The GBPUSD exchange rate has slipped to its 2024 lows as markets fret over the path of UK policy.

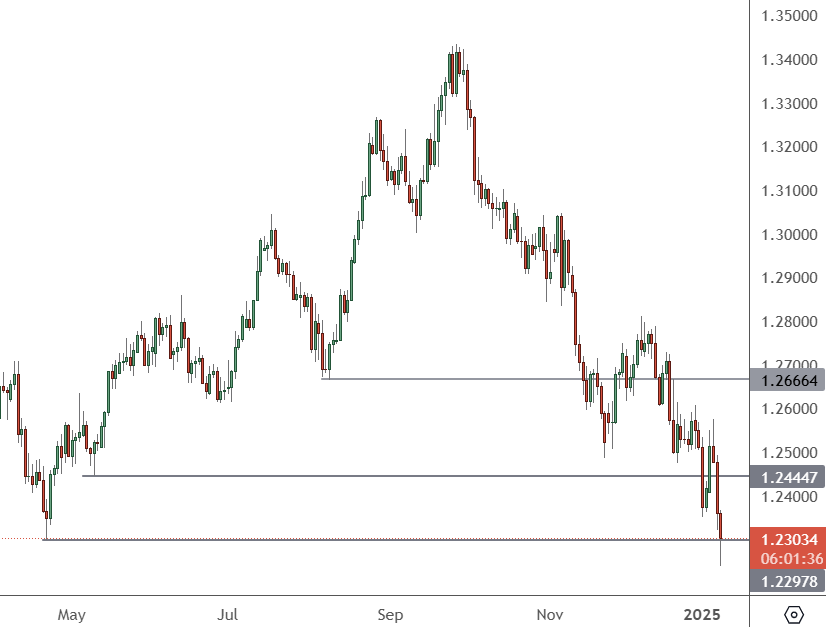

GBPUSD – Daily Chart

The GBP v USD price has moved to test the 2024 support level and this is now key support for the pair.

Britain’s Chancellor, Rachel Reeves, was urged to cancel a trip to China as she scrambled to soothe markets as the pound dropped and government borrowing costs rose. Sterling tumbled to the lowest level against the greenback for over a year on Thursday as investors added more risk premium to UK gilt bonds. Gilts are the bonds the UK government uses to fund its borrowing and higher prices put pressure on the government’s plans.

Economists now warn that the country’s growth stall and stubborn inflation will make it hard for the Chancellor to balance the books without further spending cuts or tax hikes.

Many are now talking about former Chancellor Liz Truss’s disastrous mini-Budget in 2022, which led to a spike in borrowing rates and cost her the job.

The current Chancellor did not show up to The House of Commons and sent her deputy to field questions, where he tried to explain the market panic with geopolitical and data concerns.

“Financial market movements, including changes in Government bond or gilt yields, which represent the Government’s borrowing costs, are determined by a wide range of international and domestic factors,” he said.

But markets are punishing the British currency as interest rates will have to be cut to spur growth and that is hard to do when inflation is still hovering. There are some geopolitical fears as incoming US President Donald Trump may have an impact on the country with tariffs, but the reality is that the October Budget pumped up borrowing to invest in infrastructure and also made a big tax raid on business to fund spending.