US stocks have slumped more than 1% on Tuesday after port workers on the east launched the largest strike in decades, threatening supply chains.

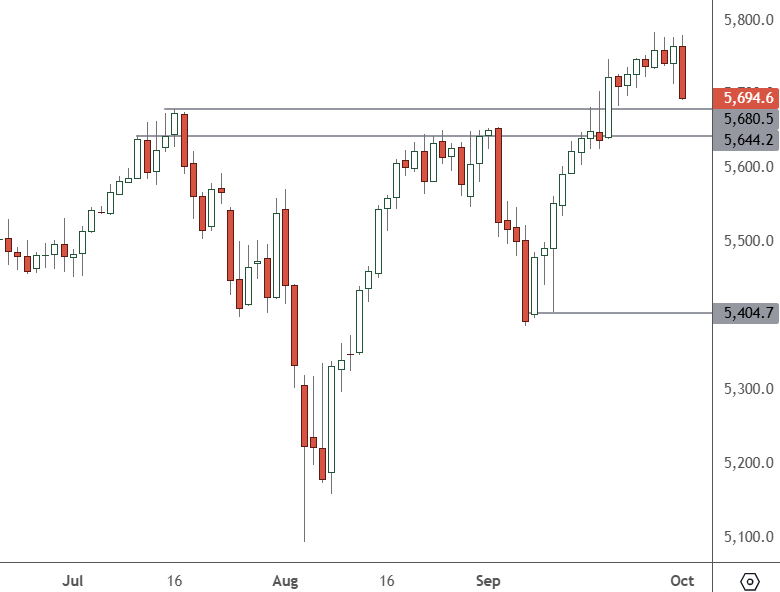

SP 500 – Daily Chart

The SP 500 has slumped on Tuesday with a move to 5,694 that has support very close and could mark the start of a correction in US stocks.

Dockworkers at 36 ports across the eastern US are now on strike for the first time in decades with an action that could affect supply chains, leading to shortages and higher prices. That could be uncomfortable for the Federal Reserve after the bank cut interest rates due to slowing inflation.

Workers started a strike over wages and the ports’ use of automation, though some progress had been reported in the latest contract talks. The contract between the ports and 45,000 members expired at midnight on Monday.

The strike also comes a few weeks before a tight presidential election and could become a factor if shortages affect voters. The workers union plans to strike for as long as it needs to achieve a fair deal and has leverage over the companies.

“This is not something that you start and you stop,” he said. “We’re not weak,” he added, pointing to the group’s importance to the nation’s economy. Labour experts say the workers on strike command a lot of leverage.

“This is a very opportune time,” said William Brucher, an assistant professor at Rutgers University.

Even though inflation has slowed down, the cost of living is still much higher than it was before the pandemic, which has hurt workers’ wages. Brucher also pointed to momentum from other labour activity over recent years as unions across industries have demanded more.

The action is set to affect different stock sectors, but it is still early days. Railroad stocks were lower due to the heavy container volume they process. Stocks like UPS (NYSE:UPS) and FedEx (NYSE: FDX) were higher as they have their aircraft that can ship vital products and could see prices rise for those services.