US election drama poll swings could affect the price of the greenback going forward.

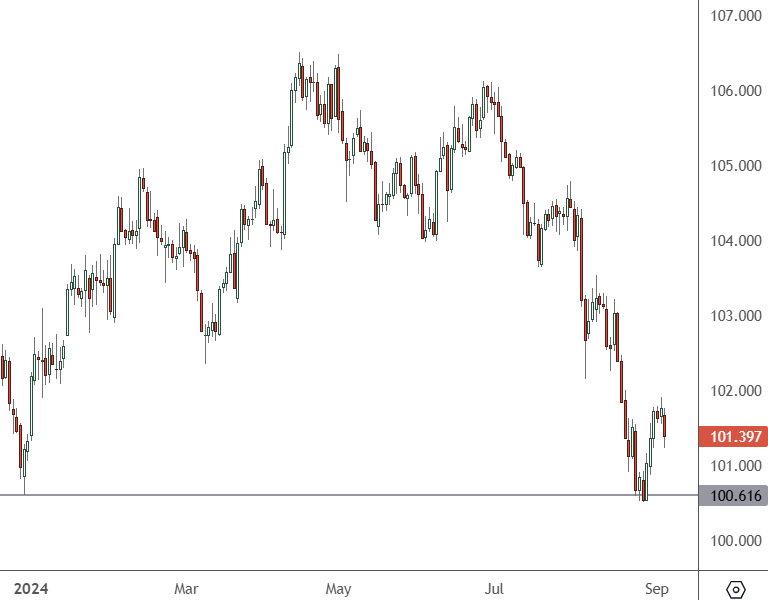

DXY – Daily Chart

The price of DXY has bounced from 100.61 which held the market rally through 2024. The dollar will have to hold this level or risk a further correction.

Some confusion in markets may be occurring as polls show Kamala Harris closing the gap in the Presidential race.

In overall voting, Harris is said to be leading by Trump, 48%-43%, according to one, which has a margin error of 3.1%.

Rising expectations that former President Trump would regain the White House in November led to a so-called “Trump trade,” which believed his policies would boost corporate profits and alleviate the country’s debt spiral.

However, some confusion is now creeping into the market as investors are unsure what foreign and domestic policy will look like.

Stock investors had been moving into corners of the US equity market that could benefit from Trump policies such as tax cuts and regulatory easing, including small caps and energy shares. That idea also helped to fuel a rotation out of big tech stocks into other areas.

One problem in the outlook is the bond market with investors moving out of longer-term bonds as they worry about spending. UK merchant banking firm Close Brothers estimated that a second Trump term could create $4 trillion to $5 trillion of extra government borrowing over 10 years, potentially boosting inflation and hurting bond prices.

But it is unlikely that a democratic government will fare better on spending and that may be the reason that the US dollar is possibly looking for a rebound.