What drives the price of commodities? If you’re new or experienced in the financial market, knowing the factors that affect commodity prices can be a game-changer. From currency fluctuations to government policies, discover the intricacies. In this article, you will learn 6 factors that drive commodity prices!

Commodities are basic goods or raw materials used in commerce that are interchangeable with other goods of the same type. These can be categorised broadly into two types: hard commodities, which are natural resources that must be mined or extracted (such as gold, oil, and natural gas), and soft commodities, which are agricultural products or livestock (such as corn, wheat, coffee, and pork). Their prices are determined in commodity markets, which are subject to fluctuations based on various factors discussed below.

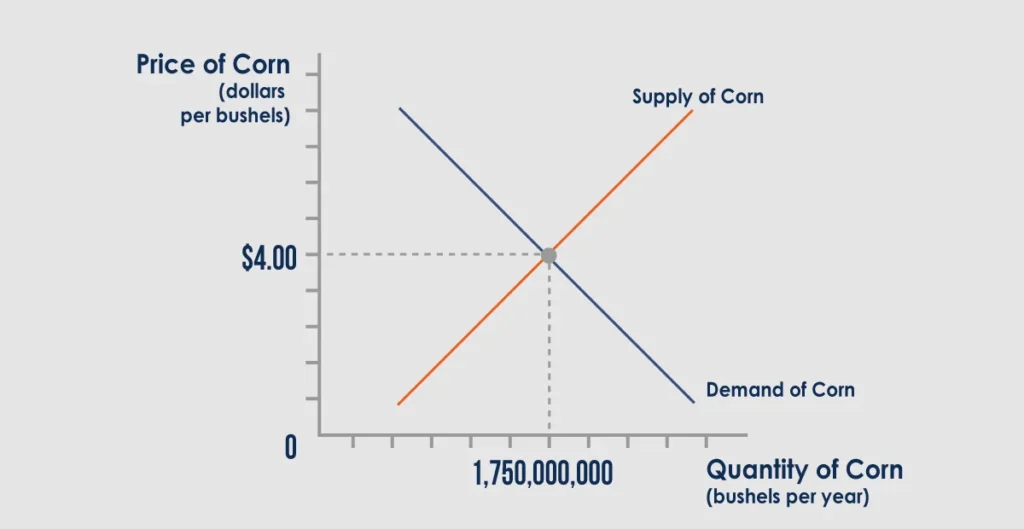

Supply and Demand Dynamics

The basic economic principles of supply and demand are at the heart of commodity price fluctuations. Prices tend to rise when a commodity is in high demand but low supply. Conversely, if the market has a surplus, prices usually fall.

Example: Consider the impact of seasonal changes on agricultural commodities. During harvest season, the market might experience a glut of certain crops, leading to lower prices. However, off-season, these same commodities might see price increases due to reduced availability.

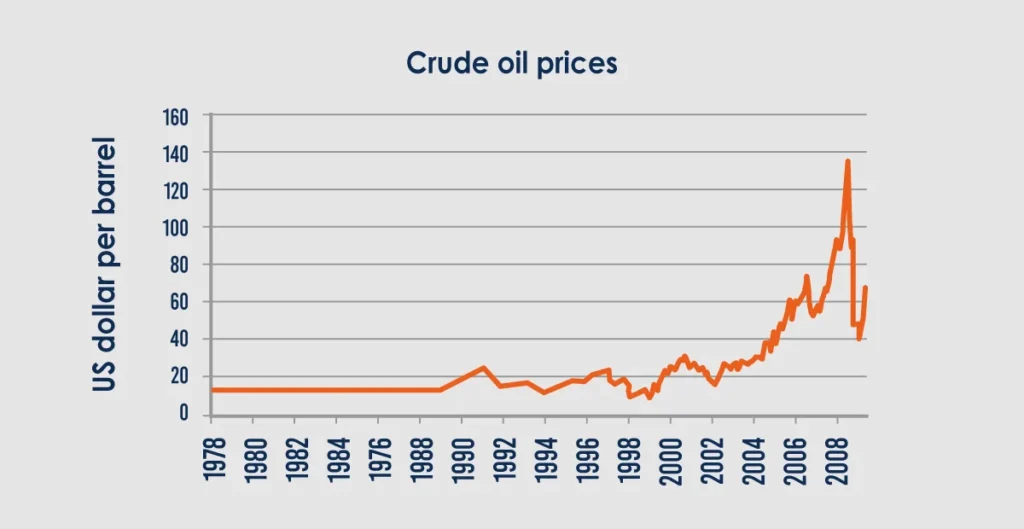

Geopolitical Tensions

Geopolitical tensions and events can cause significant volatility in commodity prices, particularly for energy commodities like oil and natural gas.

Example: The oil price fluctuations due to geopolitical instability in the Middle East are a prime example. Conflicts in this region often lead to fears of supply disruptions, causing prices to spike.

Currency Fluctuations

The strength of the US dollar plays a crucial role in commodity prices. Since most commodities are priced in dollars, a stronger dollar makes these goods more expensive for holders of other currencies, reducing demand and thus prices.

Example: Gold is often seen as a hedge against the US dollar. When the dollar strengthens, gold prices typically fall, and vice versa.

Government Policies and Regulations

Government interventions through subsidies, tariffs, and quotas can significantly influence commodity prices by altering the cost of production or the price of import/export goods.

Example: The impact of Chinese tariffs on US soybeans amid the US-China trade war led to a drop in US soybean prices due to decreased demand from China, a major importer.

Market Speculation

Speculation by traders and investors can lead to price swings independent of supply and demand fundamentals. Speculators betting on future price increases can drive prices up, while expectations of a price drop can lead to sell-offs.

Example: The 2008 oil price hike was partly attributed to speculation, as traders bet on continued price increases, driving the cost per barrel to record highs.

Environmental Factors

Natural disasters and climate change can drastically affect the supply of commodities, leading to price increases. These events can damage infrastructure, reduce crop yields, and disrupt supply chains.

Example: Droughts have a significant impact on wheat prices. Severe drought conditions in major wheat-producing regions can lead to reduced yields and higher prices.

How to start trading commodities

Commodities trading offers a dynamic avenue for diversifying investment portfolios. Platforms like ATFX serve as a comprehensive broker, providing essential resources and access to commodities markets such as oil and gold trading.

For those new to the financial markets or looking to refine their strategies, ATFX offers a demo account that simulates real-market conditions with a 50k virtual fund for traders to try out, paving the way for a seamless transition to a live account for actual trading.