Tesla (NYSE:TSLA) shares dropped by -6% as sales dropped on a yearly basis for the first time in almost a decade.

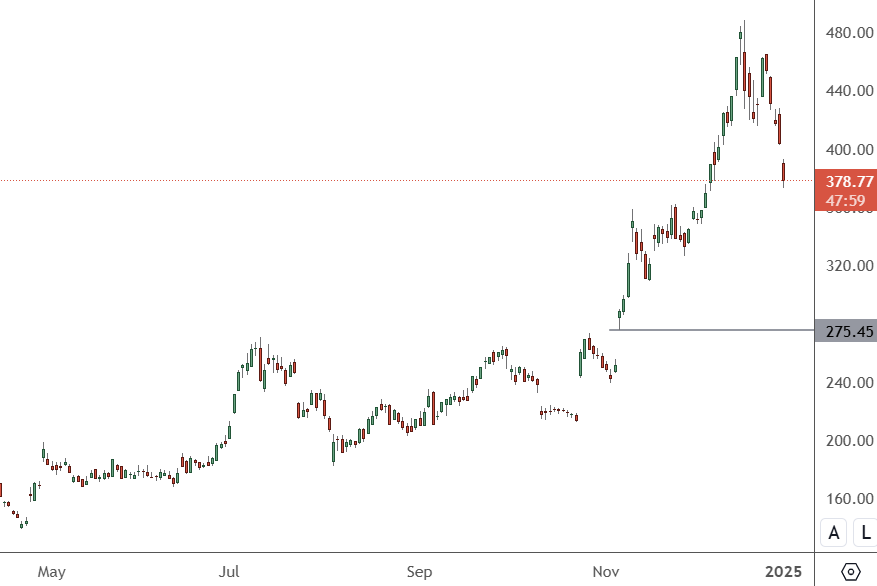

TSLA – Daily Chart

TSLA shares slipped to $378.77 on Thursday and are now down 22% from the high set in December above $480. The gap open from Trump’s victory is at $275.45. That would be a 61.8% Fibonacci correction from the 2024 low to high.

The drop in the automaker’s shares is a concern for investors as competition heats up in EVs despite the company’s price-cut strategy. Tesla sales only dropped by -1.1% globally in 2024, but marked the first annual sales drop since at least 2015. Demand for EVs decreased in the United States and other areas, leading to a drop from 1.81 million in 2023 to 1.79 million. It is also an issue for management after they projected 50% annual sales growth previously.

Tesla supplied 495,570 automobiles in the fourth quarter, which was up 2.3% over the previous quarter, but Q4 is always a strong quarter. The number fell short of revised Wall Street projections of 498,000. Analysts also noted that Tesla’s average sales price fell to $41,000 during the quarter, its lowest in four years. That could affect the company’s margins which have struggled since the price war started.

Tesla is facing issues such as outdated models as fierce competition from startups in China hits sales. Chinese rival BYD reported record sales for 2024 with a bumper December. BYD annual sales were boosted by 509,440 cars last month, marking an almost 50% year-on-year jump. With the yearly figure, BYD comfortably exceeded its sales target of 4 million new energy vehicles, bringing it up to speed with legacy automakers like Honda and Ford. BYD’s performance was largely driven by sales in the domestic space, only 10.8% of sales going overseas.

Tesla shares may see profit-taking continue after the sharp post-Trump election rally.