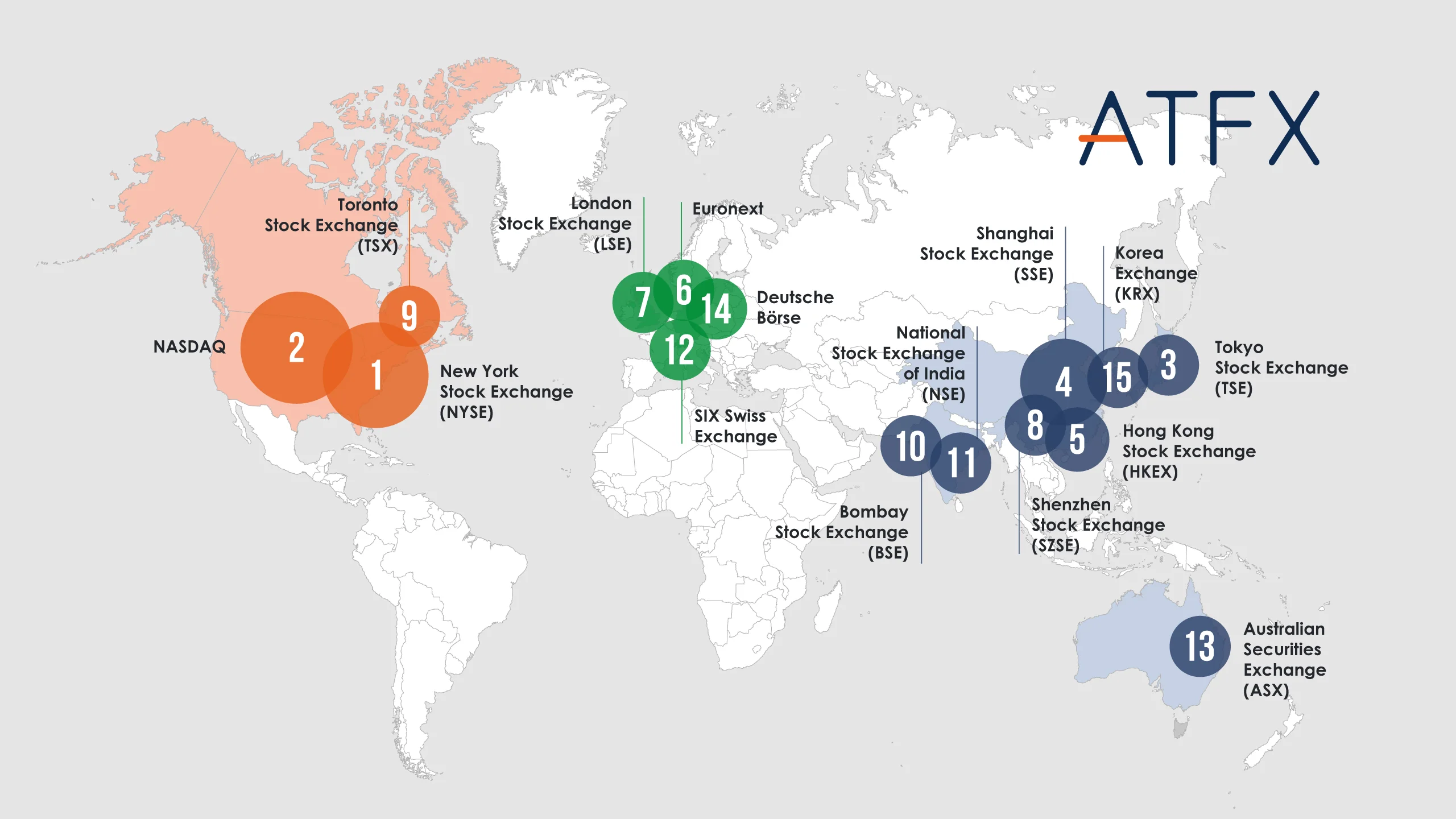

What are the top 15 largest stock exchanges in the world? The international stock market represents an extensive and ever-evolving global economic stage. Central to this are the stock exchanges, serving as crucial centres for the trading of shares, and significantly influence the success of businesses and economies. This piece delves into the 15 leading global stock exchanges, classified by market value and various important indicators.

Table of contents:

Summary Table for Largest Stock Exchanges in The World

1. New York Stock Exchange (NYSE), USA

3. Tokyo Stock Exchange (TSE), Japan

4. Shanghai Stock Exchange (SSE), China

5. Hong Kong Stock Exchange (HKEX)

7. London Stock Exchange (LSE), UK

8. Shenzhen Stock Exchange (SZSE), China

9. Toronto Stock Exchange (TSX), Canada

10. Bombay Stock Exchange (BSE), India

11. National Stock Exchange of India (NSE)

12. SIX Swiss Exchange, Switzerland

13. Australian Securities Exchange (ASX), Australia

15. Korea Exchange (KRX), South Korea

Embrace the World of Trading with ATFX

Summary Table for Largest Stock Exchanges in The World

Stock Exchange | Year Founded | Market Capitalization (Approx.) | Number of Listed Companies | Notable Fact |

New York Stock Exchange (NYSE), USA | 1792 | $28 trillion | 2,200+ | Largest stock exchange in the world |

NASDAQ, USA | 1971 | $25 trillion | 3,500+ | Preferred exchange for tech companies |

Tokyo Stock Exchange (TSE), Japan | 1878 | $6 trillion | 3,900+ | Largest in Asia |

Shanghai Stock Exchange (SSE), China | 1990 | $4 trillion | 2,100+ | Known for its volatile yet lucrative market |

Hong Kong Stock Exchange (HKEX) | 1891 | $6.5 trillion | 2,600+ | Gateway between China and the world |

Euronext, Europe | 2000 | €5.4 trillion | 1,900+ | Pan-European stock exchange |

London Stock Exchange (LSE), UK | 1801 | $6.5 trillion | 3,000+ | One of the oldest and most prestigious exchanges |

Shenzhen Stock Exchange (SZSE), China | 1990 | $5 trillion | 2,600+ | Focuses on high-tech and SMEs |

Toronto Stock Exchange (TSX), Canada | 1861 | CAD 4 trillion | 1,700+ | Leader in mining and energy listings |

Bombay Stock Exchange (BSE), India | 1875 | $5 trillion | 5,500+ | Oldest stock exchange in Asia |

National Stock Exchange of India (NSE) | 1992 | $5 trillion | 2,100+ | Known for high trading volumes |

SIX Swiss Exchange, Switzerland | 1850 | CHF 1.6 trillion | 250+ | Focus on high-value sectors like pharmaceuticals |

Australian Securities Exchange (ASX), Australia | 1987 | AUD 2.6 trillion | 2,200+ | First to demutualize and list its shares |

Deutsche Börse, Germany | 1993 | €2 trillion | 800+ | A leading European exchange |

Korea Exchange (KRX), South Korea | 2005 | $2 trillion | 2,000+ | Known for its advanced trading and settlement systems |

New York Stock Exchange (NYSE), USA

Overview

Situated in Wall Street, the epicentre of worldwide finance in New York City, the New York Stock Exchange (NYSE) stands not only as the largest stock exchange in the world but also as a symbol of the economic power of the United States. This vibrant hub witnesses the daily trading of stocks valued in billions of dollars, impacting global economies and markets.

Key Figures and Statistics (As of 2024)

Market Capitalization: The New York Stock Exchange (NYSE) boasts a market capitalization of approximately $28 trillion, representing a significant portion of global stock market wealth.

Number of Listed Companies: The NYSE, with over 2,200 listed companies, represents a diverse range of global industries and market leaders.

Daily Trading Volume: The exchange sees a daily trading volume in the billions, reflecting its central role in global finance.

Notable Listings

The NYSE is home to some of the world’s most prestigious companies. Giants like Apple, JPMorgan Chase, and ExxonMobil, among others, are listed here, making it a barometer for the health of the US and other leading economies.

Fun Fact

A Symbol of Resilience: The NYSE has a storied history of resilience. Remarkably, it reopened just 6 days after the 9/11 attacks in 2001, symbolizing the resilience and enduring spirit of both the exchange and New York City.

NASDAQ, USA

Overview

The NASDAQ, short for the National Association of Securities Dealers Automated Quotations, is celebrated as the globe’s initial electronic stock market. It epitomises contemporary advancements and creativity in stock exchange landscapes in New York City. It is especially well-known as the chosen marketplace for numerous companies in the technology and internet sectors.

Key Figures and Statistics (As of 2024)

Market Capitalization: With a market capitalization of $25 trillion, NASDAQ is a major global stock exchange known for its heavy concentration of technology and innovative growth companies.

Number of Listed Companies: With over 3,500 listed companies, NASDAQ is renowned for its diverse array of innovative technology and growth-oriented businesses.

Daily Trading Volume: The exchange sees a high daily trading volume, often surpassing $200 billion, indicative of its active trading environment. You may also be interested in Nasdaq-100.

Notable Listings

NASDAQ is home to some of the biggest names in the tech industry, including Apple, Microsoft, Amazon, Alphabet (Google), and Facebook. These companies have been pivotal in shaping the digital age, making NASDAQ synonymous with technological innovation.

Fun Fact

A Trendsetter in Gender Equality: In December 2020, NASDAQ proposed new rules to require its listed companies to have at least one woman and one diverse director on their boards, showcasing its commitment to diversity and inclusion in corporate governance.

Tokyo Stock Exchange (TSE), Japan

Overview

Situated in Japan’s capital, the Tokyo Stock Exchange (TSE) is a significant emblem of Japan’s economic strength. Ranking among the biggest stock exchanges in Asia and globally, it holds a vital position in the Asian financial landscape. The TSE boasts many listed firms covering different industries such as electronics, automotive, finance, and consumer products.

Key Figures and Statistics (As of 2024)

Market Capitalization: The TSE’s market capitalization is approximately $6 trillion, making it a significant player in the global financial landscape.

Number of Listed Companies: With around 3,900 listed companies, the Tokyo Stock Exchange stands as a central hub for Japan’s diverse economic sectors and major global enterprises.

Daily Trading Volume: The exchange witnesses substantial trading activity, with daily volumes often exceeding several billion dollars.

Notable Listings

The TSE is home to some of Japan’s and the world’s most renowned companies, including global leaders like Toyota, Sony, Mitsubishi, and SoftBank. These corporations not only drive Japan’s economy but also significantly impact global markets.

Fun Fact

A Unique Opening Ceremony: Unlike other major stock exchanges, the TSE doesn’t have a bell-ringing ceremony to signify the start of trading. Instead, it uses a unique electronic sound, symbolizing Japan’s affinity for technology and innovation.

Shanghai Stock Exchange (SSE), China

Overview

Situated in the vibrant metropolis of Shanghai, the Shanghai Stock Exchange (SSE) epitomizes China’s swift economic expansion and its growing clout in the world of finance. Founded in 1990, the SSE is comparatively new among the leading global exchanges, but it has rapidly gained significance, mirroring the extraordinary ascent of China’s economy.

Key Figures and Statistics (As of 2024)

Market Capitalization: With a market capitalization of $6.5 trillion, the Shanghai Stock Exchange (SSE) is a pivotal financial center in China, hosting a wide array of major corporations and driving economic growth.

Number of Listed Companies: With over 2,100 listed companies, the Shanghai Stock Exchange (SSE) is a cornerstone of China’s financial markets, encompassing a diverse range of industries and major corporations.

Daily Trading Volume: The exchange experiences high trading volumes, often reaching several hundred billion yuan, indicative of its dynamic market activity.

Notable Listings

The SSE is known for listing some of China’s largest and most influential companies, including giants like PetroChina, Agricultural Bank of China, and SAIC Motor. These companies are central to China’s economic narrative and play a significant role in global markets.

Fun Fact

A Unique “Lunch Break”: Unlike many other major stock exchanges, the Shanghai Stock Exchange has a 1.5-hour midday break, reflecting traditional Chinese working hours. This break is quite unique in the fast-paced world of stock trading.

Hong Kong Stock Exchange (HKEX)

Overview

The Hong Kong Stock Exchange (HKEX) stands as a crucial financial centre in Asia, strategically serving as a bridge linking Eastern and Western economies. It is celebrated for facilitating the integration of Mainland China’s economic activities with global markets, a role enhanced by Hong Kong’s distinct position as a Special Administrative Region of China, possessing its own legal and economic framework.

Key Figures and Statistics (As of 2024)

Market Capitalization: HKEX boasts an over $4 trillion market capitalisation, making it one of the largest stock exchanges in the world.

Number of Listed Companies: With over 2,600 listed companies, the Hong Kong Stock Exchange is a crucial financial gateway. It offers diverse investment opportunities and facilitates major international trade and capital flows.

Daily Trading Volume: The exchange sees robust trading activity, with daily volumes often exceeding several billion dollars.

Notable Listings

HKEX is home to major global financial institutions and Chinese giants, including HSBC, Tencent, and Alibaba. These companies’ presence companies highlight HKEX’s role as a critical platform for international and Chinese businesses.

Fun Fact

A Symbol of Resilience: The HKEX has a history of resilience, notably during the 2003 SARS outbreak. Despite significantly affecting the city, the exchange continued its operations, demonstrating its robust crisis management and operational resilience.

Euronext, Europe

Overview

Euronext is a pan-European stock exchange located in several major European cities, including Amsterdam, Brussels, Lisbon, Dublin, Oslo, and Paris. It stands out as a unique entity in the global financial landscape, representing a unified European trading platform. Euronext’s formation and expansion signify the growing economic integration within Europe.

Key Figures and Statistics (As of 2024)

Market Capitalization: Euronext, the pan-European stock exchange, boasts a robust market capitalization of €5.4 trillion, reflecting its significant influence and the vast economic footprint it spans across multiple European countries.

Number of Listed Companies: It hosts approximately 1,900 listed companies, showcasing its pivotal role as a central marketplace for diverse businesses across Europe to access capital and drive economic growth.

Daily Trading Volume: The exchange records a substantial daily trading volume, often reaching several billion euros, showcasing its active trading environment.

Notable Listings

Euronext is home to a wide array of European companies, ranging from well-established firms to growing SMEs. Notable listings include global giants like LVMH, Unilever, and Airbus, which are key players in their respective industries.

Fun Fact

A Symbol of European Unity: Euronext’s formation was a direct response to the introduction of the Euro and the European Union’s financial integration efforts. It symbolizes Europe’s economic unity and collaborative spirit.

London Stock Exchange (LSE), UK

Overview

Situated in central London, the London Stock Exchange (LSE) ranks among the oldest and most esteemed stock exchanges globally. Back to 1698, the LSE has been a fundamental pillar of the international financial system for centuries. It is acclaimed for the varied range of companies it lists and its status as a worldwide financial centre, particularly for firms aiming for global visibility.

Key Figures and Statistics (As of 2024)

Market Capitalization: The LSE, a key global financial hub, boasts a market capitalization of approximately $6.5 trillion, highlighting its extensive influence and central role in global financial markets.

Number of Listed Companies: It hosts over 3,000 listed companies, underlining its attractiveness and pivotal role as a premier destination for businesses seeking capital and international exposure.

Daily Trading Volume: The exchange sees significant trading activity, with daily volumes often exceeding billions of pounds.

Notable Listings

The LSE hosts a range of companies, from British household names like BP and Barclays to large international firms. It is also known for the FTSE 100 Index, a benchmark index comprising the 100 most highly capitalized UK companies listed on the exchange.

Fun Fact

A Historic Trading Floor: The LSE’s former trading floor, known as “The House,” was famous for its traditional face-to-face trading system, known as “open outcry.” This method was phased out in the late 20th century as electronic trading took over.

Shenzhen Stock Exchange (SZSE), China

Overview

Founded in 1990, the Shenzhen Stock Exchange (SZSE) is a relatively newer addition compared to the Shanghai Stock Exchange. Yet, it holds equal importance in China’s financial sector. Based in Shenzhen, a city famed for its advanced technology industry, the SZSE is closely associated with progress and development, primarily targeting China’s rapidly expanding high-tech sector and small-to-medium businesses (SMEs).

Key Figures and Statistics (As of 2024)

Market Capitalization: The SZSE, a dynamic and rapidly growing financial centre, has a market capitalization of around $5 trillion, underscoring its significant role in the global economy and its support of China’s burgeoning industries.

Number of Listed Companies: It hosts over 2,600 companies, predominantly from the technology, manufacturing, and innovation sectors, reflecting its vital role in supporting China’s modern economic development.

Daily Trading Volume: The exchange experiences high trading volumes, reflecting the dynamic nature of the companies listed on it.

Notable Listings

The SZSE is known for its ChiNext board, a NASDAQ-style board for high-tech and growth-oriented companies. It includes notable companies in the technology, renewable energy, and biotechnology sectors, which are key drivers of China’s economic growth.

Fun Fact

A Unique Architectural Marvel: The SZSE building is renowned for its striking architecture. Designed by the famous architectural firm OMA, its façade is a giant electronic display, symbolizing the fusion of technology and finance.

Toronto Stock Exchange (TSX), Canada

Overview

Situated in Toronto, Canada’s biggest city, the Toronto Stock Exchange (TSX) is Canada’s foremost stock exchange and ranks among the world’s largest. It is recognized for its wide array of listed firms, notably featuring a significant presence in the natural resources sector. The TSX indicates the Canadian economy and provides a key entry point for global investors into North America.

Key Figures and Statistics (As of 2024)

Market Capitalization: The TSX, a cornerstone of Canada’s financial sector, has a market capitalization of approximately CAD 4 trillion, underscoring its critical importance in facilitating capital for a diverse range of industries, particularly natural resources and finance.

Number of Listed Companies: The TSX lists about 1,700 companies, highlighting its essential role in providing a platform for businesses, particularly in the resource and financial sectors, to access capital and drive economic growth.

Daily Trading Volume: The exchange sees robust trading activity, with daily volumes often reaching billions of Canadian dollars.

Notable Listings

The TSX is home to major Canadian corporations like the Royal Bank of Canada, Toronto-Dominion Bank, and Barrick Gold. It also hosts many international companies, making it a truly global exchange.

Fun Fact

A Leader in Mining and Energy Listings: The TSX and its junior counterpart, the TSX Venture Exchange (TSXV), are world leaders in mining and energy listings, with more mining and energy companies listed on these exchanges than any other stock exchange in the world.

Bombay Stock Exchange (BSE), India

Overview

Situated in Mumbai, India, the Bombay Stock Exchange (BSE) stands as one of Asia’s most historic stock exchanges. It is among the quickest globally, boasting a transaction speed of 6 microseconds. Founded in 1875, the BSE has been instrumental in shaping the Indian capital market and is a significant gauge of the health of India’s economy.

Key Figures and Statistics (As of 2024)

Market Capitalization: The BSE, one of India’s leading financial institutions, boasts a market capitalization of around $5 trillion, reflecting its significant role in the global market and its extensive support for India’s diverse economic sectors.

Number of Listed Companies: It boasts over 5,500 listed companies, encompassing a wide range of sectors such as technology, manufacturing, and finance, highlighting its vital role in fostering India’s diverse and rapidly growing economy.

Daily Trading Volume: The exchange experiences substantial trading volumes, reflecting the vibrant and dynamic nature of the Indian capital markets.

Notable Listings

The BSE is home to some of India’s largest and most influential companies, including conglomerates like Reliance Industries, Tata Group companies, and IT giants like Infosys and TCS.

Fun Fact

A Historic Building with a Modern Role: The BSE building, located at Dalal Street, Mumbai, is an iconic structure and has witnessed India’s financial evolution for over a century.

National Stock Exchange of India (NSE)

Overview

Founded in 1992, the National Stock Exchange of India (NSE) is a contemporary, technologically advanced stock exchange. It is India’s primary stock exchange. Renowned for its innovative approaches and sophisticated electronic trading platforms, the NSE has revolutionized the Indian securities market, making trading and investment more attainable for the wider population.

Key Figures and Statistics (As of 2024)

Market Capitalization: The NSE, a major financial hub, has a market capitalization of $5 trillion, reflecting its crucial role in facilitating the growth and development of India’s rapidly expanding economy.

Number of Listed Companies: It hosts about 2,100 companies, predominantly from sectors such as technology, finance, and manufacturing, emphasizing its role in underpinning India’s diverse and robust economic landscape.

Daily Trading Volume: The NSE is known for its high trading volumes, often surpassing those of the BSE, indicative of its active trading environment.

Notable Listings

The NSE is home to major Indian corporations across various sectors, including IT giants like Infosys and Wipro, financial institutions like HDFC Bank, and various other diverse companies.

Fun Fact

A Record for Trading Volume: The NSE holds the world record for the largest number of trades in a single day. This record highlights the exchange’s capacity to handle high trade volumes efficiently.

SIX Swiss Exchange, Switzerland

Overview

Situated in Zurich, the SIX Swiss Exchange is the foremost stock exchange in Switzerland and stands out as one of Europe’s leading exchanges. It is celebrated for its stability, effectiveness, and innovative approach, making it a favorite among investors, especially those keen on top-tier Swiss firms. These include industry front-runners in banking, pharmaceuticals, and biotechnology.

Key Figures and Statistics (As of 2024)

Market Capitalization: The SIX Swiss Exchange has a market capitalization of around CHF 1.6 trillion, reflecting its significant role in the European financial markets.

Number of Listed Companies: It hosts over 250 companies, including some of the world’s largest and most stable firms.

Daily Trading Volume: The exchange experiences substantial trading volumes, with billions of Swiss Francs traded daily.

Notable Listings

The exchange is home to global giants such as Nestlé, Novartis, Roche, and UBS, which are leaders in their respective industries and significant players in the global economy.

Fun Fact

A Pioneering Spirit in Sustainability: The SIX Swiss Exchange was one of the first stock exchanges to introduce a sustainability index, the SXI Switzerland Sustainability 25 Index, reflecting Switzerland’s commitment to sustainable and responsible investing.

Australian Securities Exchange (ASX), Australia

Overview

Based in Sydney, the Australian Securities Exchange (ASX) serves as Australia’s main stock exchange and is a significant entity in the Asia-Pacific area. It is recognized for the variety of companies it lists, with notable strength in the mining and natural resources industries. The ASX is vital to the Australian economy and a major participant in the international financial arena.

Key Figures and Statistics (As of 2024)

Market Capitalization: The ASX, a cornerstone of Australia’s financial markets, boasts a market capitalization of AUD 2.6 trillion, underscoring its significant influence and pivotal role in supporting a wide range of industries within the Australian economy.

Number of Listed Companies: It hosts around 2,200 companies, offering a wide range of investment opportunities across various sectors.

Daily Trading Volume: The exchange experiences robust trading activity, with daily volumes often reaching billions of Australian dollars.

Notable Listings

The ASX is home to major Australian corporations such as the Commonwealth Bank of Australia, BHP Group, and CSL Limited. It also hosts a significant number of small to medium-sized enterprises, making it a diverse and dynamic market.

Fun Fact

First to Demutualize: The ASX was the first major financial market in the world to demutualize and list its shares on its own exchange. This move has been followed by several other exchanges around the world.

Deutsche Börse, Germany

Overview

Situated in Frankfurt, Germany, Deutsche Börse stands as a premier stock exchange in Europe and a key contributor to the worldwide financial markets. Renowned for its innovation and efficiency, it occupies an essential position in European finance. Deutsche Börse extends a broad spectrum of services, surpassing conventional stock trading, to include clearing houses, settlement systems, and providing market data.

Key Figures and Statistics (As of 2024)

Market Capitalization: Deutsche Börse’s market capitalization is approximately €2 trillion, positioning it as a significant force in the European financial sector.

Number of Listed Companies: It hosts around 800 companies, ranging from well-established German corporations to growing international firms.

Daily Trading Volume: The exchange records substantial daily trading volumes, reflecting its active and dynamic market.

Notable Listings

Deutsche Börse is home to major German and international corporations, including global powerhouses like Volkswagen, Siemens, and BASF. It’s also known for the DAX index, a benchmark stock market index comprising 40 major German blue-chip companies.

Fun Fact

A Trading Floor Turned into a Museum: The historic trading floor of the Frankfurt Stock Exchange, part of Deutsche Börse, has been preserved as a museum, showcasing the exchange’s rich history and evolution from traditional floor trading to modern electronic systems.

Korea Exchange (KRX), South Korea

Overview

Based in Seoul, South Korea, the Korea Exchange (KRX) is the nation’s exclusive operator of securities exchange. It was formed in 2005 by merging the Korea Stock Exchange, the Korea Futures Exchange, and KOSDAQ. The KRX represents a contemporary and vibrant market, mirroring South Korea’s impressive economic development and technological advancements.

Key Figures and Statistics (As of 2024)

Market Capitalization: The KRX has a market capitalization of approximately $2 trillion, making it one of the major stock exchanges in Asia and globally.

Number of Listed Companies: It hosts over 2,000 companies, including a mix of South Korea’s large conglomerates (chaebols) and innovative tech startups.

Daily Trading Volume: The exchange sees significant trading activity, with daily volumes often reaching high numbers in Korean won.

Notable Listings

The KRX is home to some of South Korea’s and the world’s leading companies, such as Samsung Electronics, Hyundai Motor, and SK Hynix. These companies are central to South Korea’s economy and have a significant global presence.

Fun Fact

A Unique Closing Bell Ceremony: The KRX has a distinctive closing bell ceremony where different guests, including celebrities and public figures, are invited to ring the bell, making it a cultural event in addition to a market function.

Embrace the World of Trading with ATFX

Before entering the trading world, traders must understand the largest stock exchanges in the world. As we’ve journeyed through the largest stock market in the world, it’s clear that opportunities abound in global markets. ATFX invites you to be part of this exciting world. Whether you’re interested in indices, individual stocks, or ETFs, our platform offers a comprehensive trading experience.

- Start with a Demo Account to practice in a risk-free environment.

- Ready for the real deal? Open a Live Trading Account and trade with confidence.

- Explore Indices Trading, ETF Trading, and Stock Trading with ATFX.

Join us at ATFX, where we offer tight spreads, zero commission, and a user-friendly platform perfect for both beginners and seasoned traders. Your journey into the world of trading starts here!