Table of contents:

Introduction to Gold Trading

Gold is valued in financial markets both as a commodity and a safe-haven asset. It is favoured by traders and investors for its reliability as a store of value and inflation hedge. Its demand is driven by its scarcity and use in technology, jewellery, and industry. Gold trading offers options from long-term investments to short-term deals. Knowing how to trade gold can stabilise any trader’s portfolio.

Why is Gold a Good Asset to Trade?

Gold is a valuable asset to trade because it is a reliable store of value and a hedge against inflation. Its scarcity and diverse technological, jewellery, and industry applications ensure continuous demand. During economic uncertainties and geopolitical tensions, investors flock to gold as a safe-haven asset, often increasing its price. Additionally, gold trading offers flexibility with various methods such as spot trading, futures, ETFs, options, and gold mining stocks, catering to different trading styles and risk tolerances. This versatility, combined with gold’s inherent value and market dynamics, makes it an attractive and strategic asset for traders.

Top 6 Profitable Gold Trading Strategies

What is the best way to trade gold? Having a gold trading strategy gives you a structured approach to the markets that guides you in making informed decisions regarding buying and selling gold. A well-defined strategy is essential because it helps you navigate market fluctuations, mitigate risks, and achieve your financial goals. Tailoring a strategy to suit your individual trading style, risk tolerance, and current market conditions could significantly improve your chances of success in gold trading.

- Position Trading: This strategy involves holding gold positions for an extended period, typically months or even years, to capitalise on long-term trends. Position traders analyse macroeconomic factors, historical data, and market cycles to make informed decisions.

- News Trading: Traders base their trades on specific news events, such as economic reports, central bank announcements, and geopolitical developments. Quick reactions to news can result in substantial profits, but it requires staying constantly updated with current events.

- Trend Trading: By identifying and trading in the direction of prevailing market trends, traders use technical analysis tools to spot upward or downward trends. This strategy works well in markets where trends are strong and sustained.

- Day Trading: Day traders hold positions within a single trading day to profit from intraday price movements. This strategy requires close monitoring of the market and quick decision-making skills to capitalise on short-term price fluctuations.

- Price Action Trading: This strategy involves trading decisions based on price movements and patterns rather than technical indicators. Traders study candlestick patterns, support and resistance levels, and other price action signals.

- Expert Advisors / Copy Trading: Utilizing automated systems or copying trades from experienced traders can be effective for those who lack the time or expertise to develop their gold trading techniques. These tools leverage algorithms and historical data to execute trades.

Technical Analysis Tools and Indicators

Technical analysis is critical for gold traders to spot trading opportunities and make better trading decisions. Key indicators include:

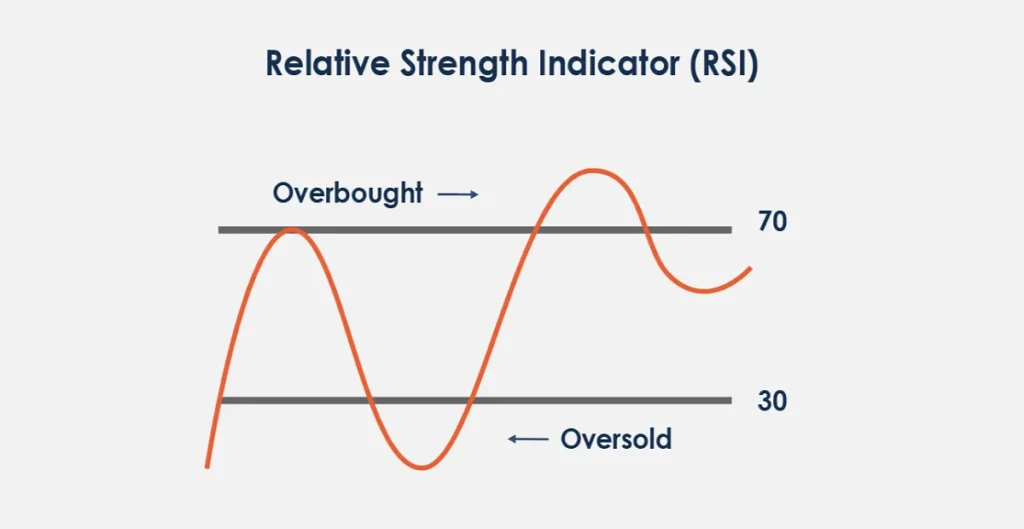

- Relative Strength Indicator (RSI): Measures the speed and change of price movements to pinpoint overbought or oversold conditions. An RSI above 70 indicates overbought conditions, while a reading below 30 suggests oversold conditions.

- Moving Averages: Used to smooth out price data and identify trends. Common types include Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). Crossovers of short-term and long-term moving averages can signal potential trend reversals.

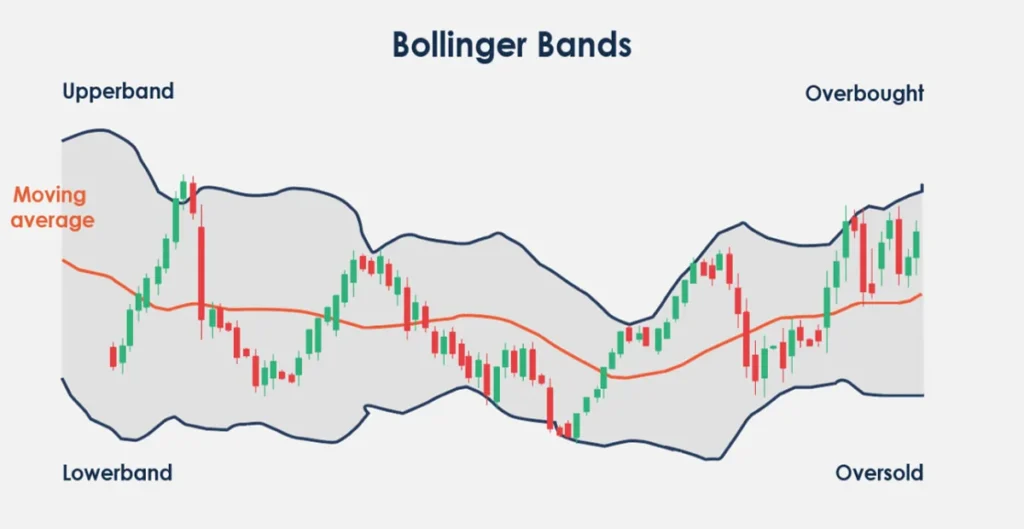

- Bollinger Bands: Consists of a moving average and two standard deviation lines above and below it. They help identify volatility and potential price breakouts. When prices move outside the bands, it may indicate overbought or oversold conditions.

- Pivot Points: Calculated using the high, low, and close prices of the previous trading day, pivot points indicate potential support and resistance levels. They are used by traders to determine entry and exit points.

Key Factors Influencing Gold Prices

Several critical factors influence gold prices, making it essential for traders to stay informed about global events and economic trends:

- Geopolitical Developments: Gold’s appeal as a safe-haven asset increases during political instability, conflicts, and tensions, increasing its price.

Example: In 2022, the Russia-Ukraine conflict triggered a significant increase in gold prices. Investors embraced gold due to its safe haven status, which provided security amidst geopolitical uncertainty, pushing its price above $2,000 per ounce in March 2022.

- Inflation Fears: Gold is widely used to hedge against inflation. Investors tend to prefer buying and holding gold during periods of high inflation as the purchasing power of fiat currencies declines, which also helps them preserve their wealth.

Example: In 2023, inflation in the United States reached its highest level in decades, due to supply chain disruptions and increased consumer demand after the pandemic. The popularity of gold among investors caused its prices to rise as investors sought to protect their investments from inflationary pressures.

- Monetary Policy: The policies implemented by Central banks, particularly regarding interest rates, tend to have a significant impact on gold prices. Lower interest rates increase gold’s attractiveness since it does not yield interest.

Example: In 2024, the US Federal Reserve kept interest rates low to spur economic recovery. The decision made gold more appealing to investors than interest-bearing assets, fueling a steady rise in gold prices throughout the year.

- Physical Supply and Demand: The physical availability of gold compared to the demand from various industries, jewellery markets, and investors influences gold prices. Factors such as the rate of mining production and demand from emerging markets countries such as India and China play critical roles in determining gold’s market value.

Example: In 2023, a drop in gold mining production by major gold-producing countries like China and South Africa, combined with increasing demand from the Indian jewellery market during the peak wedding season, led to a tangible increase in gold prices. Learn more information about gold prices today.

Selecting the most profitable gold trading strategy depends on individual trading styles, risk tolerance, and market conditions. Traders should experiment with different strategies in a demo account to find the one that suits them best. Testing allows traders to refine their approach, understand the nuances of each strategy, and gain confidence before committing their actual capital.

Best Trading Sessions for Gold

Gold trading is most active during the London and New York sessions, which offer the highest liquidity and volatility. Monitoring market activity during these periods can help traders capitalize on significant price movements. Key economic data releases and geopolitical events, such as U.S. employment data, Federal Reserve announcements, and geopolitical tensions, can cause substantial fluctuations in gold prices, creating strategic trading opportunities. For example, in November 2023, gold prices saw significant volatility following the Federal Reserve’s decision to maintain interest rates amidst rising inflation, providing multiple trading opportunities for those active during these sessions.

Why Trade Gold with ATFX?

A Golden Opportunity!

- Deep Liquidity and High Volatility: Positions can be easily opened, providing numerous opportunities whether gold’s price rises or falls.

Always Online

- 23-Hour Market: The precious metals market is open 23 hours a day, 5 days a week, offering attractive timing flexibility to traders.

Trade Anywhere

- MT5 Mobile and Tablet Apps: With MetaTrader 5 (MT5) mobile and tablet trading apps, you can take your trading platform with you wherever you go.

No Commission

- Tight Competitive Spreads: Enjoy tight, competitive spreads, meaning you pay less to open a position.

Ready to seize the golden opportunity? Trade gold with ATFX and take advantage of deep liquidity, high volatility, and the flexibility to trade anywhere, anytime. Open a live account today and start trading confidently, or open a demo account to practice and familiarise yourself with the platform.

Summary

- Gold trading offers unique opportunities due to its status as a safe-haven asset and store of value.

- Key factors influencing gold prices include geopolitical developments, inflation fears, monetary policy, and physical supply and demand.

- Essential gold trading tips and strategies are as follows:

- Position Trading: Focuses on long-term trends, holding positions for months or years.

- News Trading: Trades based on specific news events for quick reactions and potential profits.

- Trend Trading: Identifies and trades in the direction of market trends.

- Day Trading: Holds trades within a day, capitalising on intraday price movements.

- Price Action Trading: Makes decisions based on price movements and patterns.

- Expert Advisors / Copy Trading: Uses automated systems or copy trades from experienced traders.

- Key technical analysis tools and indicators include the Relative Strength Indicator (RSI), Moving Averages, Bollinger Bands, and Pivot Points.

- Choosing the best & profitable gold trading strategy involves matching strategies to individual trading styles and risk tolerance and testing them on a demo account.

- Optimal trading times for gold are during the London and New York sessions due to high liquidity and volatility.

- Combining various gold trading techniques and staying informed about market trends enhances the effectiveness of gold trading.