Crude oil prices settled up 2% on Thursday after the European Central Bank cut interest rates, hoping the Fed would follow suit. OPEC+ ministers reassured investors that the latest oil output agreement could change depending on the market.

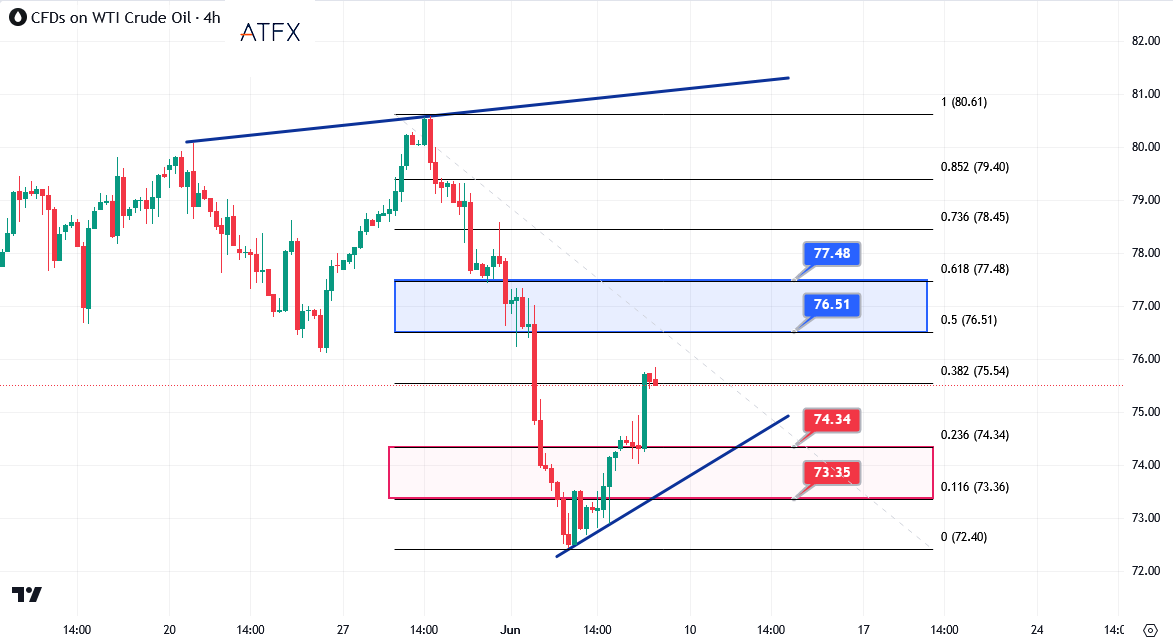

WTI 4-Hour chart

Brent crude futures settled $1.46 higher or 1.86% at $79.87 a barrel. US West Texas Intermediate crude futures settled up $1.48 or 2% at $75.55.

On Thursday, the European Central Bank proceeded with its first interest rate cut since 2019, citing progress in tackling inflation but cautioning that the fight was far from over.

Denmark’s central bank lowered its benchmark interest rate by 25 basis points to 3.35%.

Analysts in the US saw the European rate cuts as a likely precursor to Fed rate cuts.

Lower fuel costs and easing post-pandemic supply snags have helped drive inflation down to 2.6% in the 20 euro-using countries from 10% in late 2022.

Investors are now less confident than they were a few weeks ago that inflation had retreated enough for the ECB to institute a significant easing cycle. In the US, economists predict the Federal Reserve will cut rates in September, according to Reuters’ May 31-June five poll.

“Today the ECB rate cuts are helping, and casting a view that the Fed will finally follow suit here in the US as well which is supportive, but both central banks are cutting in the face of a slowing economy which is not necessarily supportive of oil demand,” said John Kilduff, partner at Again Capital.

The number of Americans filing new claims for unemployment benefits rose last week. However, the Labor Department said first-quarter unit labour costs grew less than previously.

While this shows a cooling labour market, it is unlikely to push the Fed to start rate cuts.

Meanwhile, trading house Trafigura’s chief economist Saad Rahim said the OPEC+ decision to phase out some output cuts, combined with solid fuel supplies, has decreased oil prices.

OPEC+, the Organization of the Petroleum Exporting Countries and allies agreed on Sunday to extend most production cuts into 2025. However, they left room for voluntary cuts from eight members to gradually unwound.

On Thursday, Saudi Energy Minister Prince Abdulaziz bin Salman said that OPEC+ could pause or reverse production increases if it decides the market is not strong enough.

And Russian Deputy Prime Minister Alexander Novak said the group might adjust the deal if necessary, adding that the post-meeting price drop was caused by misinterpretation of the agreement and “speculative factors”.

“Oil markets have overreacted to the mildly negative OPEC+ meeting outcome. Demand indicators have certainly softened somewhat recently, but are not falling off a cliff,” Barclays analyst Amarpreet Singh wrote in a note.

Elsewhere, a merchant vessel reported an explosion near it in the Red Sea on Thursday about 19 nautical miles west of the Yemeni port city of Mokha, British security firm Ambrey said.

The vessel fit the target profile of Yemeni Houthi militants, Ambrey said in a note. Militants have attacked ships off the country’s coast for several months in solidarity with Palestinians fighting Israel in Gaza.

The vessel was en route from Europe to the United Arab Emirates.

“This puts more risk on top of a market that was already nervous,” said Phil Flynn, an analyst at Price Futures Group. “And if it turns out to be an oil tanker, this will probably raise the stakes,” he added.