Alibaba released its earnings on Wednesday when the Chinese stock market saw stimulus support.

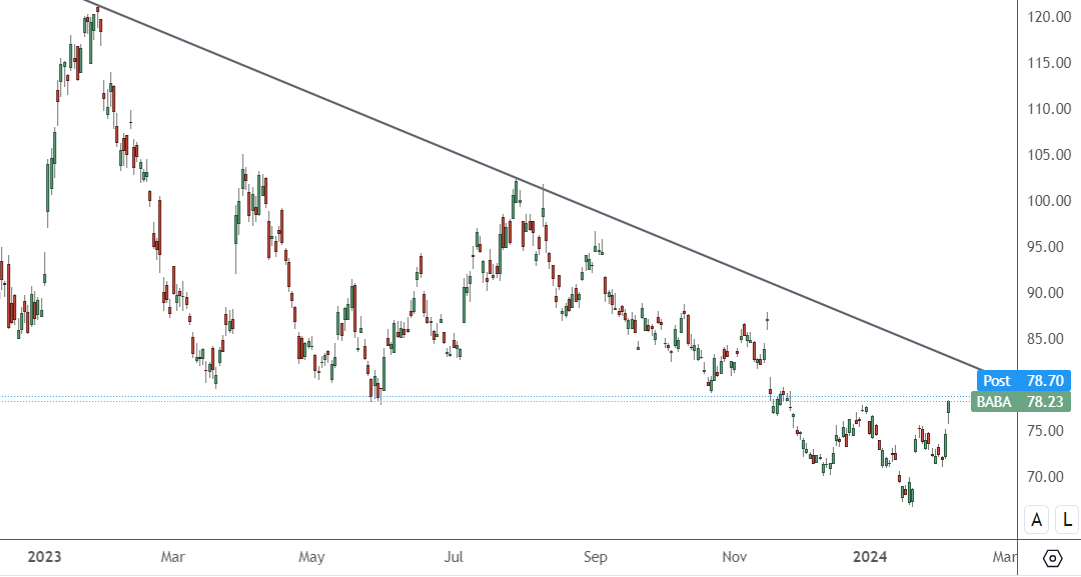

BABA – Daily Chart

BABA stock surged from recent lows to $78.33 on the US exchange. The share price can test resistance at the $80 level.

According to the expectations of analysts surveyed by FactSet, Alibaba is expected to report earnings of 2.39 Chinese yuan per share on revenue of 261 billion yuan ($36.7 billion) in the December quarter. According to estimates, the results would be a 1% decline in earnings from a year earlier, with a gain of 5% in revenue.

China’s economic slowdown has hit the company’s core e-commerce business hard over the past year. Alibaba has seen pressure from consumers less willing to spend money and competition from rivals such as PDD. After Beijing’s regulatory crackdown on tech and COVID-19 lockdowns, Alibaba has had a tough few years.

The beginning of 2024 has brought a few changes. Chinese stocks remain volatile as investors worry about the economy and hope the government will conduct a strong stimulus effort. Investors will also be keen to see progress on Alibaba’s Alibaba’s cloud computing and artificial intelligence efforts. Exports of high-tech chips to China have slumped after geopolitical tensions with the US, hampering Alibaba’s cloud and AI division and its plans to spin off the business.

Investors should examine the recent bottom in Chinese stocks, which could result in a solid foreign investment. A stronger-than-expected earnings result could be a price driver for Alibaba stock.