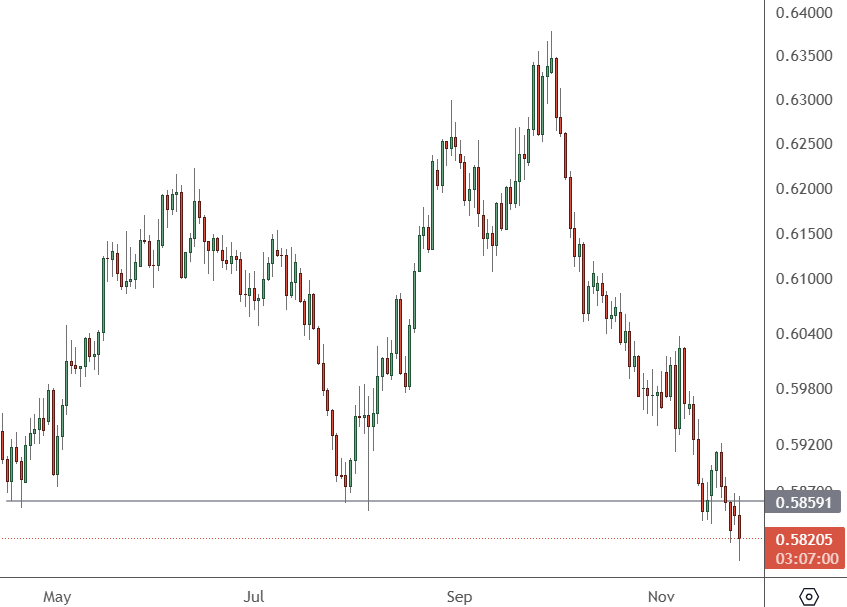

The NZDUSD exchange rate has central bank action ahead on Wednesday as the pair trades at a key support level.

NZDUSD – Daily Chart

The price of NZDUSD has dipped below the support at the 0.5860 level. That will be the key to a rebound or further lows in the pair.

The Federal Reserve released the minutes of its latest minutes at 3am HKT with traders looking for clues of a rate cut in December. The Committee eased monetary policy again with a 25-basis-point rate cut on November 7, following September’s big cut that caught markets off guard.

Fed policymakers noted that the labor market had “generally eased,” while inflation appeared to be progressing toward the Fed’s 2% target. The Fed may be concerned about recent war tensions as that started inflationary problems back in 2021-22.

The Donald Trump election victory in November has brought expectations for US tariffs, loose fiscal policy, and business deregulation, which could all raise inflationary pressures.

The Reserve Bank of New Zealand is next up at 8am HKT with an interest rate decision and monetary policy announcement.

Commerzbank analyst Volkmar Baur said the policy talk will be more important than the rate decision.

“It cut the cash rate by 25 basis points. However, the indication that a move of 50 basis points was being seriously considered did surprise some. As a small open economy, New Zealand is often one of the first to recognize changes in the global economy. And more often than not, the central bank is not shy about responding to changing circumstances. This summer, the RBNZ’s hint of a 50 basis point cut proved to be a harbinger for the Fed, which surprised markets by cutting rates by that amount in September,” he wrote.

“And at its last meeting in October, the RBNZ followed up its August hint with a 50 basis point cut. Tomorrow morning, the RBNZ will hold its last policy meeting of the year, and once again, the RBNZ’s statement may be more interesting than the decision itself”.

Markets expect another 50bp move, however, what the bank says about the outlook will be more important.

“Another 50bp cut is almost fully priced in for the next meeting in February, another 25bp in April and a total of 150bp (6 steps of 25bp) by the summer. I think this is justified given the recent softening in inflation and economic growth. However, if the RBNZ were to focus on heightened international risks and their impact on inflation in New Zealand, the market might be forced to reconsider,” Vaulk added.