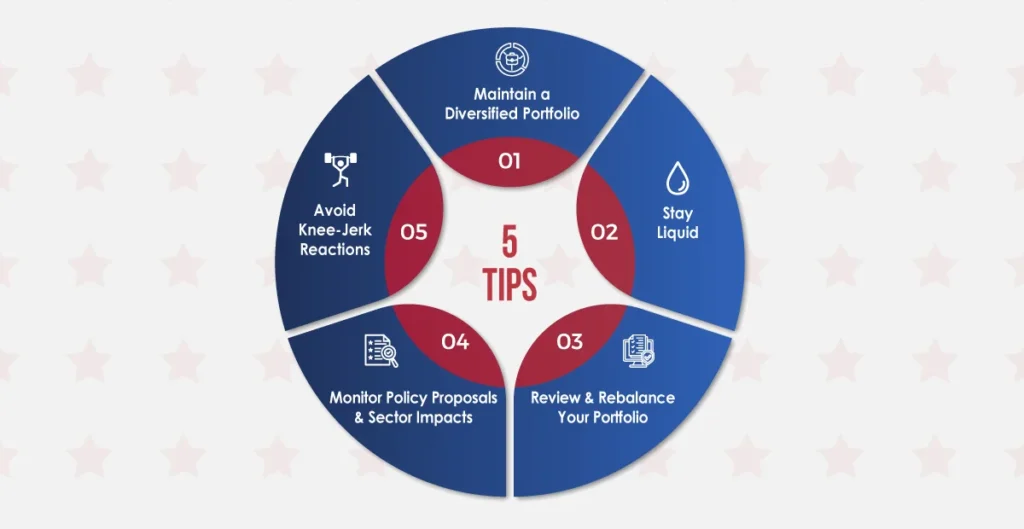

5 Trading Tips During The US Presidential Election 2024

Trading during an election year can be challenging due to increased volatility and uncertainty. Here are some strategies to consider:

Maintain a Diversified Portfolio

Due to accelerated marketplace volatility in the course of election durations, diversification is essential. Spreading investments across diverse sectors and asset classes can reduce your portfolio’s overall risk. Different sectors react differently to political and economic changes. Hence, a diversified portfolio facilitates protection against sector-specific impacts that may arise from policy changes due to election results. This method also ensures that your portfolio’s performance is not overly dependent on a single investment or sector, providing an extra stable and resilient investment approach during uncertain times.

Stay Liquid

Maintaining liquidity in your portfolio means preserving some cash or equivalent investments. This strategy allows investors to quickly benefit from purchasing opportunities or mitigate risks during heightened market volatility. Liquidity ensures traders can react to marketplace moves without being pressured to sell other investments at potentially unfavourable prices. It provides a financial cushion, allowing traders to navigate market fluctuations and surprising downturns more quickly and confidently.

Review and Rebalance Your Portfolio

Regularly reviewing and rebalancing your portfolio is essential, especially during unstable periods like election years. Rebalancing entails adjusting the weightings of your portfolio assets to hold your desired level of risk and return. This process ensures the portfolio aligns with your investment goals and risk tolerance. Traders can lock in profits and take advantage of lower prices by systematically selling overperforming belongings and buying underperforming ones, retaining a balanced and diversified portfolio.

Monitor Policy Proposals and Sector Impacts

It is critical to acknowledge each candidate’s key policy proposals and their potential impact on each market sector. Taxation, healthcare, environmental regulations, and trade policies can significantly impact specific sectors. By understanding these proposals, traders can tailor their investment strategy to anticipate and respond to changes that could benefit or negatively impact unique industries. This proactive approach lets traders function their portfolios to take advantage of sectors probably performing under the proposed policies.

Avoid Knee-Jerk Reactions

Election-associated market moves can be unpredictable and frequently driven by short-term sentiment and news cycles. Avoid making impulsive decisions based on instantaneous reactions to election news. Instead, develop a well-thought-out investment strategy that considers various potential election outcomes and adheres to it. This disciplined approach enables traders to stay focused on their long-term investment goals and avoid the pitfalls of reacting to short-term marketplace noise. By remaining calm and strategic, traders can navigate the volatility more efficiently and make decisions aligned with their financial plan.

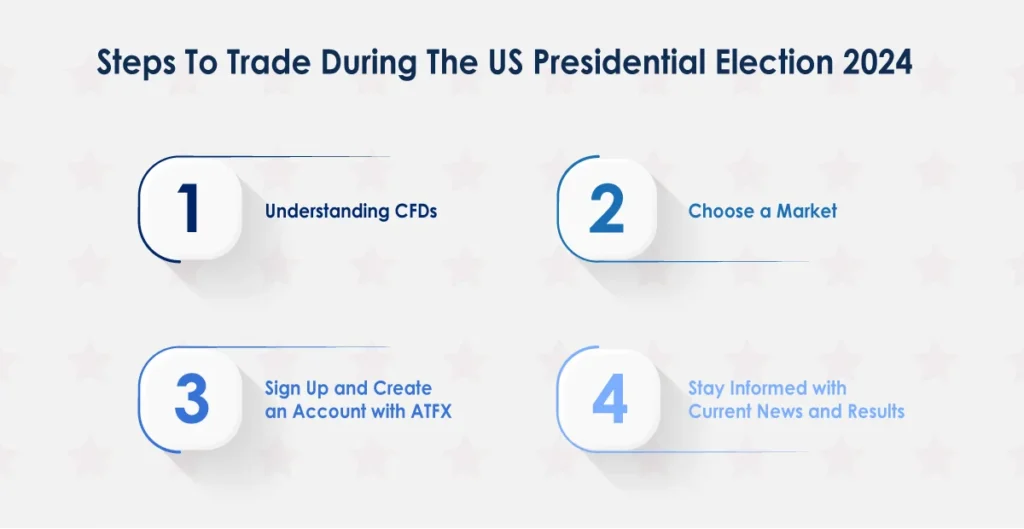

How To Trade During The US Presidential Election 2024

The US Election in 2024 will bring significant volatility and opportunities to the financial markets. One robust choice to effectively trade at some point in this era is to deal with ATFX using Contracts for Difference (CFDs). Here are the steps to navigating this process and making the most of the market movements during the election.

Step 1: Understanding CFDs

CFDs are economic derivatives that allow traders to speculate the price movements of numerous assets without owning the underlying asset. CFDs may be traded on multiple markets, which include forex, stocks, indices, commodities, and ETFs. This flexibility makes them an excellent tool for trading at some point in unstable periods, which provides for presidential elections. Further, trading with CFDs allows you to take long and short positions, profiting from rising and falling markets.

Step 2: Choose a Market

After understanding CFDs and the current market conditions, traders can trade during the US Presidential Election 2024 by speculating on CFD markets such as forex pairs (EUR/USD), indices (S&P 500), and shares (MSFT, AAPL, NVDA, etc.). Based on the results, all US stocks, indices, and currency pairs will continue to fluctuate.

Step 3: Sign Up and Create an Account with ATFX

First, fill out a simple online application form, and we will be able to verify your identity. Once we’ve verified your identity, we will set up your account. Further, fund your account using any of the various methods available, and you can begin trading on every device, including PC, Android, iPad, and iPhone, or through a web browser.

Step 4: Stay Informed with Current News and Results

Staying informed with the latest news and results during the US presidential election 2024 is crucial to trade effectively. Traders can better anticipate fluctuations and make informed decisions by closely monitoring election updates, financial news, and market responses. This attention facilitates traders in regulating their trading strategies in real-time, allowing them to seize opportunities and mitigate risks as the political landscape evolves. Stay proactive and vigilant to navigate the volatile market environment surrounding the election.

By following these steps and creating an account with ATFX, traders can efficiently trade CFDs during the US Election 2024. Stay disciplined, informed, and prepared to navigate the market volatility and capitalize on potential opportunities.

Summary

The US Election of 2024 will undoubtedly have significant implications for the financial markets. By understanding the major candidates, key issues, and historical impacts, traders can be well-prepared for the potential market volatility. Employing sound trading strategies and staying informed could be essential to navigating this pivotal event effectively. Diversification and a focus on fundamentals will serve traders well during uncertain times.

Trade During the US Election 2024 with ATFX

Are you ready to navigate the market during the US presidential election in 2024? Enhance your trading strategies with ATFX. Whether you are new to trading or an experienced trader, ATFX offers the tools and platforms to help every trader succeed. Take advantage of our demo accounts to refine your strategies in a risk-free environment, or dive into the live markets to capitalize on real-time opportunities with live accounts. Embrace the dynamic market changes during the election years and make informed trades with ATFX from your perspective. Start your journey today and experience the difference with ATFX!