Alphabet (NYSE:GOOG), the parent company of Google, releases its third quarter earnings on Tuesday.

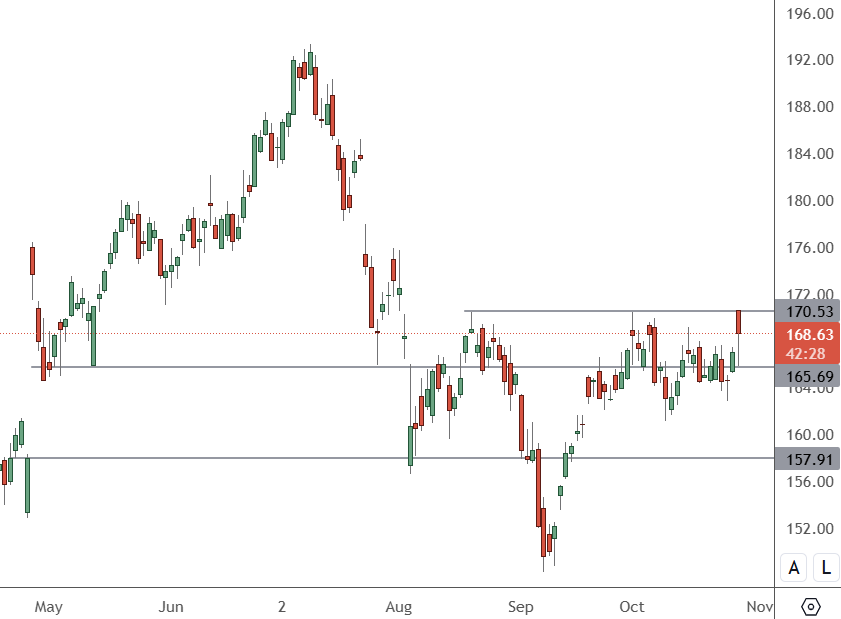

GOOG – Daily Chart

The price of GOOG has touched the upside resistance on Monday and a strong earnings report could see it leap above that level. There is a cluster of recent support ahead of $160.

The key focus again for Alphabet becomes its cloud revenue growth and AI projections.

The tech giant is expected to show third quarter revenue increasing 12% year-on-year to $86.4 billion. Earnings are also expected to be higher at $1.85 per share, up from $1.55 last year.

The second quarter was strong for the company with cloud revenue up 28% year-over-year to $10.35 billion. However, the share price still dropped as investors fretted about the high level of spending that the company is doing in artificial intelligence.

CEO Sundar Pichai said at the time that the “risk of underinvesting is dramatically greater than the risk of overinvesting”. Despite that statement, investors will want to see a return on the outlay, or at least signs that earnings will not be impacted.

Jeffries analysts said that the company’s AI returns could show up later in 2025-26. The estimate for cloud growth in Q3 is $10.87 billion, which would mark a y-o-y increase of 29%.

In the coming earnings release, analysts also expect to see an AI boost to Google search, alongside increased ad spending ahead of the election and new advertising growth.

The company’s quarterly increase from cloud was $10.35 bn to $10.87 bn and that could indicate slower y-o-y growth in 2025 with the potential pressure of AI spending on earnings.

Ahead of the earnings release, Google said it was rolling out its AI search overviews to 100 countries. Google Search’s AI Overviews, which display a snapshot of information at the top of the results page, are beginning to roll out in more than 100 countries and territories, the company announced on Monday.

The AI-driven summary feature launched in the USA in May and now has 1 billion global users each month. A larger rollout can help to boost advertising revenue within the company.