The GBPUSD exchange rate has continued to decline after the Federal Reserve took a cautious tone on interest rates.

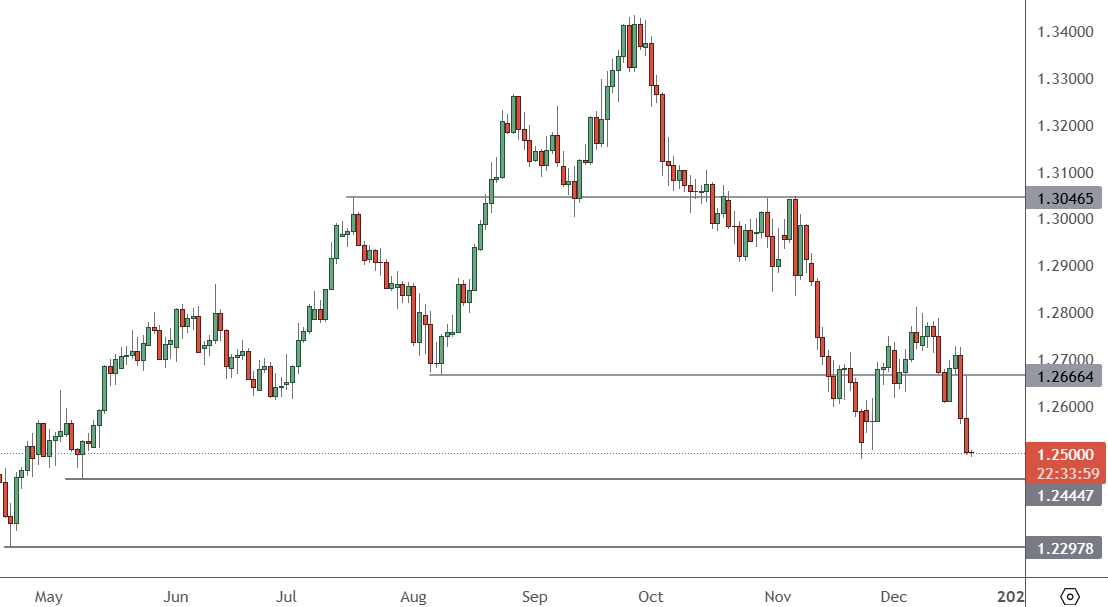

GBPUSD – Daily Chart

The GBPUSD exchange rate has slumped since September as the new UK government ramped up taxes. The 1.2665 level has proved to be an obstacle and that risks a move to 1.25 initially.

The British pound was weak despite the Bank of England holding interest rates at current levels. A more cautious Federal Reserve has traders expecting that the UK will still cut more than the US.

Interest rates were held at 4.75% following a divided vote among BoE policymakers, as they weighed up concerns over a stagnating economy and higher inflation. The Bank’s Monetary Policy Committee (MPC) said it was keeping rates unchanged on Thursday after cutting in August and again in November.

But it wasn’t a unanimous decision, with six members voting to keep the base rate at 4.75% while three voted for a 0.25 percentage point cut. New projections from the MPC showed also that economic growth will be worse over the final three months of 2024 than previous projections.

The Bank’s economists now see 0% gross domestic product between October and December, weaker than the 0.3% growth it had forecast in November. US Federal Reserve Chair Jerome Powell boosted the price of the US dollar as he projected higher rates.

The Fed said inflation will remain higher than expected in 2025, and that it is now pricing in just two rate cuts in 2025, rather than the four it had expected. That was a “punch in the face to the market,” said Art Hogan, chief market strategist at B. Riley Investments. “That got everyone spooked,” he added. The UK has retail sales released at 3pm HKT on Friday and investors expect a jump to 0.5% from -0.7 last month.