The S&P 500 posted a sharp sell-off on Wednesday with some possible profit-taking ahead of the year end. The Dow Jones has now posted its largest losing run in 46 years nine downward days.

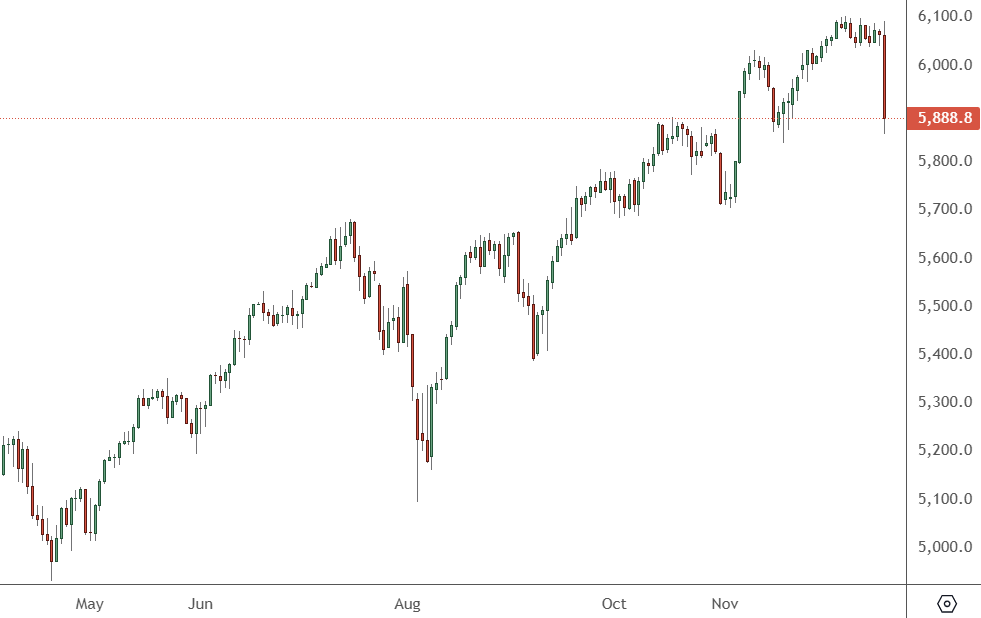

SP500 – Daily Chart

The S&P 500 rose above 6,000 and has fallen sharply on Wednesday. There is now a risk of further selling ahead of the festive shutdown and the new year.

Despite the recent decline, the Dow Jones is still up over 15% year-to-date, after a strong year for the stock markets in North America. It also remains more than 3% above the level recorded during the presidential election, highlighting positive expectations for the next administration.

Tech stocks were also lower and will not be helped on Thursday after chipmaker Micron fell by more than -14% in after hours trading. The memory chip maker issued an outlook for the fiscal second-quarter that was well below expectations by a wide margin.

Data center business growth of roughly 400% year-over-year was positive, but the company is cautious about the PC consumer business, leading to the weaker-than-expected forecast.

Broader stocks were hit, and bond yields soared even after the FOMC cut interest rates by an expected -25 bp but signaled only 50 bp of rate cuts next year. That was half the 100 bp of rate cuts signalled in September. The FOMC also raised its GDP and inflation estimates for this year and next, suggesting that rates will not fall as fast as expected.

The next three trading sessions could be tense as markets get ready to close for Christmas day. Year-end trading can often be a time for portfolio rebalancing as fund managers look to free up capital to purchase fresh positions for January.

Investors may also take profits ahead of the incoming Trump administration in order to get more clarity on the President’s tariffs and business regulations.