US election polls and inflation data are among the factors driving the stock market.

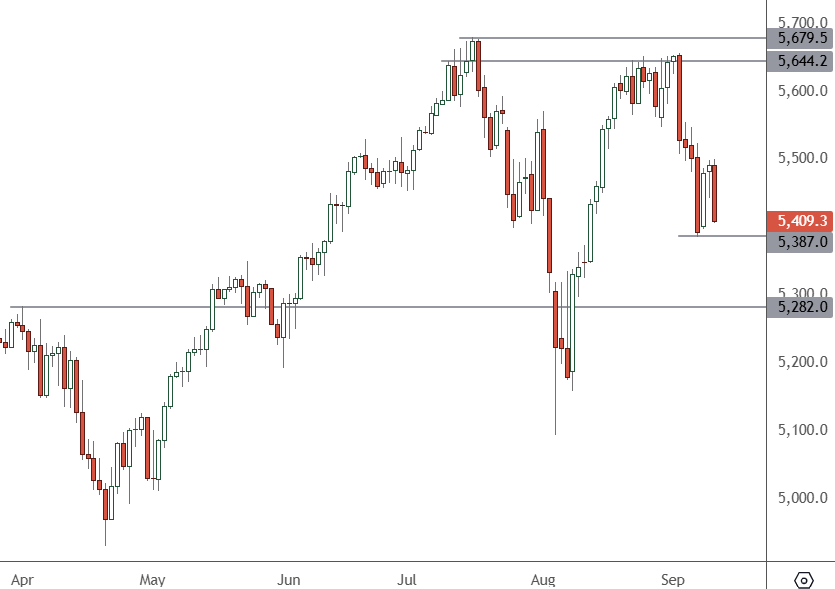

SP 500 – Daily Chart

The S&P 500 was able to bounce over the last two days but there is a risk of returning to the Monday lows. The August lows would be a target of further correction.

Kamala Harris was seen as winning the Presidential debate and that could see some bets unwound on Trump’s policies. Another reason for the day’s dip was an important inflation indicator in the CPI. The report was scheduled for 9:30 pm HKT and could play a big role in Thursday’s trade.

There are further numbers on that day as PPI producer inflation is released at a similar time and these readings will guide stocks into the weekend.

Elevated core prices have boosted bond yields and cut the chances of a 50 bp rate cut at next week’s FOMC meeting down to 17% from 50% after the release of last Friday’s US payroll jobs number.

The S&P 500 was down by -0.55% ahead of the reading as investors worry about recent strength in prices.

The election is less than two months away and could cause some volatility depending on the policy outlook. Kamala Harris is now said to be leading the betting Donald Trump’s odds drifting to their biggest in the last four weeks.