A rebound in the price of the EURJPY will have economic data this week to test recent strength.

EURJPY – Daily Chart

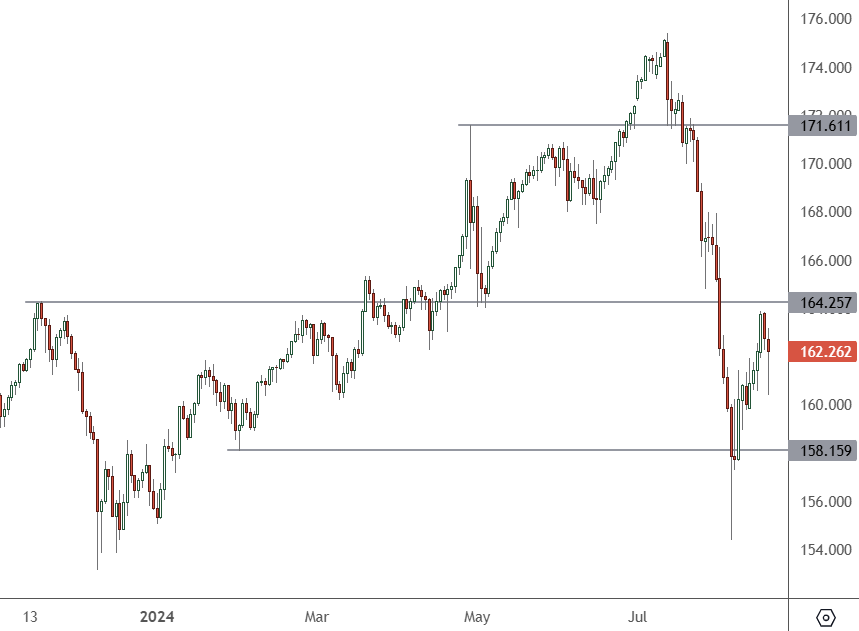

The price of the EURJPY has bounced from recent lows to 162.26. The next barrier to the rebound is at 164.25. Support comes in around the 158.15 level.

Eurozone inflation on Monday showed a 2.9% increase in core inflation, which was in line with previous readings.

The following vital data set and the recent European Central Bank meeting minutes will be on Thursday. That will be released after a German manufacturing PMI release at 15:30 HKT on Thursday. The former manufacturing and export powerhouse has been struggling in recent years.

Germany and the Eurozone’s economic sentiment collapsed in August, raising fears over the economic outlook. The ZEW Economic Sentiment Index, which measures the financial outlook for Germany and the Eurozone over the next six months, dropped more than 20 points between July and August, from 41.8 to 19.2.

The Eurozone’s economic sentiment was also plunging, with the index hitting its lowest since February and dropping well below the expected 35.4, moving from 43.7 to 17.9 points. That was the worst slowdown in the Eurozone’s economic morale since April 2020.

Assessing the recent survey results, ZEW Professor Achim Wambach said: “The economic outlook for Germany is breaking down. In the current survey, we observe the strongest decline of the economic expectations over the past two years.”

Professor Wambach said that fears of a larger war in the Middle East, an ambiguous monetary policy by Olaf Scholz’s government, and disappointing business data from the US have contributed to the decline in the economic sentiment. The German economy is also seeing a severe slowdown in exports to China.

For the Japanese economy, inflation numbers will be released at 7:30 am HKT on Friday. A recent interest rate hike from the Bank of Japan shocked the market, and if inflation remains high, then the BOJ may feel pressure to take rates higher again.

However, Japan’s economy grew by a faster-than-expected 3.1% in the second quarter, rebounding from a slump at the beginning of the year thanks to a substantial rise in consumption. That is also adding to calls for another near-term interest rate hike.

The Bank of Japan forecasts that a solid economic recovery will help inflation sustainably hit its 2% target and justify raising interest rates further. A slowdown in Europe, alongside a more robust Japanese economy, could lead to further gains for the yen.