The price of gold has been consolidating after recent all-time highs and could attempt another move higher.

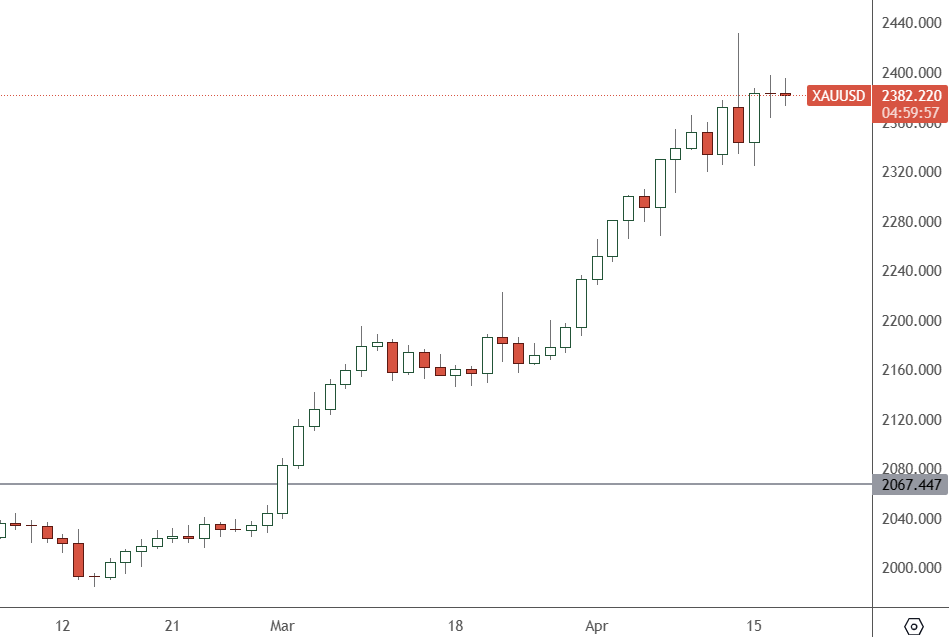

Gold – Daily Chart

The price of gold trades at $2,382 and is looking for another push higher to the recent all-time high above $2,400.

Gold has been supported after Iran’s involvement in the Middle East conflict last week. That helped to outweigh any pressure from the hawkish tone of the US central bank on interest rates.

With external factors underpinning gold, Goldman Sachs raised its price outlook to $2,700 an ounce, citing the metal’s stability following the latest US inflation data. That showed a disconnect to the inflation rates as investors expect rates to fall over the medium term.

Central banks have also continued to buy gold at these higher levels. China’s central bank added 160,000 troy ounces of gold to its reserves in March. Turkey, India, Kazakhstan, and some eastern European countries bought gold in 2024.

That is another sign that countries are starting to diversify from the US dollar and its debt, especially when there are tensions in the global order.

“The market is pricing rate cuts by June despite strong economic data. But, if we continue to see strong data, which indicates that the Federal Reserve is in no hurry to cut rates, then gold will not be able to sustain the gains,” said analysts at TD Securities.

According to exchange data on Friday, COMEX gold traders increased their net long positions by 20,493 contracts to 178,213 in the week ended April 2.

Reuters reported that India’s silver imports also hit a record high in February as lower duties led to large purchases from the UAE.