Nvidia saw a significant price slump last week, which suggests caution ahead of tech earnings this week.

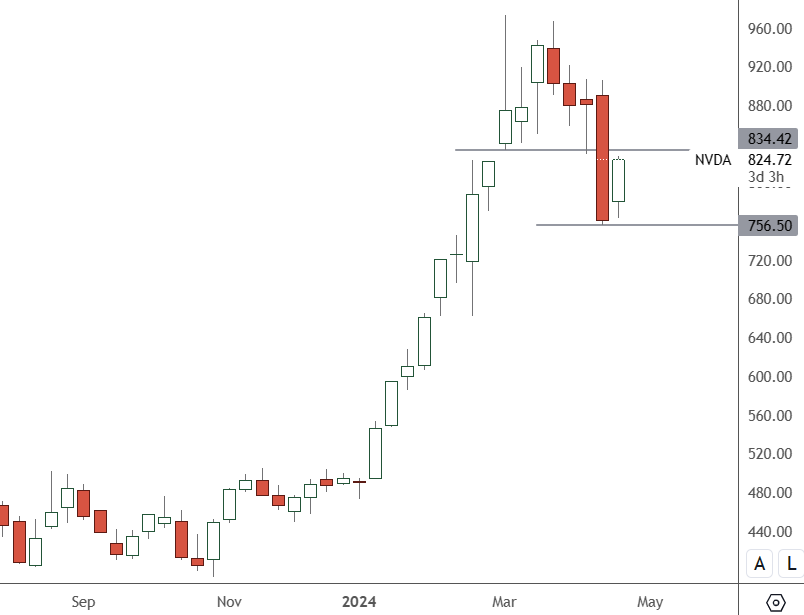

NVDA – Weekly Chart

NVDA hit a low of $756.50 last week, which hinted at a prominent investor selling out. The price has since bounced to $824.72, and the gap open to $834.42 is a possible resistance level.

Despite artificial intelligence’s recent dominance, eight prominent billionaire investors have significantly reduced their funds’ stakes in Nvidia until the end of 2023. This move should not be taken lightly; it signals a cautious approach towards Nvidia’s future performance.

Steven Cohen’s Point72 Asset Management (1,088,821 shares) and David Tepper’s Appaloosa Management (235,000 shares) were among them.

Billionaire investors may be taking profits but also noting a lack of assistance Nvidia is getting from US regulators. Nvidia developed AI GPUs specifically for the Chinese market. However, further export curbs hurt the new models last year.

Nvidia’s subsequent earnings, expected around the end of May, could be a game-changer. Investors last week may have been anticipating the tech earnings this week, which could have a ripple effect on the market. For instance, a slower uptake in AI could significantly impact tech stocks and chipmakers like Nvidia.

Investors should take care of some resistance ahead as a disappointing earnings season for tech could become a more significant issue once NVDA releases again. Nvidia is still up 205% over the last year and 67% year-to-date after the company was a market leader in the rush to AI products and services. Insiders sold $75 million of stock in Q1, but management guided for a strong quarter ahead. Chipmaker TSMC also beat expectations in its own earnings release last week.