EUR/USD

The EURUSD is everyone’s favorite and most liquid forex pair, famous for having tight spreads. However, it is one of the most volatile pairs in the FX market. Investors can place trades to capitalize on the EUR/USD’s exchange rate while using the pair’s live chart to perform technical analysis before trading.

After reading this guide, you will better understand the EURUSD price and how the pair’s exchange rate fluctuates daily. You will also be able to conduct technical analysis of the pair and understand how analysts create price forecasts. You will also get multiple educational tips on trading the pair, including the best trading hours. Finally, you will better understand how to use historical data to trade the pair. We will also answer the most frequently asked questions at the end.

EUR USD live chart

The EUR/USD is a symbol that refers to the Euro against the U.S. dollar currency pair. The value of the Euro against the dollar is quoted as 1 Euro x U.S dollars. The average exchange rate for the EUR/USD pair sits at approximately 1.15 dollars to buy 1 Euro.

It is the most widely traded pair because the Euro-Zone and the United States are two of the largest and most influential economies globally. Even though the euro is used across most European countries, it is also important to note the commanding power of the central banks of these two major economies and their ability to impact other foreign currencies significantly.

The price chart below represents the EURUSD exchange rate live chart.

EUR USD forecast

The EURUSD forecast predicts that the currency pair shall trade in a specific direction in the future. Such forecasts answer the question, where is EURUSD going? Traders can take advantage of such forecasts to place trades in the most probable future direction.

For example, the EUR/USD dropped below the 1.16 level after the European Central Bank monetary policy statement was released in late October 2021. This is because the ECB decided to leave monetary policy unchanged despite inflation jumping to a 13 year high. As a result, the Eurozone CPI figure increased to 4.1% in October from 3.4% in September.

Shrugging off concerns that the spikes in inflation are transitory. The EUR USD forecast long term indicates that the currency pair will stay in the 1.16 trading range till the end of Q1 2022r unless it breaks the 1.15 handle, where it could witness a sharp selloff. The EUR USD forecast 2022 by strategists from Danske Bank is that the pair will fall to 1.10 by the end of the year. The move could be driven by the ECB’s inability to control inflation and its hesitancy to act.

Other factors weighing on the highly liquid FX pair also affect the world, such as the microchip supply chain issues, affecting multiple economic indicators and pressuring the Euro. Therefore, the EURUSD long term forecast will remain vulnerable to 1.17. Investor sentiment also indicates more short positions than long ones, but the bottom line remains mixed.

Traders have started to price in the November 3rd Federal Reserve meeting and are adjusting their positions with expectations of a hawkish tone toward tapering asset purchases. As a result, the USD has been climbing higher, and retail sales from the Euro-Zone countries like Germany have also pressured the Euro, capping gains after its retail sales contracted by 2.5%.

Today’s EUR/USD forecast will remain bearish, especially given the thin trading volumes ahead of the much anticipated Federal Reserve meeting.

What affects the EUR USD exchange rate?

1. Single currency strength or weakness.

The EUR/USD exchange rate can increase or decrease according to the Euro’s and US dollar’s strength or weakness.

2. Central bank monetary policy changes.

A move by either of the two central banks to change interest rates or a general intervention to strengthen their base currencies would lead to the decline of the opposing currency. For example, if the US Federal Reserve Bank intervenes by raising interest rates to make the dollar stronger, investors will notice a decline in the EUR/USD rate.

3. Fundamental News

Geopolitics, economic crisis, economic and natural disasters, or inflation can significantly impact currencies.

EUR USD technical analysis

At the time of writing (28 October 2021), the EURUSD technical analysis came ahead of the month’s European Central Bank’s monetary policy meeting.

EUR/USD

Support levels: 1.157,1.15,1.1544

Resistance levels: 1.1663,1.1695,1.18

Pullback strategy

Based on the EUR/USD’s extensive momentum, traders like to use the pullback strategy to buy and sell the pair. The pullback strategy takes advantage of opportunities within its optimized trend. However, traders could incur losses if the price swings to a reversal (longer-term).

Before an uptrend resumes, there will often be a pullback, which traders can use to open a position, assuming that the asset will resume its uptrend. Pullbacks are usually applied to short term price declines in an uptrend.

Using different indicators such as the moving average or Fibonacci retracements, key pivot points and critical levels can be identified to help initiate a successful trade. Traders need to pay attention not to mistake reversals for pullbacks. The difference is that reversals are more long term and can be triggered by weaker than expected economic indicators, among other fundamental news.

Breakout strategy

This is a simple buy the breakout and sell the breakdown strategy when a breakout happens outside a defined trading range or support and resistance levels. This is one of the most noticeable movements on a price chart because the price pattern will look different on a diagonal or horizontal level. In other words, it is when the price finally breaks critical support or resistance level after a few attempts. Therefore, the best moment to take advantage of a breakout strategy is to buy during the breakout. Depending on your position, you should place your stop loss above or below the breakout candle.

Scalping

Scalping is one of the most straightforward strategies and is very suitable for beginners and advanced traders. Using indicators such as the RSI or Bollinger bands will give you buy and sell signals. You will also see visible signs that the direction is changing as the price heads towards the opposite direction.

To critically analyze any chart, you need to explore a deep dive into research and analyst expectations. There are many valuable resources to identify the trend direction of an asset, other than reading the materials found online. Using different technical indicators will also guide you to understand where the market is heading, as at least you will have an idea.

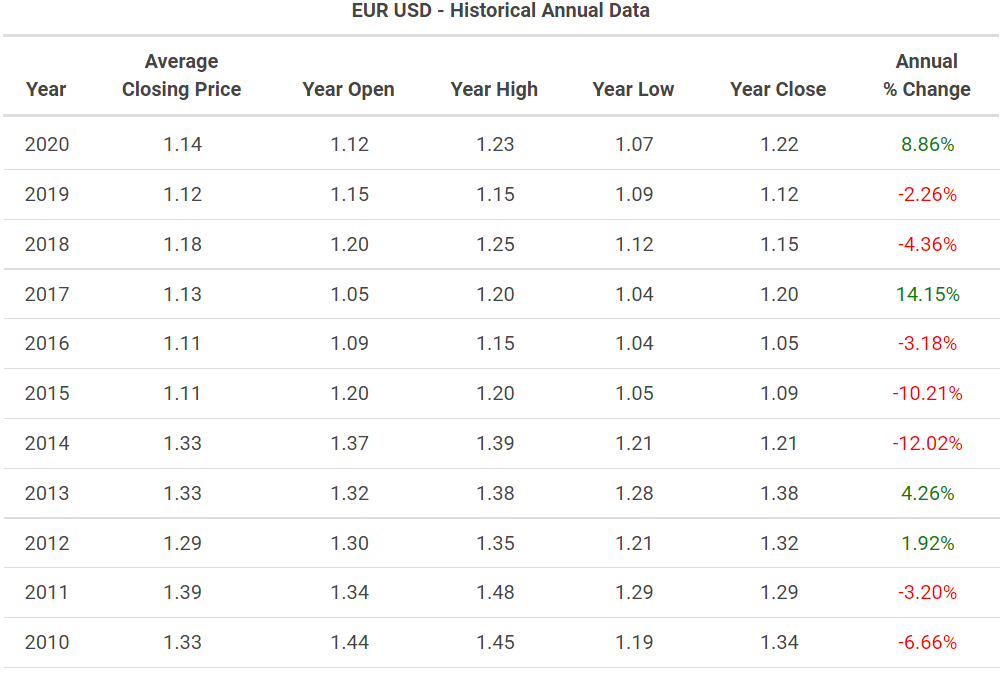

EUR USD historical data

To accurately identify the price direction of any financial instrument, we need to study the historical patterns of the asset. In the next section, we will briefly skim through the history of EUR/USD prices to establish projections regarding future and current trends. The likelihood of this trend following the narrow range is expected to follow or continue its downtrend and trade below the 1.16 level.

Historical charts are extremely valuable to technical analysis because financial instruments and commodities tend to mimic patterns seen on the chart through historical price action. However, the reliability of historical data may vary when trading the EUR/USD due to ever-changing financial news. Nevertheless, the trends are measurable, and they will give you an idea of where markets could be heading. In addition, traders use historical patterns to identify the best entry and exit positions.

The more you get used to past price patterns, the better you will be at spotting them as they happen again. Historical price patterns affect the current price action. They show you areas where breakouts happened in the past and if markets are genuinely bullish or bearish. Making trading decisions can be challenging, and your psychological state plays a massive role in your risk management. Hence, historical patterns can boost your confidence and give you an idea of where to start.

According to the Euro/Dollar exchange rate historical chart, the EUR/USD average closing price was indicated below.

- 1.12 in 2019

- 1.14 in 2020

- 1.19 in 2021

EUR USD Trading hours

The Forex market operates 24-hours a day in all different time zones because it operates based on the different times in which many financial markets open worldwide. The forex markets are usually closed over the weekends. The busiest time in the Forex markets based on volume is between the New York and London markets.

Three key market sessions allow you to trade whenever and wherever you are. The Asian, European, and American sessions are based on the Tokyo, London, and New York time zones.

New York – is between 01:00 pm to 10:00 pm GMT

London – is between 8:00 am to 5:00 pm GMT

Tokyo – is between 00:00 am to 9:00 am GMT

The best time to trade the EUR/USD is when news releases come out, particularly during the U.S. Session or when economic indicators are due, especially when a major central bank decision is anticipated. You will find that volatility increases during these hours.

How to trade or invest in the EURUSD like a pro - 3 simple steps

You can trade the financial markets the way you want to. There are various ways to trade the markets through ATFX, each with its advantages. Whatever your preference, we’ve got you covered. You can start with a demo account to minimize your risks if you are a beginner, or you can start directly with a live account by following the steps below;

But first, you have to get familiar with the forex markets and trading: Take online courses that will deepen your knowledge of forex trading and understand the fundamental triggers of the market.

Register for an account

Open your account

Complete the Live Trading Account application form. Once we have verified identity, we will set up your account.

Fund your account

Deposit funds via debit/credit card, instant EFT or

bank transfer to start trading

Start trading

ATFX offers several online trading services, spread betting (UK and Ireland clients only) and CFD trading. These are some of the most popular ways to trade instruments like forex, equity indices and commodities and shares.

Why trade EURUSD with ATFX?

Competitive Spreads

24/5 Forex Trading

Trade 40+ Currency Pairs

Zero Commission

FAQ

The sterling, 1 pound equals 1.18 Euro, and 1 Euro is 0.85 sterling.

The GBP/USD currency pair, otherwise known as 1 British Pound Sterling per X number of US Dollars, is the best example in terms of correlation. Whenever the EUR/USD trades upwards, GBP/USD moves in the same direction. When the correlation equals negative 1, the common observation is that two currency pairs will move in the opposite direction 100% of the time.

The Euro is currently in a downtrend, and the technical indicators show that the currency pair will stay in the 1.16 trading range till the end of this quarter unless it breaks the 1.15 handle where it could witness a sharp selloff.

For more details, refer to the EUR USD Forecast section above.

The GBP/USD is highly correlated with the EUR/USD; usually, you’ll find similar movements in both currency pairs.

The forex market is open 24 hours within different time zones, except on weekends.

Kindly refer to the Support and Resistance pivot points to identify signals in the technical analysis section.

The Euro is currently following a downtrend. Technical indicators designate that the currency pair will stay in the 1.16 trading range until the end of this quarter unless it breaks the 1.15 handle, where it could witness a sharp selloff.

For more details, refer to the EUR USD Forecast section

In 2008, The EUR/USD reached an all-time high of 1.6038.

You can use a EUR USD lot size calculator or ultimately the below formula;

Account Risk / (Trade Risk in pips x Pip Value) = Position size in lots

The EUR CoT stands for the commitment of traders’ reports, and it’s usually used to help the public understand market dynamics. So, for example, when the COT index rises, investors tend to be more bullish about the Euro.

Both assets have a negative correlation to the U.S. Dollar.

To calculate the value of a pip, you should divide 1/100 by the exchange rate.

For the EUR/USD: One pip is 1/100 divided by 1.160

The forex market is open 24 hours within different time zones, except on weekends.

The best time to trade EUR/USD is when news releases come out or when economic indicators come out and when a major central bank decision is anticipated. You will find volatility increases during these hours. The busiest time zone is between New York and London by volume.