This week’s big event is the latest US inflation report, with markets poised for volatility.

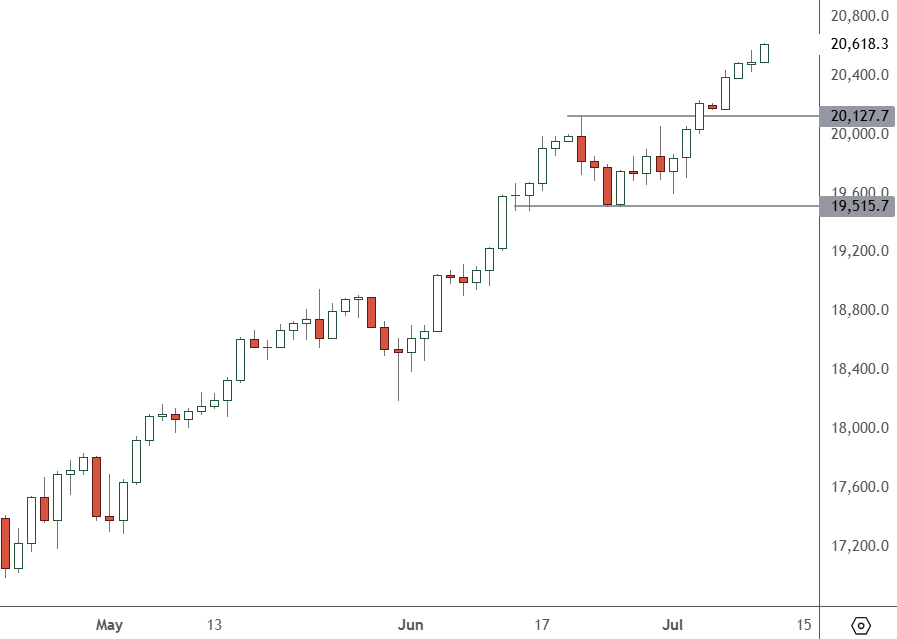

NAS 100 – Daily Chart

The Nasdaq 100 index has been grinding higher, and the uptrend is starting to look steep. If selling arrives, investors should be wary of an extended pullback.

Bloomberg reported that JP Morgan analysts have warned of volatility around this week’s CPI inflation figures. Based on the price of straddles expiring that day, the options market is pricing in a move of around 0.9% in either direction by Thursday. A higher inflation print could end any hopes of two rate cuts by the Fed this year.

Thursday’s report will be released at 8:30 pm HKT but will spill over into Friday and probably next week. Markets expect the inflation rate to drop to 3.1% from 3.3% in May.

This week, traders were on the fence after Fed Chair Jerome Powell hinted at elevated rates but also said the jobs market was cooling.

“We’re not just an inflation-targeting central bank,” Powell told Congress. “We also have an employment mandate.”

Powell said this week that the Fed had made “considerable progress” toward lowering inflation but warned that cutting rates “too late or too little could unduly weaken economic activity and employment.”

Most economists expect the US central bank’s first rate cut to occur in September. Powell refused to confirm when he saw the first cut.

Various markets have been confused about whether the Fed will cut twice this year. Thursday’s data will heavily influence that decision, ripple through stocks, crypto, bonds, and forex.