Electric vehicle maker Tesla stock price fades after the post-election rally into the year-end.

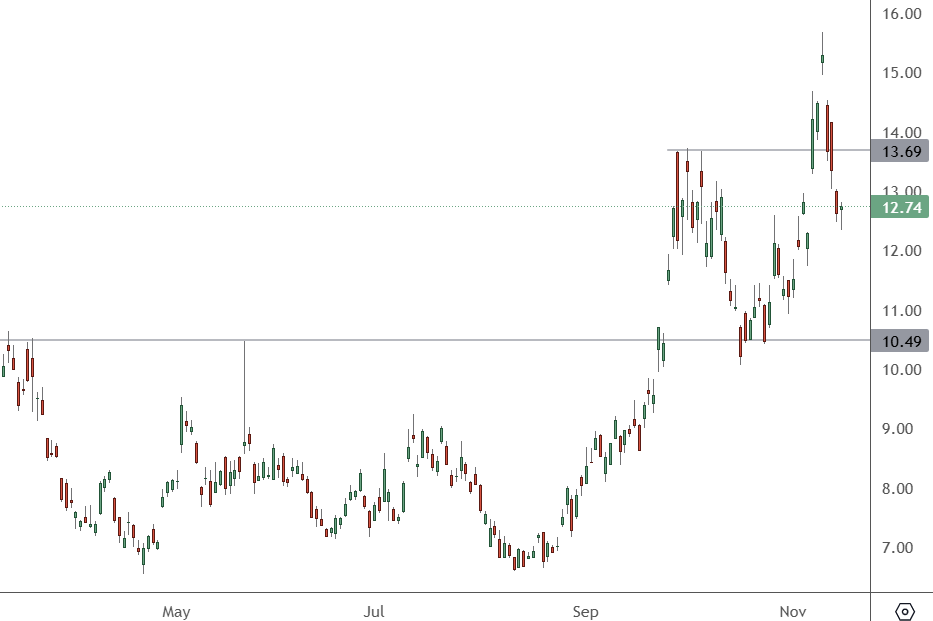

TSLA – Daily Chart

The price of TSLA has faded to the $406 level and is in danger of a move lower to test the support around $360-375.

Tesla earnings ahead will test investor’s resolve for the high valuation offered to Elon Musk’s firm. Wedbush Securities analyst Dan Ives is positive that AI can help the firm.

“I think 90% of what’s going to drive the stock is the autonomous and the AI future because that’s the ultimate story here,” he said. “The autonomous piece could be worth $1 trillion alone”.

With a potential change to EV regulation under President Trump, Ives says, “I think the stock is actually underestimating what this is going to do to the story in terms of cyber cabs, autonomous [full self-driving] FSD robotics. And that’s why I think there’s a $2 trillion market cap”.

Ives adds, “Next week starts what I believe is going to be a massive year ahead”.

Analysts expect Tesla to deliver revenue of $27.27 billion for the fourth quarter, with net income of around $2.31 billion, or 65 cents per share. In the same quarter last year, Tesla’s revenue was $25.17 billion with $7.93 billion in net income.

There are some fears over the upcoming earnings as the company’s production and delivery numbers for the quarter came in short of expectations. That led to the first year-over-year decline in full-year vehicle deliveries for Tesla.

Analysts from Wedbush, Morgan Stanley, and Piper Sandler all lifted their price targets for Tesla stock to $550, $430, and $500, respectively.

Piper Sandler believes that investors will need to wait a year for the full picture on Tesla’s path with new vehicles and autonomous driving.

There are still some challenges ahead for Tesla with margin pressure amid economic uncertainty, and competition is intensifying. The company’s US EV market share has declined to 50% from 63% in 2022, while Chinese competitors like BYD and NIO continue to catch up. In the autonomous vehicle sector, Tesla’s Full Self-Driving system remains at Level 2, requiring human supervision, while competitors like Alphabet’s Waymo have already moved to robotaxi pilots.

Tesla will have to deliver something good in the upcoming earnings to avoid a near-term correction in the stock price.