Airbus shares dropped 11% on Tuesday after sales failed to capitalise on the woes at rival Boeing.

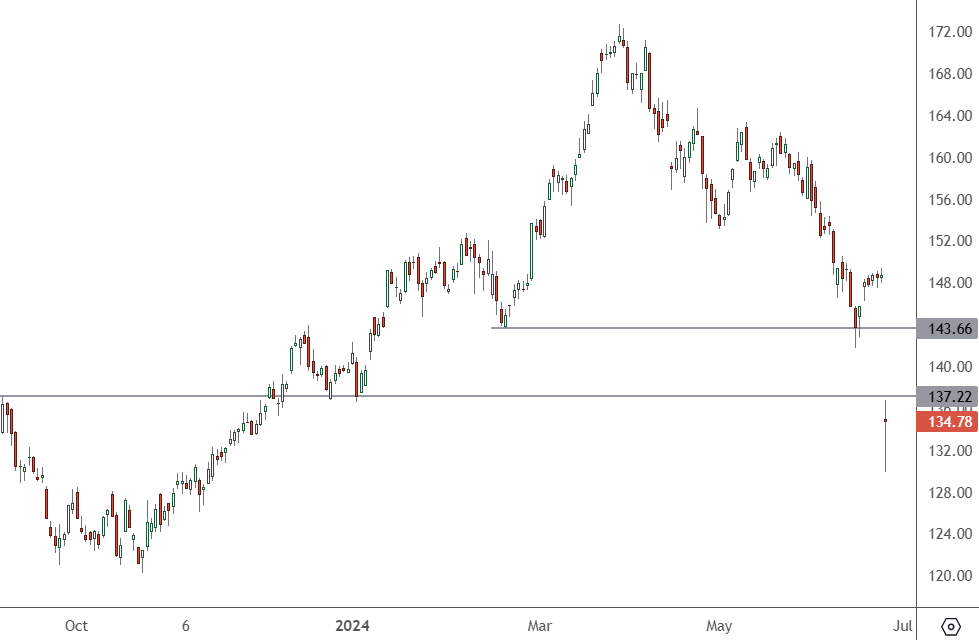

AIR – Daily Chart

The price of AIR shares slumped to 134.78 on the French stock exchange. The 137.22 level was resistance in September 2023 and will be crucial moving forward.

The aerospace giant’s market valuation is 106 billion euros, and on Tuesday, it dragged European benchmarks and related stocks lower.

Airbus shares declined after the company issued a profit warning, which sparked an aerospace-related sell-off. Investors are also wary about French parliamentary elections later in the week when Emmanuel Macron’s party is expected to lose ground.

The profit warning and forecast for fewer plane deliveries weighed on jet-engine manufacturers Rolls-Royce and MTU Aero Engines. The broader STOXX Europe aerospace and defence index slid 3.8% to its lowest level in three months.

Rival aircraft manufacturer Boeing had its struggles in the first half of 2024, and investors hoped that Airbus could take advantage of them. Boeing was forced to withdraw its 737 Max aircraft after a door blew out in mid-air during a January flight.

In an update this week, the French manufacturer cut its 2024 delivery target from 800 to 770 and delayed increasing its output of the A320 to 2027. The A320 is the main competitor to the 737 Max.

Issues in the aircraft supply chain are proving too tricky to handle. Demand for planes is rising with increased travel, but supply cannot keep up.

“Demand is not the problem; quite the reverse. But if supply can’t keep pace and competition is so constrained, it ought to mean airline capacity doesn’t increase too much, which could keep fares higher for longer,” said Neil Wilson, markets analyst at Finalto.

Airbus CEO Guillaume Faury said engine makers would have to “face the consequences” of any delays, which could be financial penalties from airline clients.

Airlines have been vocal about the supply issues, with Ryanair CEO Michael O’Leary blaming delays at Boeing and Airbus for increased airfares across Europe. Another issue was a 900 million euro charge at the company’s Space Systems segment. Earnings forecasts for the group have been lowered to 5.5 billion euros from 7 billion.